Alpine Village, LLC #6315 | NEVADA – FUNDED

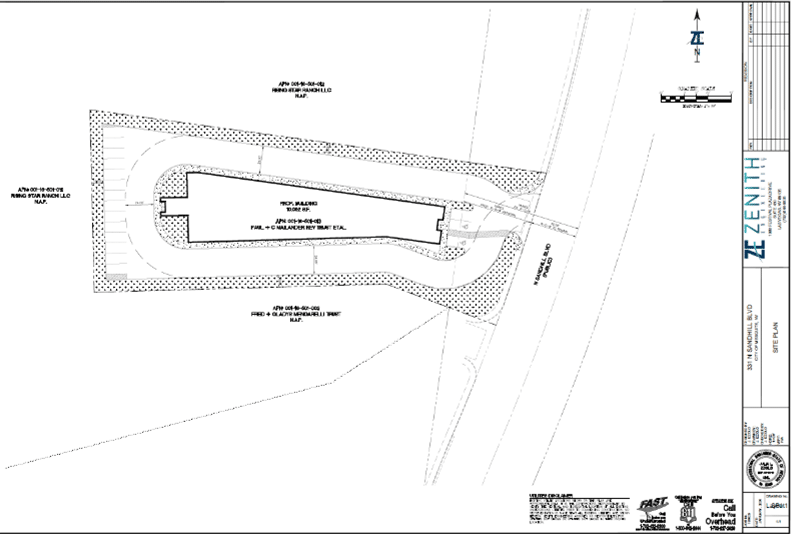

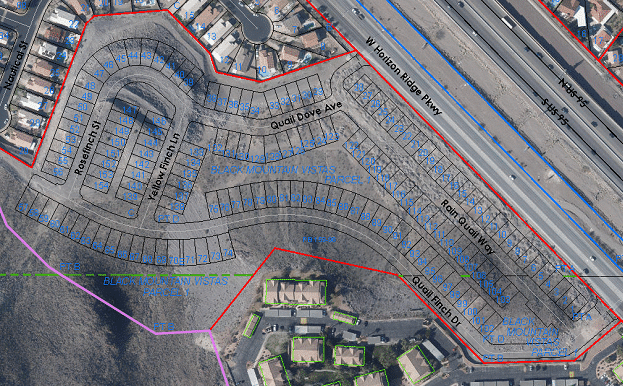

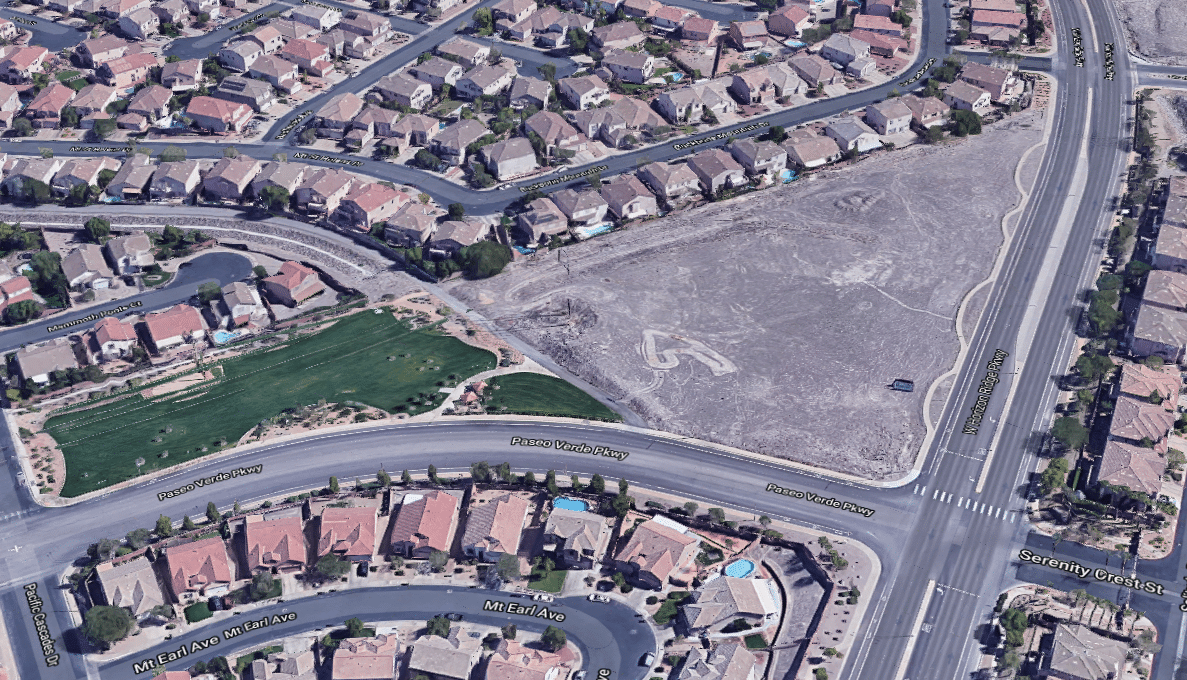

A 1.46 acre parcel of land, situated near the mouth of Kyle Canyon in Las Vegas, NV is the collateral for this first trust deed loan. This part of Las Vegas has seen more residential building permits pulled over the past year than nearly all other submarkets. As the old adage goes; “commercial follows rooftops.” This property is a prime example of that. The borrower intends to get zoning approval for the ultimate construction of a fuel station which will be nearly surrounded by newly constructed homes. The borrower also has the property presold and is under contract with a nationally recognized fuel operator who will ultimately construct and occupy the building. The completion of the zoning process which will be the triggering event to sell the project and is anticipated to be completed within nine months. Loan Amount: $1,450,000 Yield: 10% interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. *For investments equal to or greater than $100,000 investors will earn 10.5%. Term: Nine months with an optional nine-month extension at maturity. Final maturity date is 3/8/26.