Vanquish Capital, LLC #5403 | ARIZONA – FUNDED

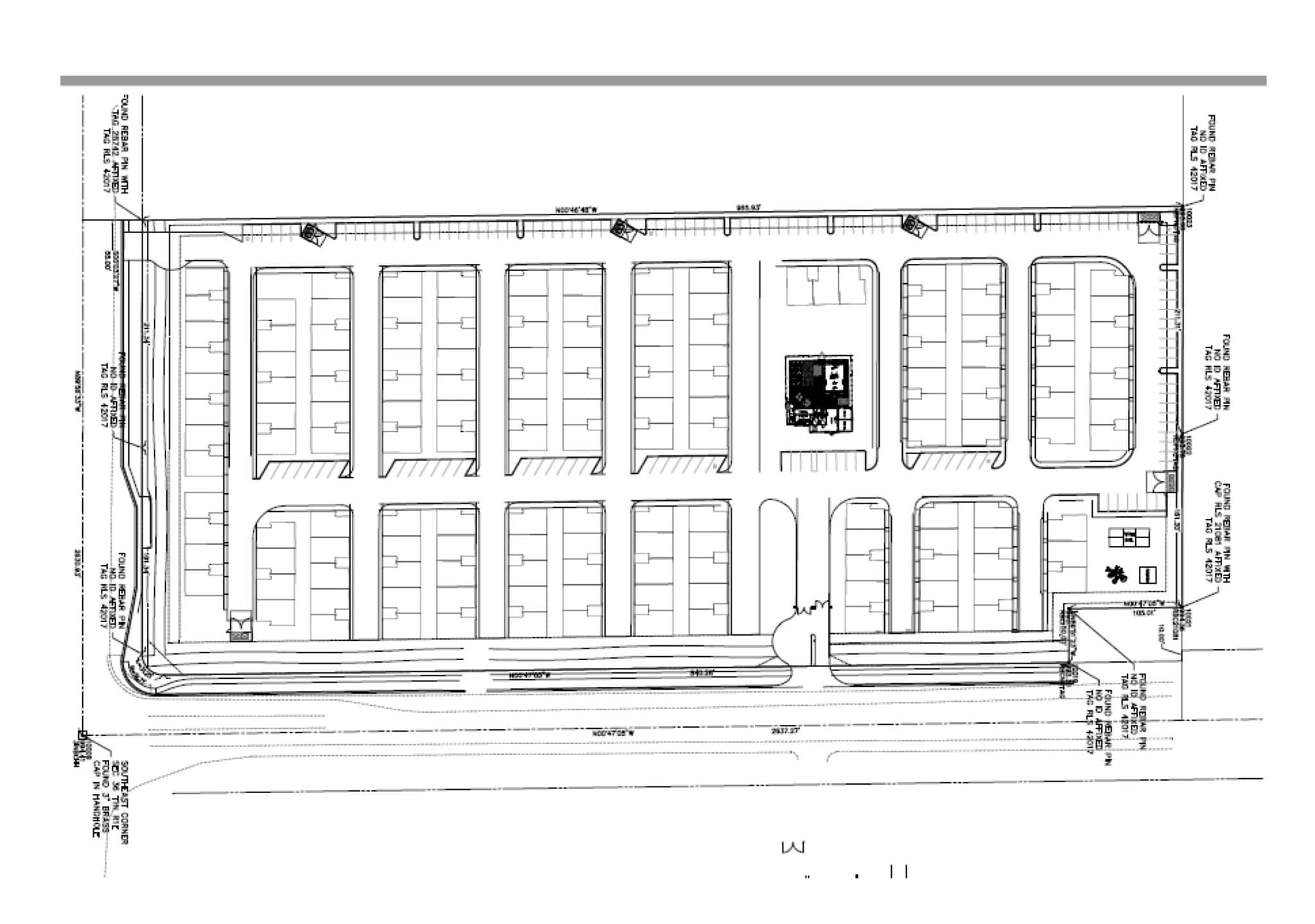

The collateral for this first position trust deed is a 10.95 acres site that will eventually be developed into 165 townhome lots. Since putting the property under contract nearly 16 months ago, not only has the borrower “added value” by locking in their purchase price in a rapidly improving real estate market, but they have also added value by reducing risk in the project by getting the property fully entitled. Typically, FIG would sell each of the buildings to individual investors but have found one investor that wants the entire project. With that said, once the building permits are ready to be issued, the investor will close on the sale of the property and purchase it from FIG in one transaction. In the unlikely event the buyer falls out of contract, FIG’s regular investors will acquire individual buildings. Loan Amount: $3,250,500 Yield: 10% interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. *For investments equal to or greater than $100,000 investors will earn 10.5%. Term: Nine months with an optional extension at maturity. Final maturity date is 11/21/23.