Our Pledge to our Investors

Ignite Funding believes strongly in transparency to our Investors, which is why every year we release our Loan Portfolio Performance Record with supporting data. The information contained within the Performance Record includes the following statistics; number of Borrowers, aggregate number of loans and amount funded, loan type by percentage, average annual interest rate paid to Investors, aggregate loan-to-value ratio, average duration of loan terms.

2011 – End of Q2 2024 Loan Portfolio Performance Record

Acquisition Loans***

55% Residential

45% Commercial

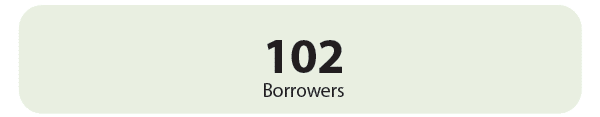

82 Borrowers****

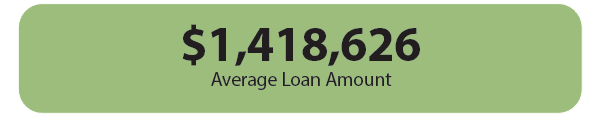

$1,011,305,100 Total amount funded

643 Loans funded

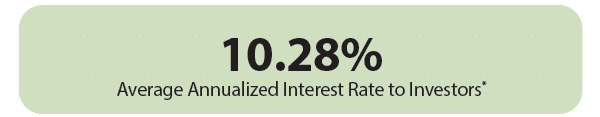

10.37% Average annualized interest rate to investors*

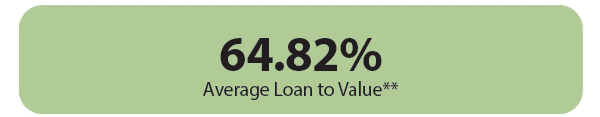

60.87% Avg Loan to Value**

11.47 Avg duration of loan term (months)

$105,137,542 Income Paid to Investors

Development Loans

81% Residential

19% Commercial

25 Borrowers****

$527,001,050 Total amount funded

228 Loans funded

10.17% Average annualized interest rate to investors*

67.14% Avg Loan to Value**

9.09 Avg duration of loan term (months)

$44,439,876 Income Paid to Investors

Construction Loans

65% Residential

35% Commercial

37 Borrowers****

$379,676,400 Total amount funded

481 Loans funded

10.26% Average annualized interest rate to investors*

69.20% Avg Loan to Value**

8.36 Avg duration of loan term (months)

$28,814,923 Income Paid to Investors

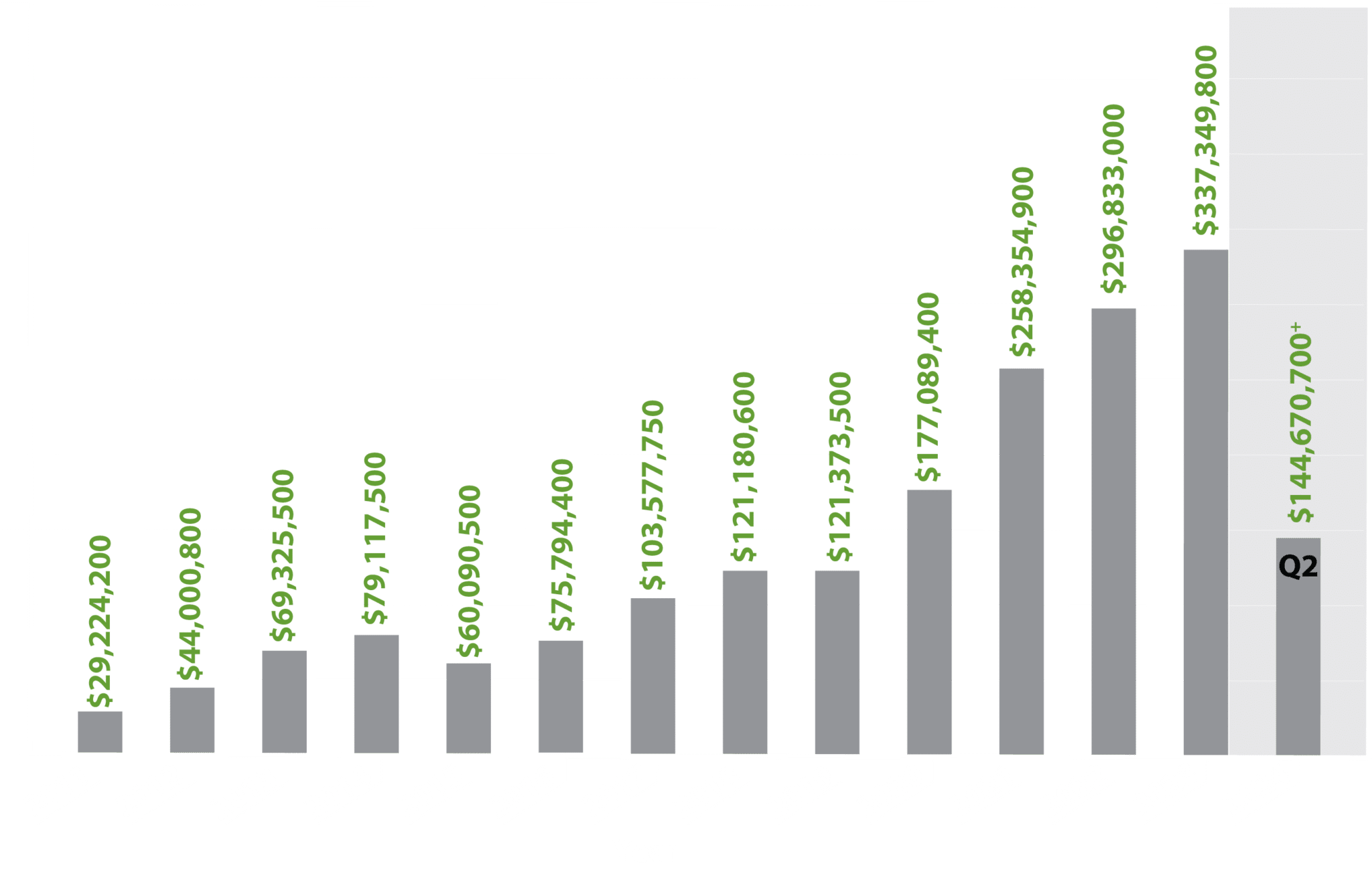

Total Loans Funded by Year

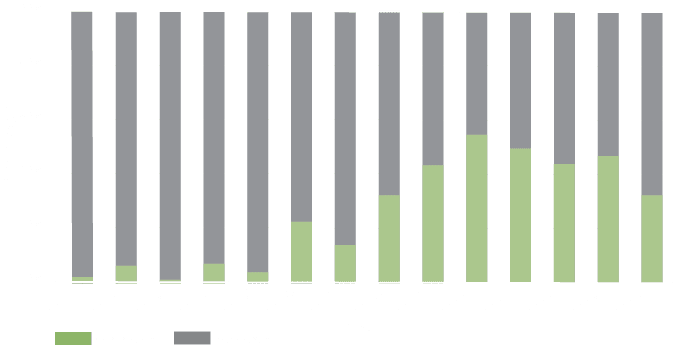

Commercial vs. Residential Fundings By Year

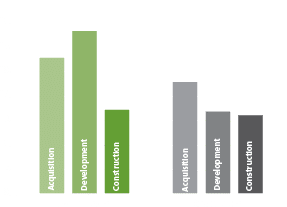

Average Duration of Loans By Loan Type

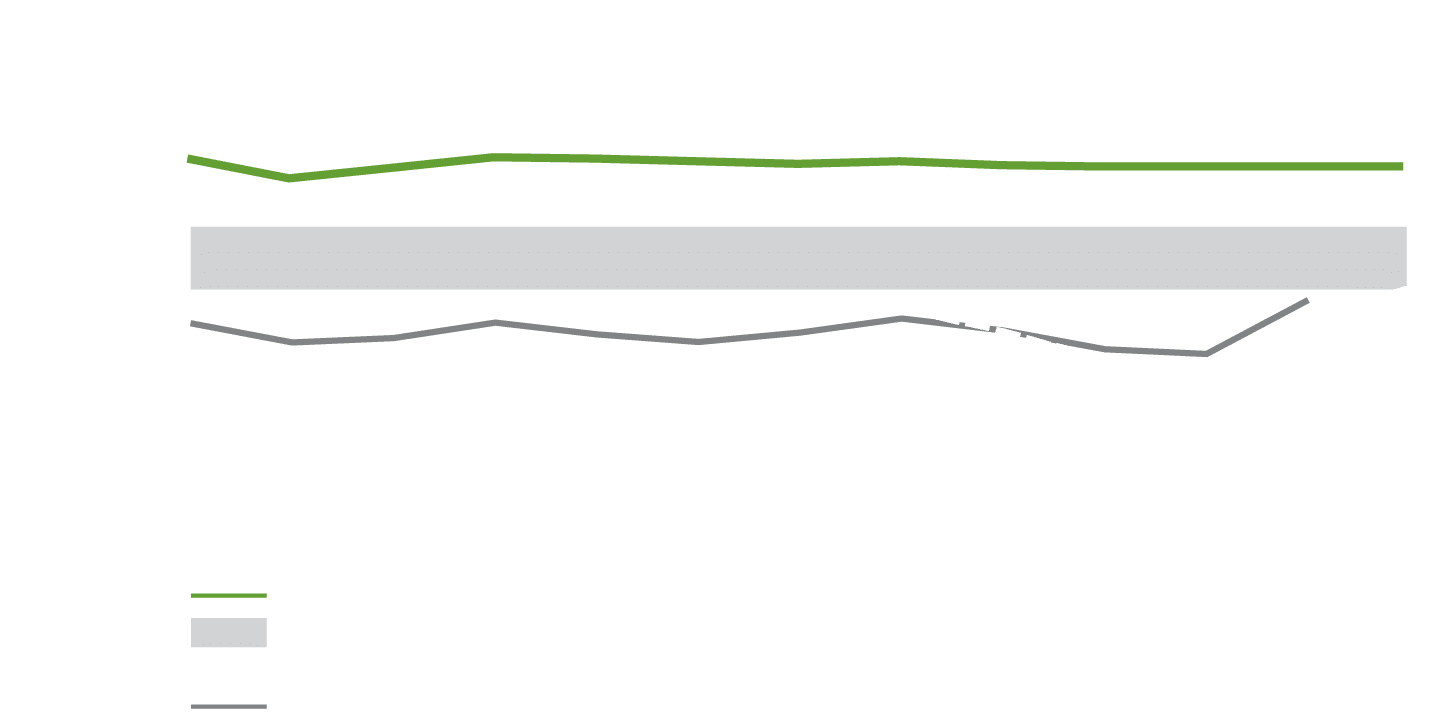

Residential and Commercial Borrowing Rates

Information reflected above is for loans funded in 2011 through Q2 of 2024. *Average annualized interest rate to investors is based upon the annualized interest rate received by investor(s) is dependent upon the payoff before maturity or extension of the loan term. Some loans may payoff before the loan terms which would decrease the duration of the loan, and others may have extensions available that could increase the duration of the loan. **Loan to Value is determined by an appraisal, Broker Price Opinion (BPO), or the valuation provided by the County Assessor’s Office. Loans with an appraisal wavier are not included. *** An acquisition loan includes raw land and/or an existing structure. ****Number of borrowers calculated uniquely by point of contact per segment.

Our Pledge to our Investors

Ignite Funding facilitates the role of Default Coordinator when a borrower defaults on a loan, and the property needs to be taken back through foreclosure or a Deed in Lieu of Foreclosure. Upon completion of a foreclosure or execution of a Deed in Lieu of Foreclosure the investors transition from a Lender to an Owner of a Real Estate Owned (REO) asset.

Likewise Ignite Funding’s role changes from Loan Servicer to Asset Manager for the property. In this role, Ignite Funding coordinates ownership responsibilities on behalf of the investors and markets the asset for sale. Our top priority is protecting our investors principal investment. We take great pride in the assets we underwrite and offer as investments. We also recognize the risk of the investment and the trust our investors place in us when a borrower goes into default. We encourage our Investors to review the materials below to have a clear understanding about the default/foreclosure process, should a Borrower default on a loan.