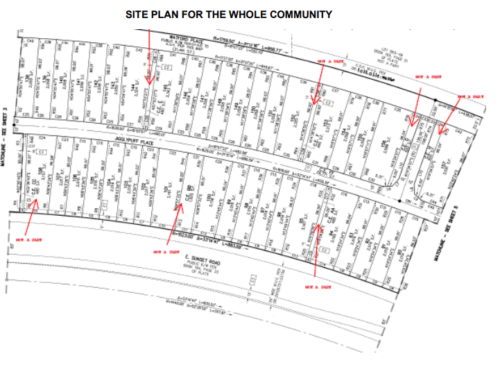

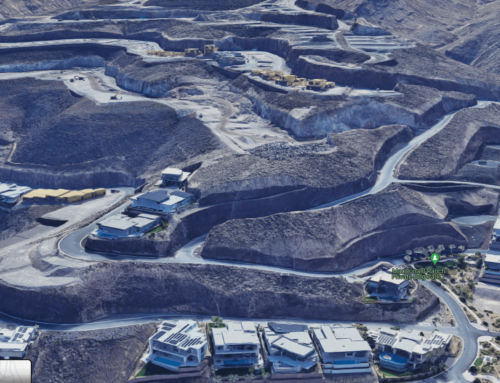

Since acquiring a majority of the shopping center for $19,100,000 in the past year, the borrower is looking to refinance the collateral of the remaining 66,000 square foot shopping center. The collateral has existing regional tenants like Dotty’s, Paycheck Advance, Metro PCS, and a T-Mobile cell tower. Other tenants in the center include Tractor Supply Company, Autozone, Harbor Freight Tools, Applebee’s, Jack in the Box, Sizzler, Firehouse Subs, and El Pollo Loco. Since acquiring the property, the borrower worked to get a parcel map recorded to sell individual parcels/buildings to prospective buyers. This was done to take advantage of the arbitrage between bulk sales and triple net sales. Simply put, the parts are worth more than the whole. The borrower will continue to work to increase the current occupancy of 66%. Occupancy would increase to 92% once the four tenants he is currently working with sign a lease. Upon getting the occupancy increased, the borrower will begin to sell individual buildings unlocking the additional value in the property.

Master Loan Amount: $14,750,000

Yield: 10% Interest is paid monthly in arrears with payments due on the 1st of each month with a 10- day grace period. *For investments equal to or greater than $100,000 investors will earn 10.5%.

Term: Nine months with an optional nine-month extension at maturity. Final maturity date is 5/12/24.