Midway Land Holdings, LLC #5923 | UTAH – SOLD OUT

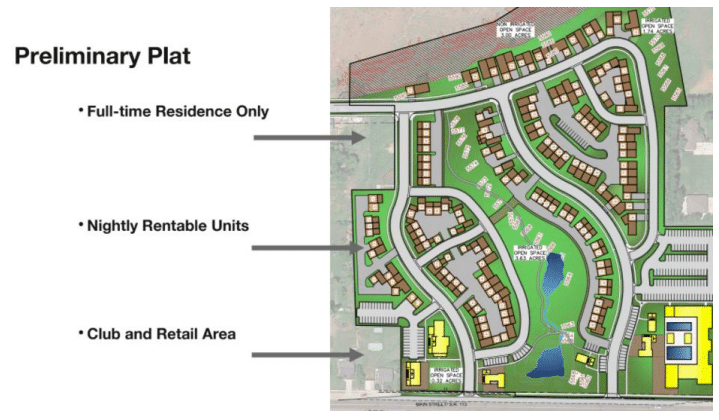

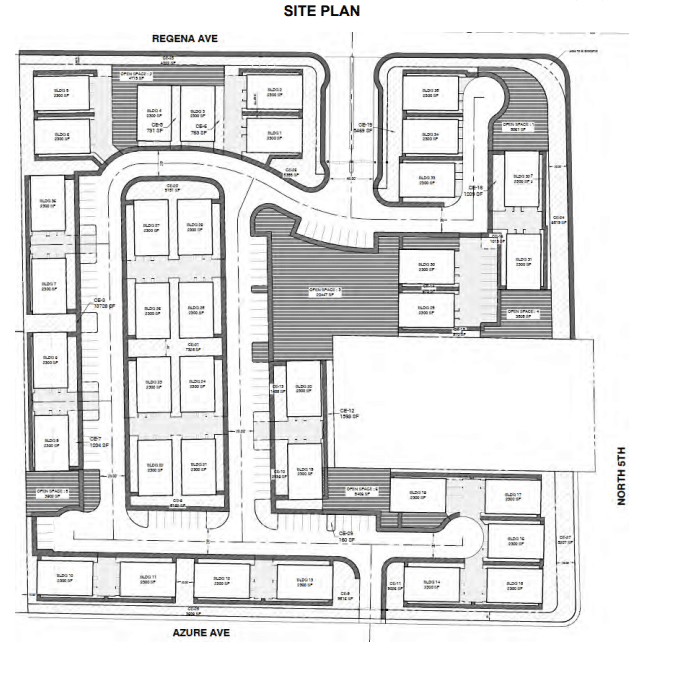

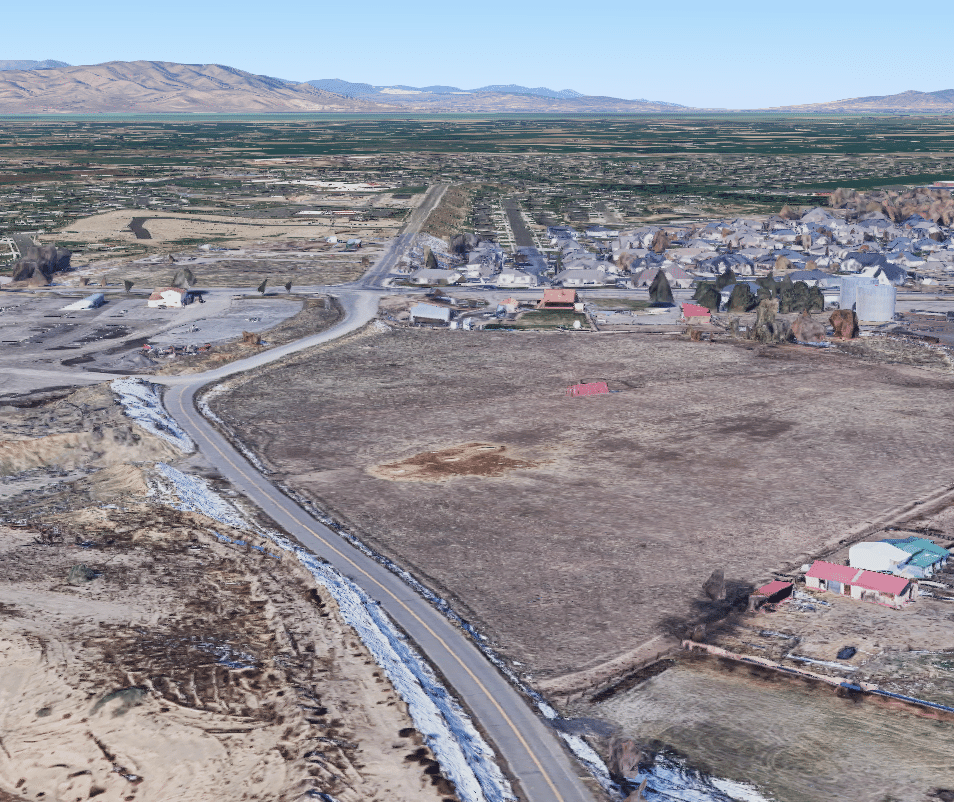

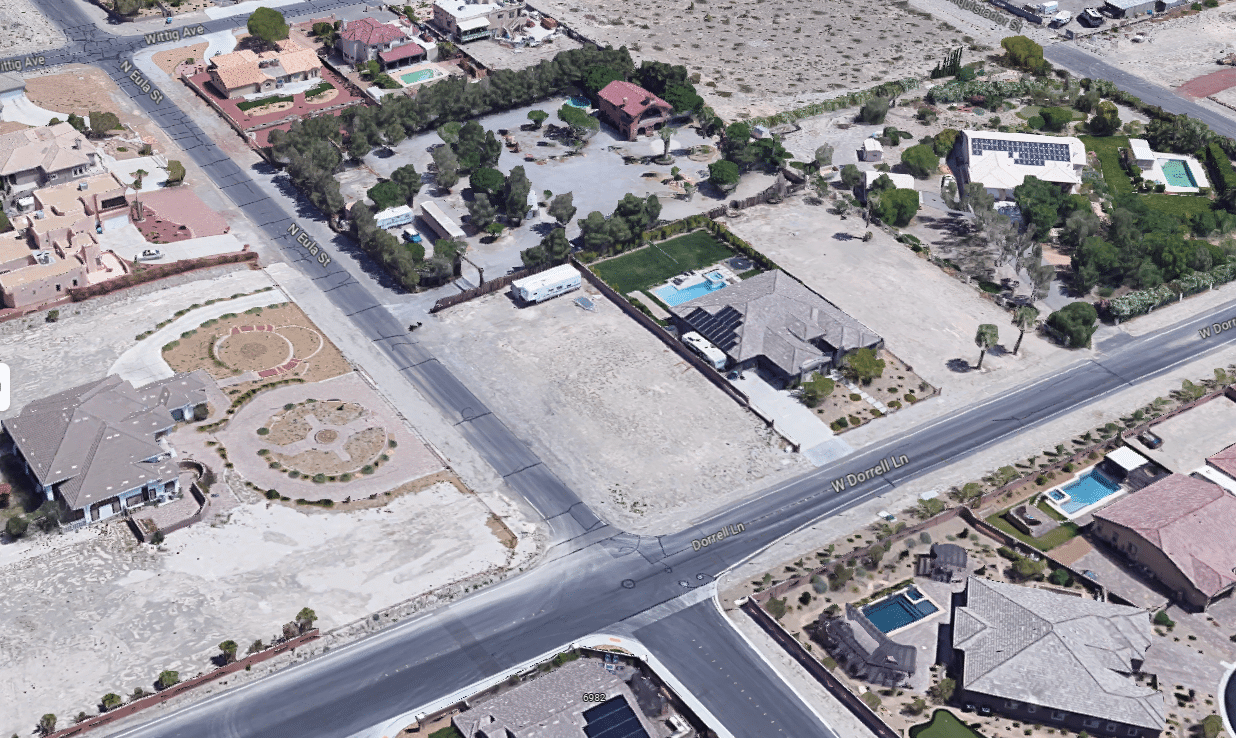

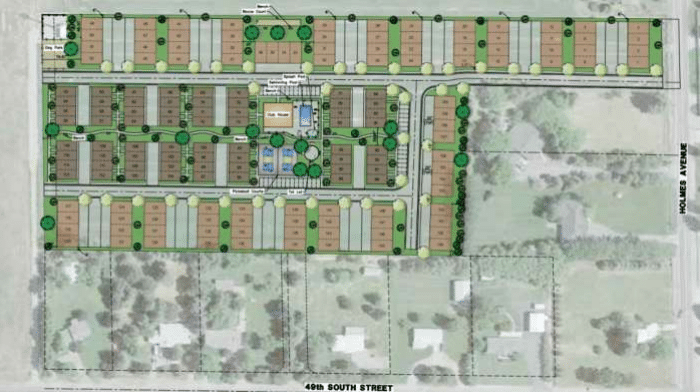

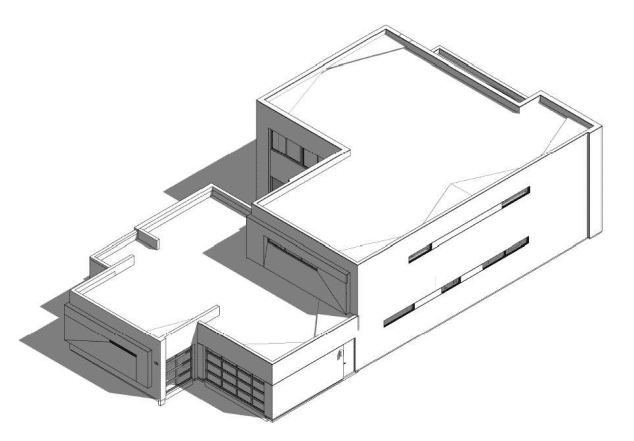

First Trust Deed collateralized by roughly 25 acres of partially improved land which will eventually be developed into 143 townhomes as well as a few commercial pads. This is the next phase of the successful Whitaker Farms project the borrower completed three years ago. Since acquiring the property in September of 2020, the borrower has torn down the old buildings on site and received master plan approval for the entire project. Additionally, phase one through three final map will be approved with the payment of fees and posting a bond, all of which this loan will be used for. Future fundings will be used for the development of phase two and three as well as to get the final map approved on the last two phases. In all, there will be 143 units built in the community, some of which will allow for nightly rentals. Additionally, the borrower already has over 40 reservations for the townhomes and two of the commercial pads even though homes won’t be finished for at least nine more months. Master Loan Amount: $37,300,000 Yield: 10% Interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period.