1759 Harpsichord Way, LLC #5802 | NEVADA – FUNDED

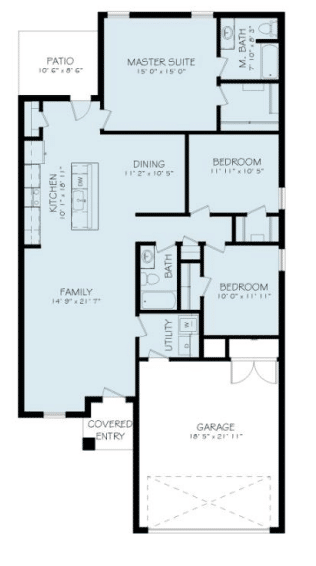

1759 Harpsichord Way, LLC is a special purpose entity set up to construct this home. Michael Johnson, the manager of the company, has been building semi-custom homes and renovating high-end homes for nearly a decade. As a licensed general contractor, Michael has the experience and expertise to fix most issues that may arise without having to outsource the work. Loan Amount: $1,200,000 Yield: 10% interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. *For investments equal to or greater than $100,000 investors will earn 10.5% Term: Nine months with an optional nine-month extension at maturity. Final maturity date is 11/23/24.