Harmony Homes Nevada, LLC #6144-#6148 – FUNDED

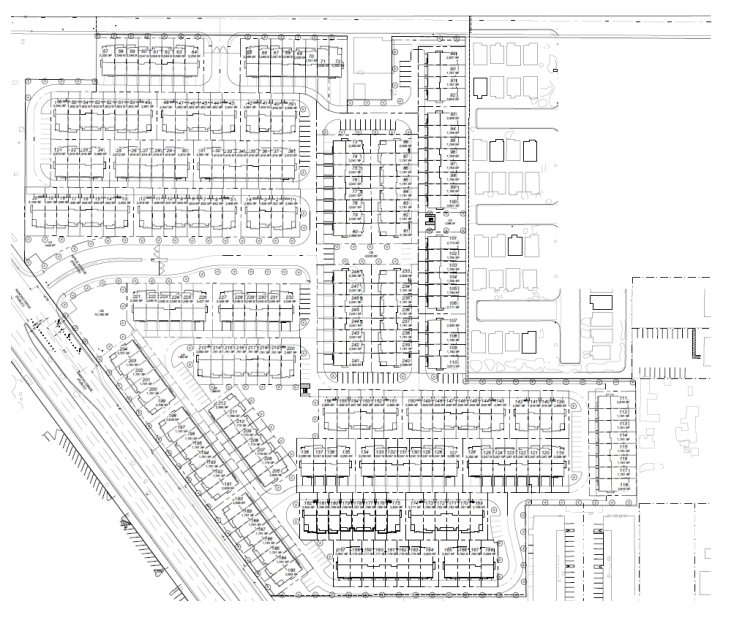

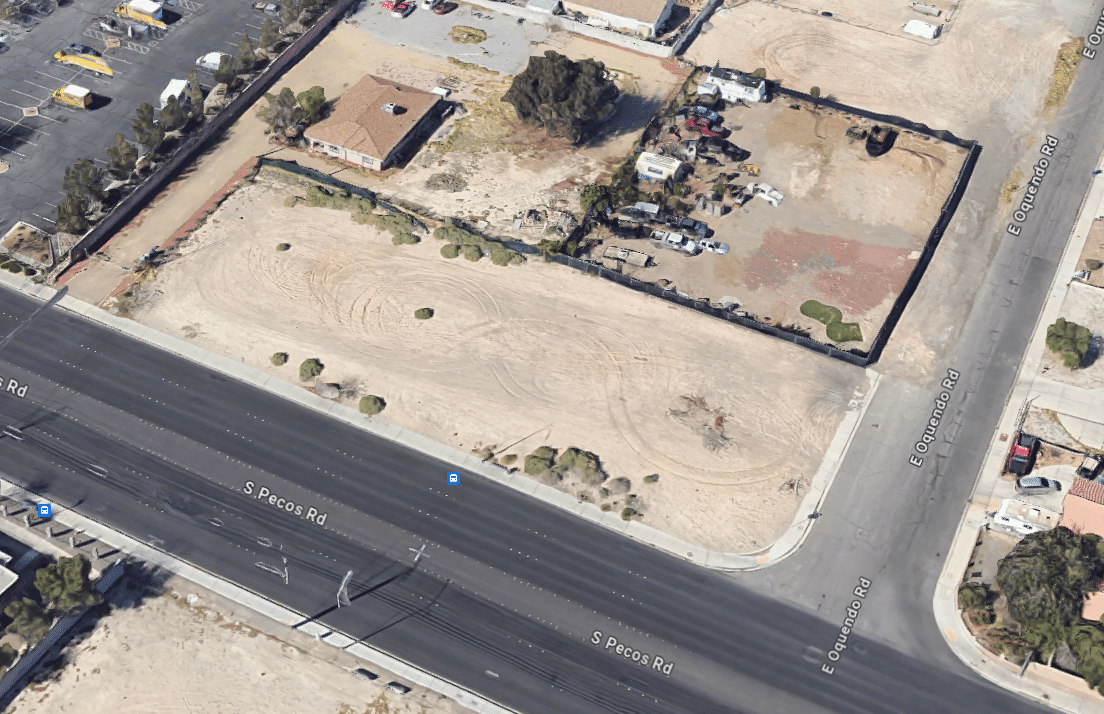

First Trust Deed collateralized by 29 finished townhome lots that was once roughly 1.44 acres of residentially zoned land near the corner of Vegas Dr and N Rancho Dr. This community is roughly five miles northwest of downtown Las Vegas. The land was zoned R-2 which allowed for the development of 34 homes on the site, but the borrower worked with the city to approve a 248-lot community. Since acquiring the site about five years ago, the borrower has continued to work with the city to approve the 248- lot community as depicted on the next page. Home sales have already begun, averaging $330,000 and 1,300 square feet in size, it is anticipated the borrower will be sold out of the community by the middle of 2024. Master Loan Amount: $1,522,500 Yield: 10% interest is paid monthly in arrears with payments due on the 1st of each month with a 10- day grace period. *For investments equal to or greater than $100,000 investors will earn 10.5%. Term: Nine months with an optional nine-month extension at maturity. Final maturity date is 7/23/25.