Harmony Homes Nevada, LLC #6405 | NEVADA – FUNDED

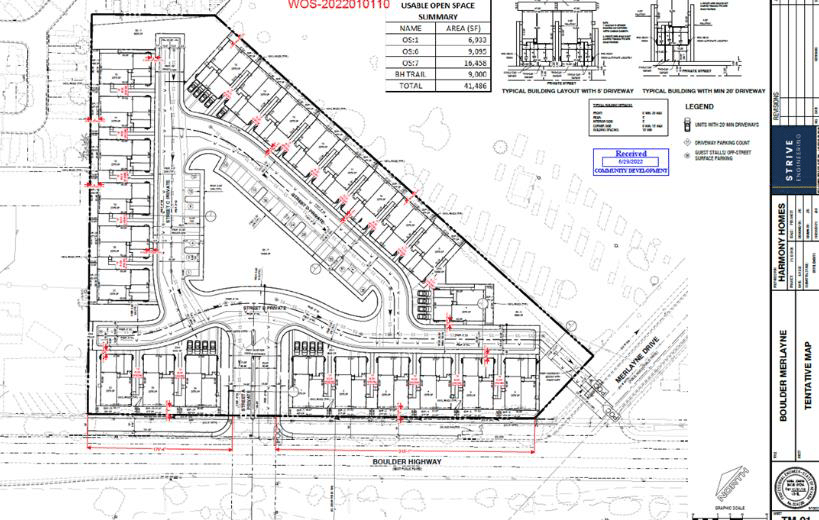

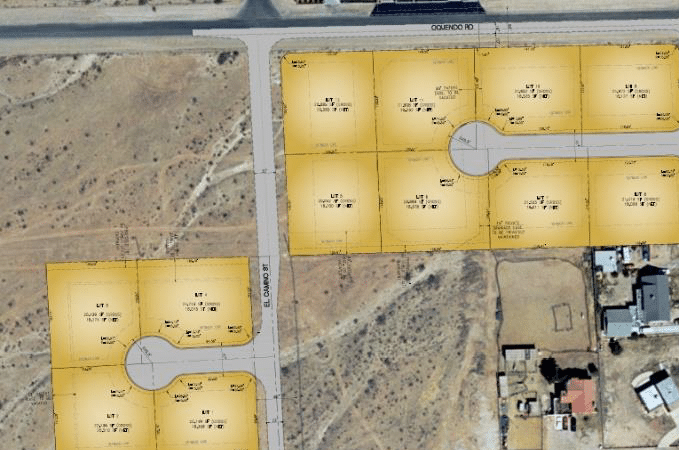

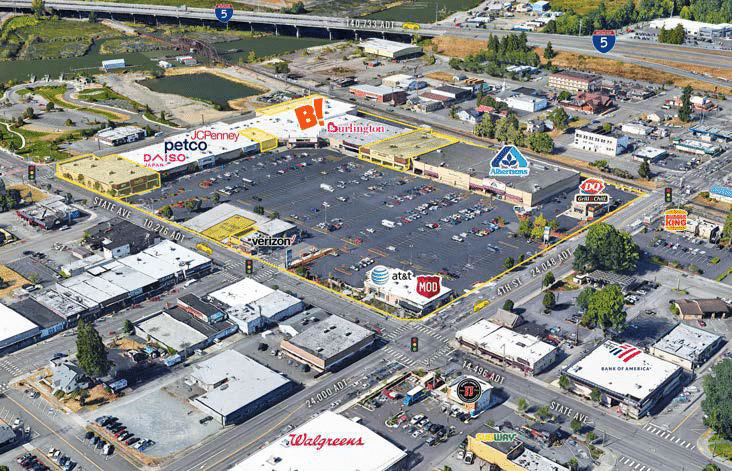

First Trust Deed collateralized by 4.88 acres of land near the corner of Boulder Highway and Sunset Rd in Henderson, NV (roughly 13 miles southeast of downtown Las Vegas). The land was zoned for Community Mixed Use and since the borrower has gotten a final map approved to allow for the development of a 72-unit triplex condo community and is currently developing the land. As a leader in the entry level residential real estate market in Las Vegas, Harmony homes has acquired this parcel with the idea of increasing density to reduce the price point. In today’s changing real estate market, it is prudent of owners to find creative ways to reduce the price of the finished product. Harmony has done that with increasing the density. The average sales price is anticipated to be 30% less than the average sales price of a home in the area. Master Loan Amount: $4,400,000 Yield: 10% interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. *For investments equal to or greater than $100,000 investors will earn 10.5%. Term: Nine months with an optional nine-month extension at maturity. Final maturity date is 4/14/26.