MJZ, LLC #6005 | NEVADA – FUNDED

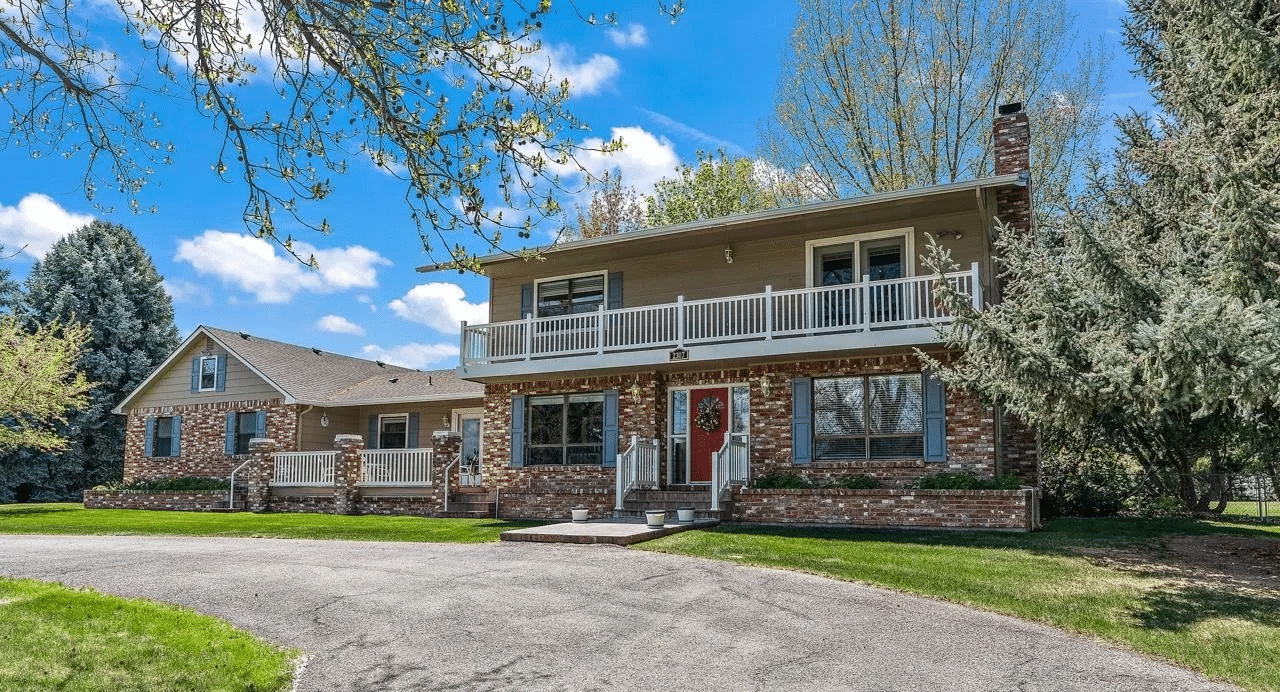

The collateral for this loan is a finished residential lot in Lake Las Vegas which is a master planned community surrounding the second largest reservoir in Southern Nevada. The lot was sold by the master planned developer directly to the borrower instead of going through a production home builder which is more typical for this type of transaction. The borrower has already consulted with a few of the top custom home builders in Las Vegas to price out potential construction jobs. The borrower ultimately chose JAG Development to build this home. Custom homes in this community average about 6,000 square feet and are valued at nearly $5,000,000. The borrower has submitted plans for a 5,500 square foot home with an estimated cost of over $4,000,000. Loan Amount: $514,000 Yield: 10% interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. *For investments equal to or greater than $100,000 investors will earn 10.5%. Term: Nine months with no extensions at maturity. Final maturity date is 7/16/24.