Elegance Russell, LLC #6260 | NEVADA – FUNDED

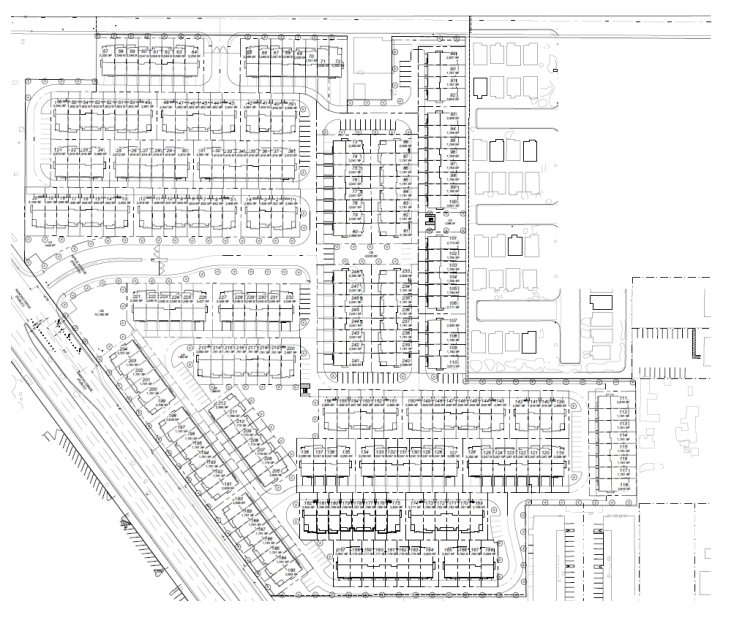

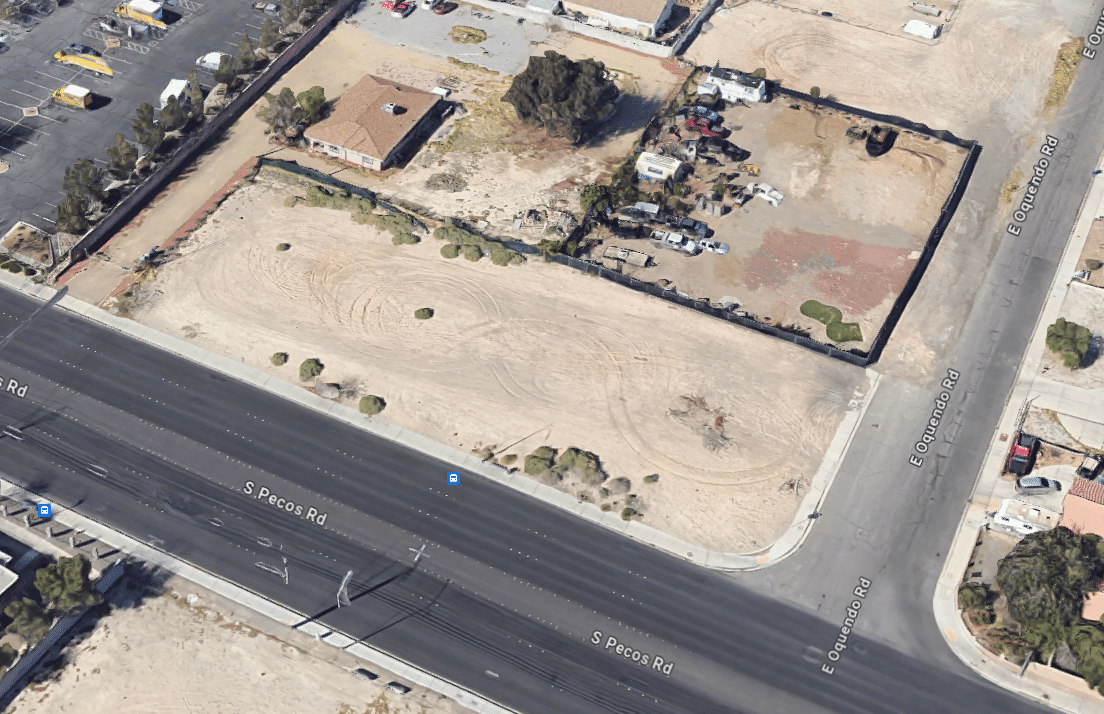

This first trust deed is collateralized by 11.15 acres of land located about 11 miles southeast of downtown Las Vegas, NV. Since getting the up zoning approved, the borrower will continue to work with the city to get approval on their proposed tentative plat map. Right now, part of the project is zoned RM32 for multi-family residential. The other part of the project is zoned for general commercial purposes. The borrower intends to develop a 240-unit age restricted community where only people over the age of 55 will be allowed to live. The borrower currently owns and or manages over 5,000 rental units in and around Las Vegas, so they have a tremendous amount of experience in the field. As it currently stands, the project is nearly shovel ready and will be listed for sale shortly. Loan Amount: $4,100,000 Yield: 10% interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. Term: Nine months with an optional nine-month extension at maturity. Final maturity date is 11/14/25. *For investments equal to or greater than $100,000 investors will earn 10.5%.