Harmony Homes Nevada, LLC #6467 | NEVADA – ($600,000 AVAILABLE)

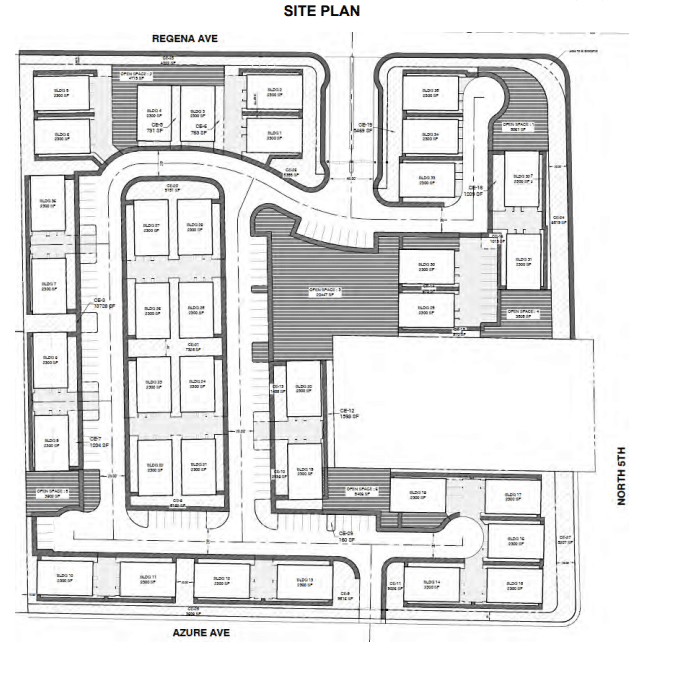

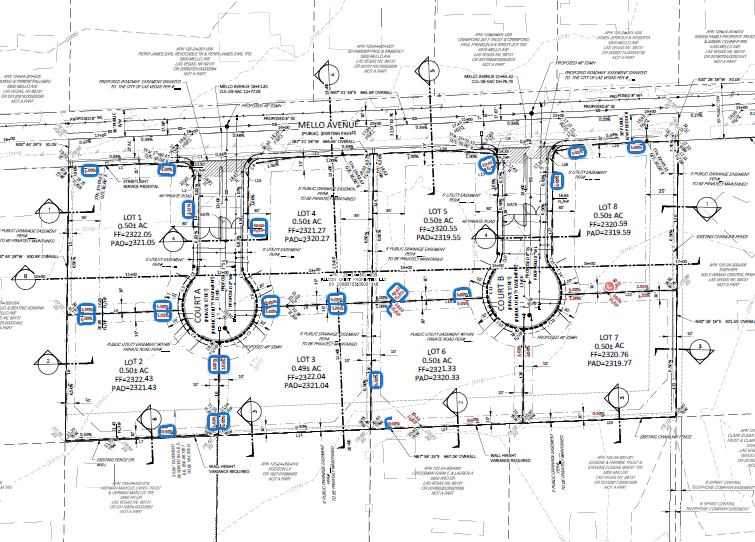

First Trust Deed collateralized by roughly 7.18 acres of residentially zoned land near the corner of Azure and N 5th St in Las Vegas, NV (roughly eight miles north of downtown Las Vegas). The borrower has successfully worked with the city to approve a 108-unit community in the form of 36 triplex buildings. Horizontal development is near completion and vertical construction is beginning with this loan refinancing the borrower’s previous land loan while also providing additional liquidity for part of the funds put into development. Sales have begun for this community and are anticipated to continue through 2025 and potentially into early 2026. With plans ranging from 1000 -1500 square feet and price points starting in the mid to low $300,000’s, these townhomes will help fill the demand for the entry level buyer. Master Loan Amount: $8,100,000 Yield: 10% interest is paid monthly in arrears with payments due on the 1st of each month with a 10- day grace period. *For investments equal to or greater than $100,000 investors will earn 10.5%. Term: Nine months with an optional nine-month extension at maturity. Final maturity date is 6/17/26.