Green Level West I Apartments, LLC #6465 | NORTH CAROLINA – ($1.6M AVAILABLE)

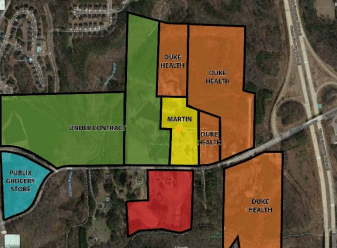

The collateral for this loan is an approximately 25-acre site that will be entitled to allow for the construction of a 300+ unit apartment building. This acquisition sits contiguous to two separate properties the borrower has under contract which will total over 40 acres. Since the purchase of this land happened before it was fully entitled, the borrower used Ignite to acquire the property while finalizing the entitlements. Entitlements on all 40 acres have now been officially approved by the city, allowing a mixed use district including residential spaces, commercial spaces, and some offices as well. On the other side of the property construction has begun on over 1 million square feet of medical space that is owned by Duke Health. The city has already expressed a desire to make this corridor the new “heart” of the city which bodes well for the long-term viability of the project and the short term needs to get the property entitled Loan Amount: $6,600,000 Yield: 10% interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. *For investments equal to or greater than $100,000 investors will earn 10.5%. Term: Nine months with an