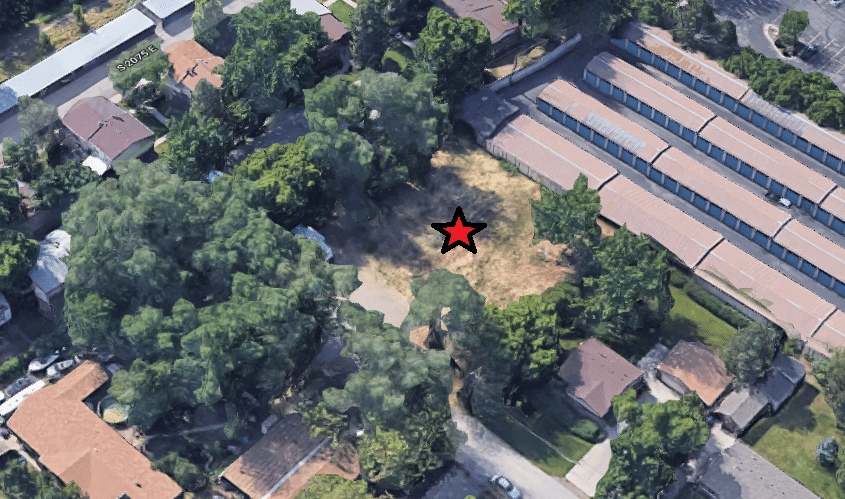

Harris53 Apartments, LLC #5268 | UTAH – FUNDED

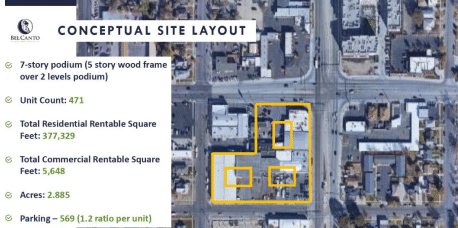

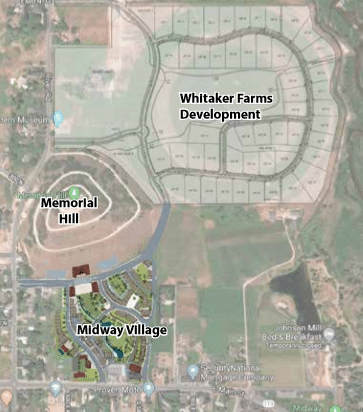

The collateral for this loan is an approximately 2.885-acre site that will be entitled to allow for the construction of a 454-unit, seven-story apartment complex. With a unit mix of 22 studio’s, 280 one-bedrooms, and 152 two-bedroom units, the project is geared to smaller units focused toward the more cost conscience renters. With final plat approval anticipated for January, the borrower is in the process of getting final general contractor pricing for the build job which will put them in a position to get construction financing. Loan Amount: $9,450,000 Yield: 10% interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. *For investments equal to or greater than $100,000 investors will earn 10.5% Term: Nine months with an optional nine-month extension at maturity. Final maturity date is 6/6/23.