Hillwood Homes at Midway 18, LLC #6284 | UTAH – ($900K Available)

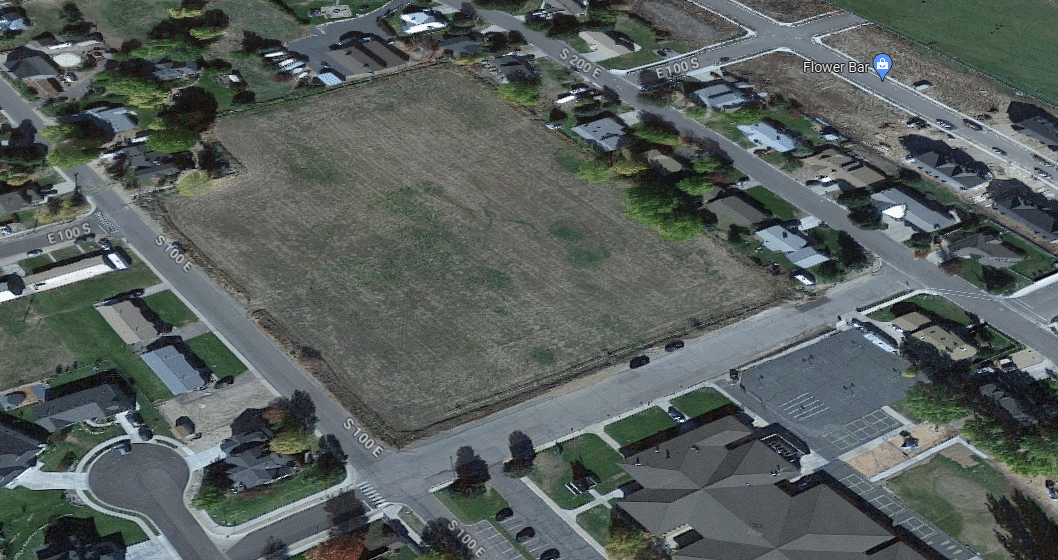

First Trust Deed collateralized by three finished lots in the Bonner Meadows community of Midway, Utah. Two of the three lots, 11 and 16, have been presold and the last lot (lot 1) is a spec home. The floor plan for lot 1 is Zurich with 4,584 sq/ft, lot 11 is Lucerne with 4,147 sq/ft, lot 16 is Rhine with 4,970 sq/ft and foundations are ready to be poured. Bonner Meadows is the newest luxury community by premier builder Hillwood Homes. There are 18 lots with 8 semi-custom layouts to choose from. Midway is an affluent suburb of Salt Lake City with Swiss influence and geographic similarities. They even host an annual Swiss Day parade, celebrating Alpine heritage. Bonner Meadows is in the heart of the city, just south of Main Street. It is 7 minutes away from the Provo River where you can fly fish for rainbow trout year-round. Master Loan Amount: $3,000,000 Term: Nine months with an optional nine-month extension at maturity. The final maturity date is 12/22/25. Interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. *For investments equal to or greater than $100,000 investors will