Midway Heritage Development, LLC #5352 | UTAH – FUNDED

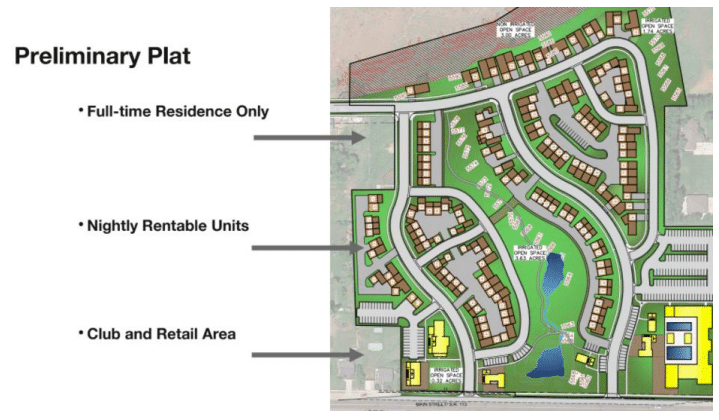

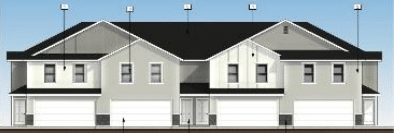

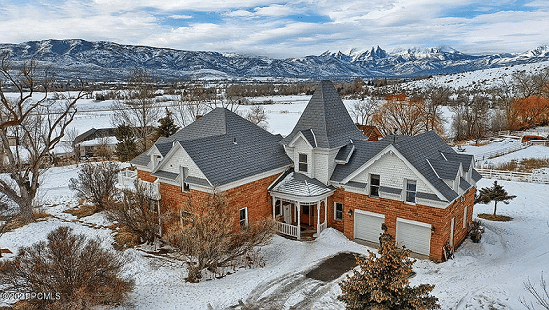

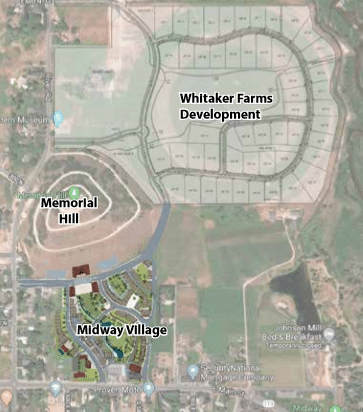

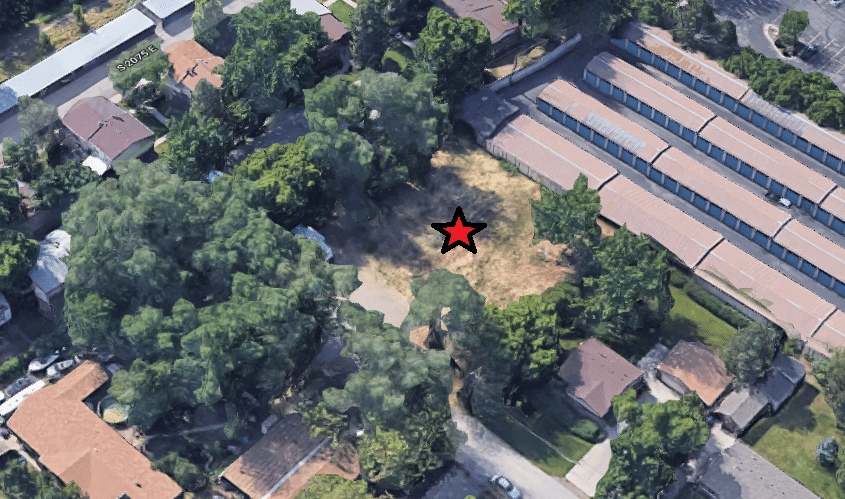

First Trust Deed collateralized by roughly 24.9 acres of farmland which will eventually be developed into 143 townhome and cottage sized lots as well as a few commercial pads. This is the next phase of the successful Whitaker Farms project the borrower completed a year ago. Although the tentative map has not been approved, part of the site is already zoned to allow higher density townhomes. Over the next six months, the borrower will continue to work with the city to get a masterplan approved for the entire site that will eventually turn into a phased development. The future fundings of this loan will go towards the approval of the final map of the project. Of the 148 approved paper lots this loan is for, there is money allocated for the development of the first 59 buildable lots. Of the first 59 buildable lots, money is allocated for the construction of the first 12 townhome units. In total, this loan will have 84 paper lots, 47 finished lots, and 12 finished townhomes. As of today, it is not anticipated for the development work to begin until July of 2022. Additionally, the borrower already has over 30 reservations for the townhomes