Future Legends, LLC #5952 | COLORADO – FUNDED

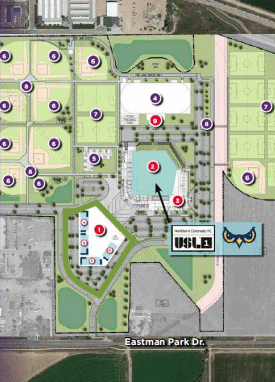

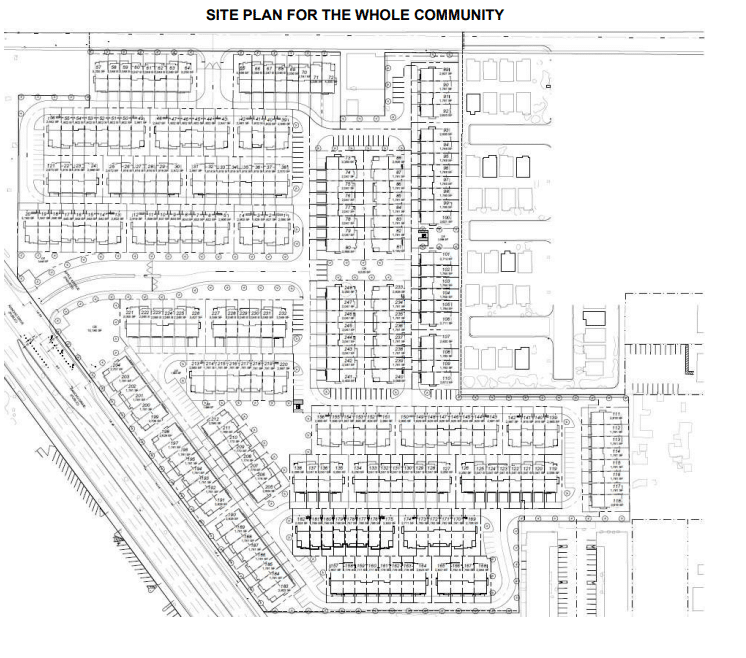

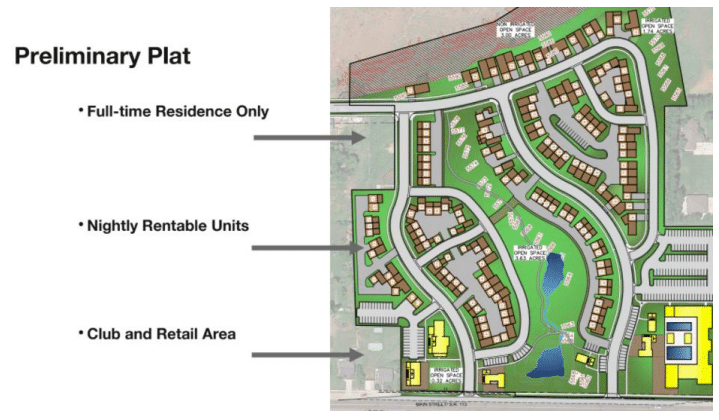

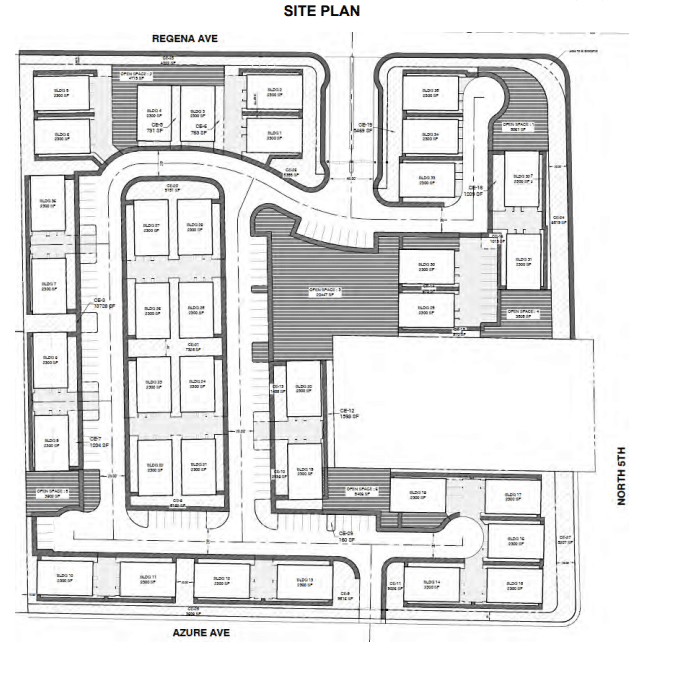

First Trust Deed collateralized by roughly 100 acres of land which will eventually be developed into a youth sports facility, surrounding a professional baseball stadium. The overall complex will combine all elements needed for a successful youth sports faculty including restaurants, fields, hotels, retail, dormitories, and other amenities. The site is located about two miles east of downtown Windsor (60 miles north of Denver, CO). After purchasing the Orem Owlz minor league baseball team in 2004, the borrower envisioned developing a youth sports complex integrated into a minor league baseball facility. This vision is being manifested into the Future Legends Complex which will consist of 12 soccer fields, 10 baseball diamonds, a 64-team dorm, with retail shops and hotels surrounding the complex. This loan will encumber everything owned by the borrower in the area excluding the stadium, dorms, future hotel parcels, and the retail area which already has bank financing in place or in process. The 100 collateralized acres will continue to be developed by the borrower using the financing from this loan and additional money from the borrower. It is anticipated that the collateral for this loan will be fully developed within three months of this loan closing. Loan