GGD Oakdale, LLC #4815 | WISCONSIN – FUNDED

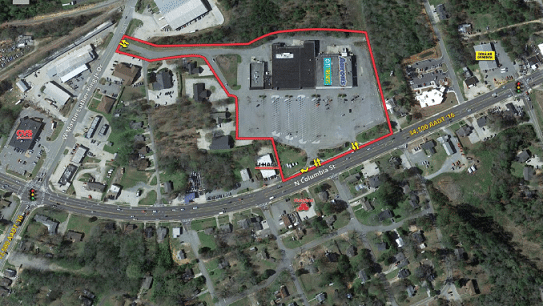

First Trust Deed collateralized by an approximately 30,000 square foot single tenant commercial building occupied by Best Buy in Kohler, WI (about 50 miles north of Milwaukee, WI). Since the property was originally built in 2006, Best Buy has been the only tenant. Given the initial lease term is set to expire in 2023, our borrower was able to acquire the site via an online auction at a steep discount to intrinsic value. The seller, an affiliate of US Bank, took the property back via foreclosure of their $5,225,000 deed of trust. After the property was originally appraised for $6,600,000, the original owner made their monthly payments to the bank until 2017 at which point it went into a default status. As it currently stands, the Best Buy continues to pay over $30,000 per month in rent and is responsible for the building maintenance, property taxes, and insurance. Our borrower has already begun discussions with Best Buy to sign a new, long term lease. Once this is accomplished, he would then sell the property via more traditional avenues. Loan Amount: $2,450,000 Yield: 10.5% (Principal Balance ≥ $100,000); 10.0% (Principal Balance < $100,000) Interest is paid monthly in arrears with payments