Forever Home, LLC #5900 | IDAHO – FUNDED

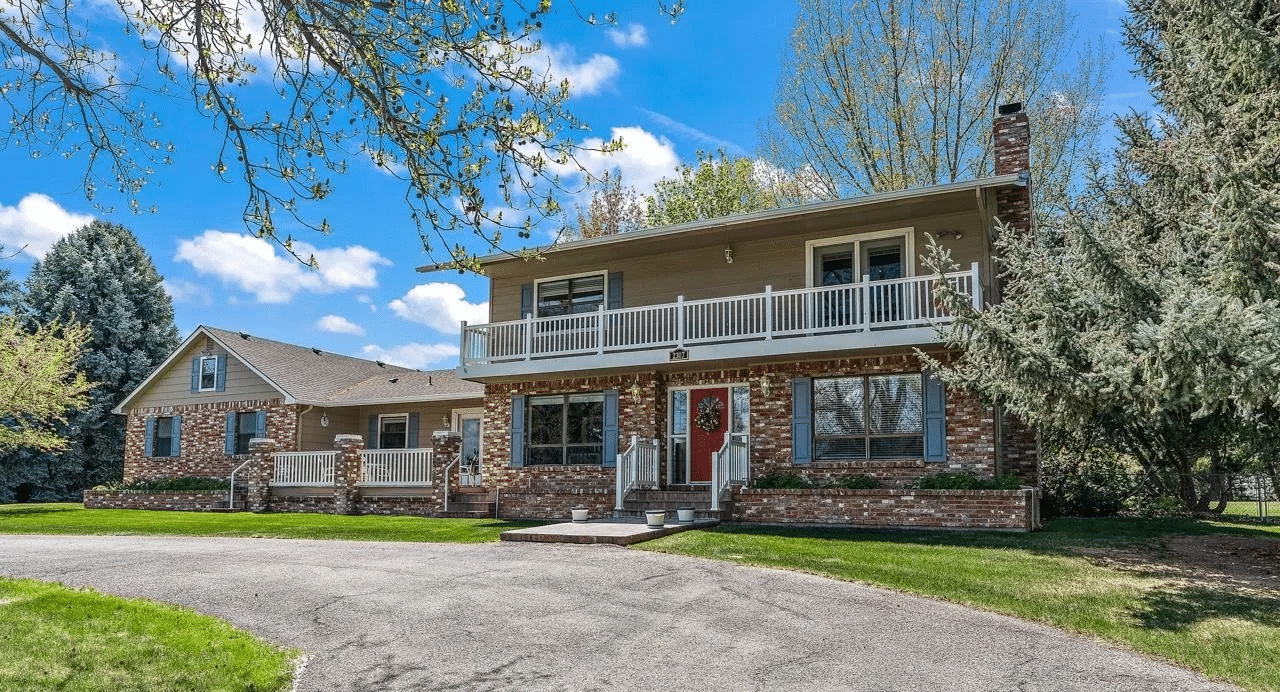

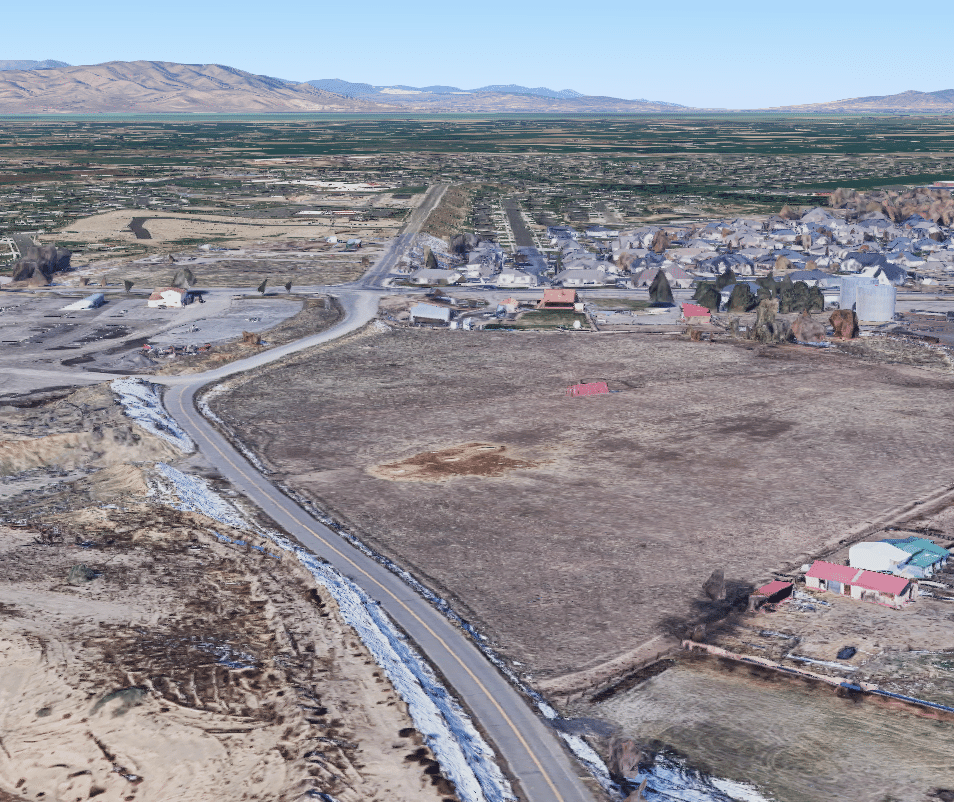

The collateral for this first position trust deed is a nearly 1.25-acre property with a 4,150 square foot home on it. This six bedroom, four and a half bathroom custom home was built in 1977 in the Aspen Grove Subdivision, an idyllic community situated in Meridian, ID which is about 13 miles West of Boise, ID. Over the past year nearly the entire home has been updated with new and modern fixtures. Loan Amount: $800,000 Yield: 10% Interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. *For investments equal to or greater than $100,000 investors will earn 10.5% Term: Nine months with no additional extensions available. Final maturity date is 4/27/24.