Thunder Mountain by Bakerson, LLC #5078 | ARIZONA – FUNDED

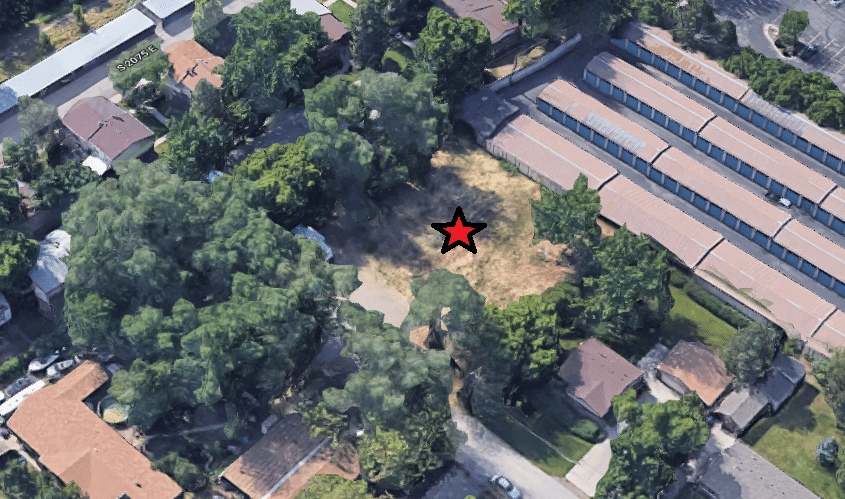

This first trust deed is collateralized by a nearly 100,000 square foot Quality Inn hotel that will be converted to a 65-unit apartment building. This apartment building will fill a void in the marketplace for market rate, workforce housing. Originally constructed in 1972, this block building has been operating as various brands of hotels and motels. Due to the pandemic and a multitude of macroeconomic events over the past few years, hotels have taken a bit of a hit forcing a consolidation in the industry. Although this property could be viewed as one of the consolidation casualties, the borrower anticipates it to become a great redevelopment opportunity. By converting the property into its highest and best use as an apartment building, it will bring new life and economic opportunity to the asset. After the conversion is completed, net rents are anticipated to be in excess of $300,000 annually. Loan Amount: $3,100,000 Yield: 10.5% (Principal Balance ≥ $100,000); 10.0% (Principal Balance < $100,000) Interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. Term: Nine months with three optional nine-month extensions at maturity