Harmony Homes Nevada, LLC #5499-5512 | NEVADA – FUNDED

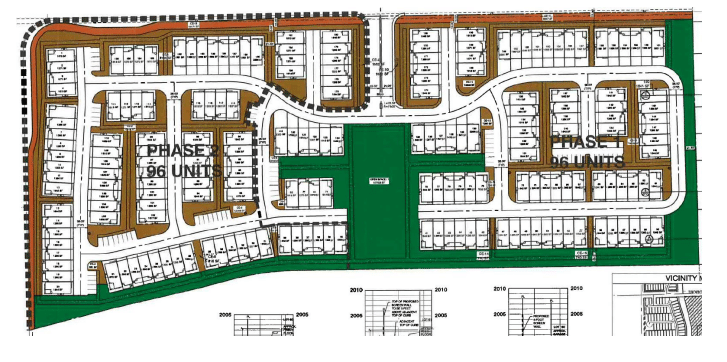

First Trust Deed collateralized by nearly 15.19 acres of land near the corner of Ann and Losee in North Las Vegas, NV (roughly 10 miles north of downtown Las Vegas). The land was zoned C-1 for Neighborhood Commercial which would allow for the development of your typical strip malls and drive through restaurants. The borrower has been working with local officials since putting the property under contract in December of 2021 to get the property rezoned for residential. The borrower believes that the zoning change will occur in the next few months. Once the zoning change occurs, they will work with local officials to get a tentative map approved for the development and ultimately construction of a 196-lot community as shown on the next page. The borrower has developed and sold over 500 homes near the corner of Ann and Losee since 2009 and are very familiar with what it takes to get the zoning completed, site plan approved, the land developed, and the finished homes closed. Master Loan Amount: $9,114,000 Yield: 10% interest is paid monthly in arrears with payments due on the 1st of each month with a 10- day grace period. Term: Nine months with an optional