Sequoia Homes, LLC #4810 | Nevada – FUNDED

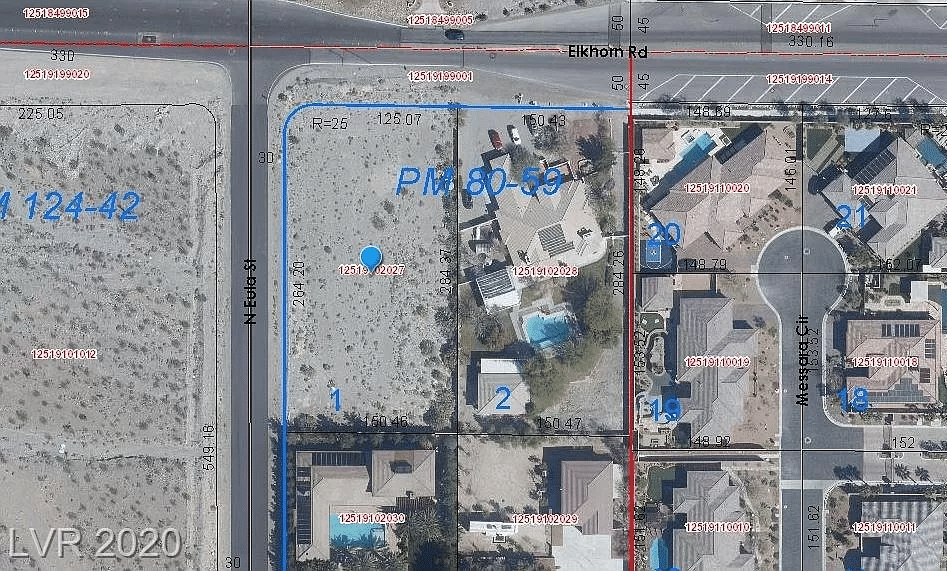

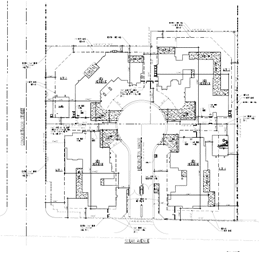

The collateral for this loan is an .98-acre lot located in the Northwestern part of Las Vegas (approximately 18 miles northwest of downtown Las Vegas, NV). Since acquiring the property in July of this year, they have worked with the city and county to allow for the construction of a home on the site. The building plans call for a 4,139 square foot home to be constructed. The home will consist of four bedrooms and four and a half bathrooms. The square footage does not include the four-car attached garage. Although the property is not presold, the borrower will engage a brokerage company to market the property for sale once the construction begins. Loan Amount: $680,000 Yield: 10.5% (Principal Balance ≥ $100,000); 10.0% (Principal Balance < $100,000) Interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. Term: Nine months with an optional nine-month extension at maturity. Value: $1,240,000 based on a BPO done by Mosaic Commercial Advisors on 10/29/2020. LTV: 55% based off the BPO shown above.