Prez Enterprises, Inc. #6393 | TEXAS – ($700K Available)

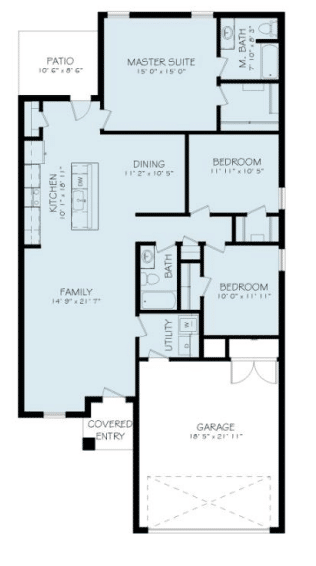

First Trust Deed collateralized by a 19 .05-acre parcels of land approximately 12 miles north of downtown Houston, TX. The borrower is purchasing all 19 parcels in the form of finished lots and intends to construct finished spec homes on each lot. Vertical construction is anticipated to begin mid Q4 of 2024 with completion expected to occur sometime in mid-2025. These homes will all be 3 bed 2.5 bath models with 9 homes being 1571 sf and the other 10 homes being 1556 sf. The borrower expects to have these homes pre-sold before construction is complete and will begin marketing them once construction begins. Master Loan Amount: $5,363,000 Yield: Interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. *For investments equal to or greater than $100,000 investors will earn 10.5%. Term: Nine months with an optional nine-month extension at maturity. Final maturity date is 3/25/26.