Gilbert Care, LLC #5552 | ARIZONA – FUNDED

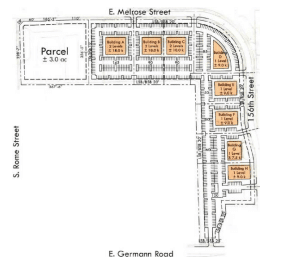

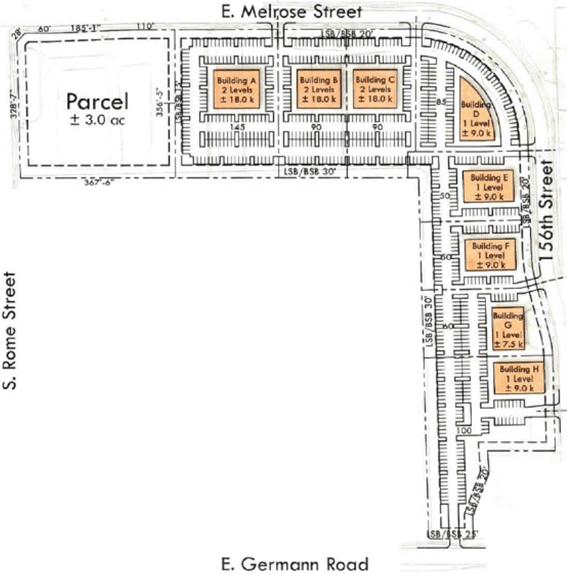

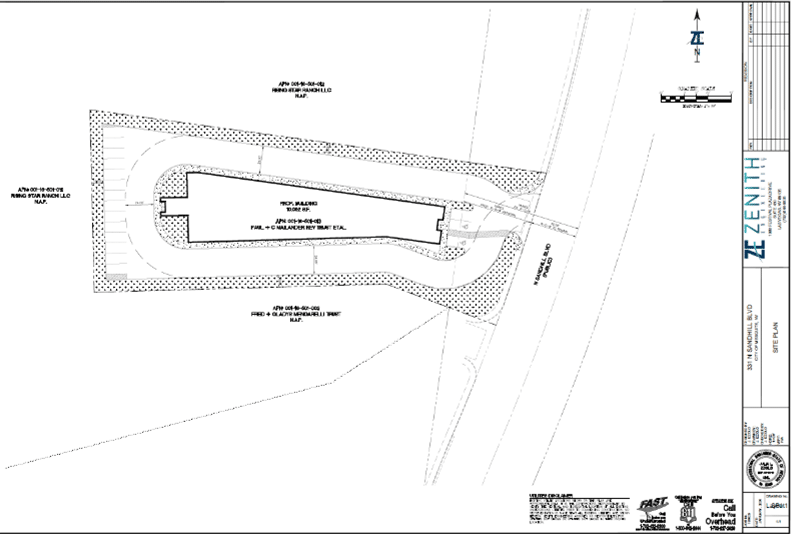

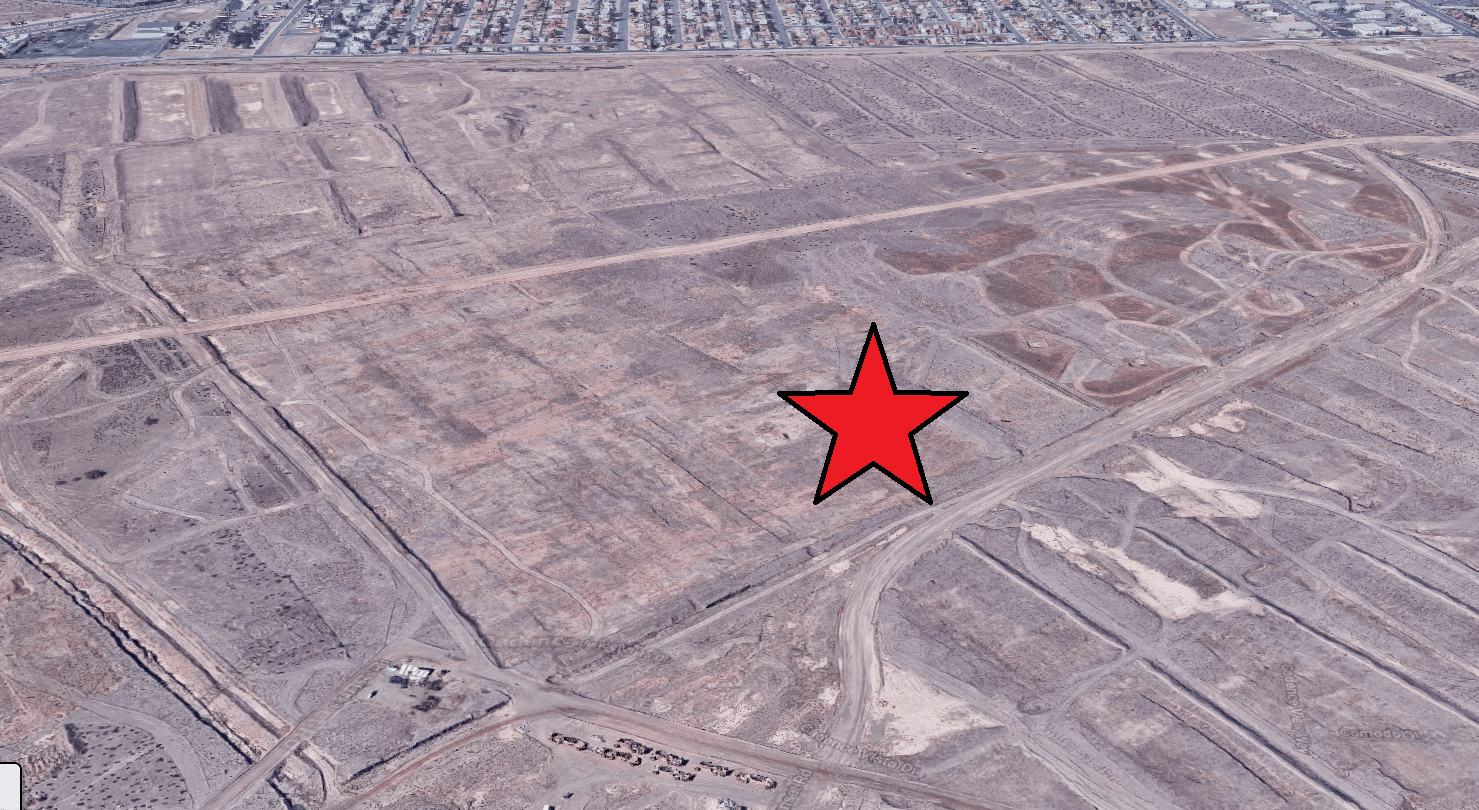

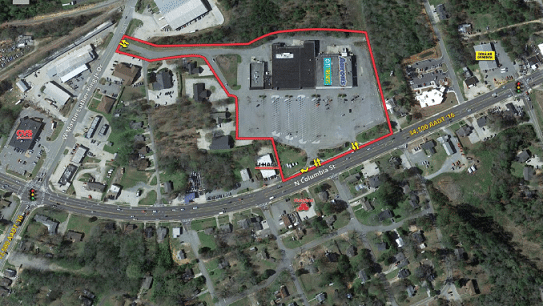

The collateral for this loan is an approximately 14.39-acre site that will be entitled to allow for the construction of medical facilities. On the large three-acre parcel shown in the picture above, the borrower intends to build a 48-bed behavior health facility which is their expertise. With the remaining 11 acres the borrower will look for built-to-suit medical tenants or sell the land off to medical developers. The project sits less than 400 yards from the entrance to the 212 bed Mercy Gilbert Medical Center which opened in 2006. The borrower is currently in discussions with a potential buyer of what will be the behavior health facility. It is the same buyer that has already purchased another behavior health facility from the borrower in 2022. Loan Amount: $8,000,000 Yield: 10% interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. *For investments equal to or greater than $100,000 investors will earn 10.5%. Term: Nine months with no additional extension periods.