Eagle Physical Therapy, LLC #5246 | UTAH – FUNDED

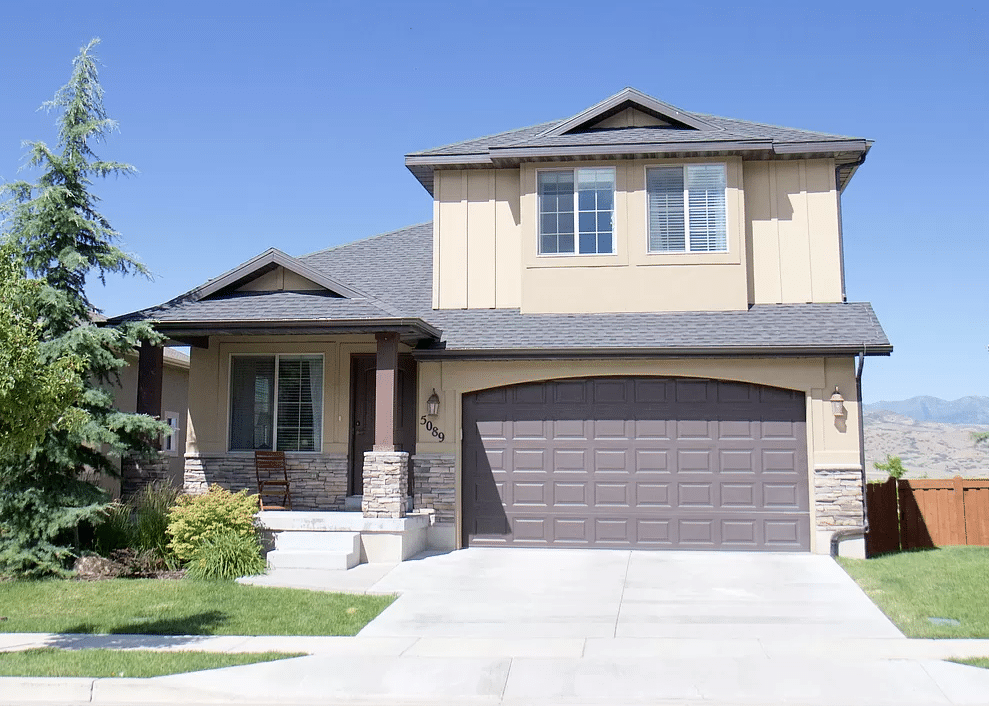

The collateral for this loan consists of a 3,007 square foot home in Lehi, UT which is 27 miles south of Salt Lake City, UT. Built in 2009, the home is in good physical condition with only minor cosmetic repairs necessary to reposition the asset to sell again. With some minor stucco work and grading the slope of the soil away from the five bedroom, three bath house, the borrower and his contractor are more than capable of making the necessary changes. Once the property repairs are performed, the borrower anticipates listing the home for $620,000 which is more in line with what a property of this size and condition should be selling for. The purchase price is $501,000 with an anticipated budget of $3,000 to fix the necessary repairs. Loan Amount: $400,000 Yield: 10% iterest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. *For investments equal to or greater than $100,000 investors will earn 10.5%. Term: Nine months with no optional extension at maturity. Final maturity date is 8/2/22.