GGD Oakdale, LLC #4798 | GEORGIA – FUNDED

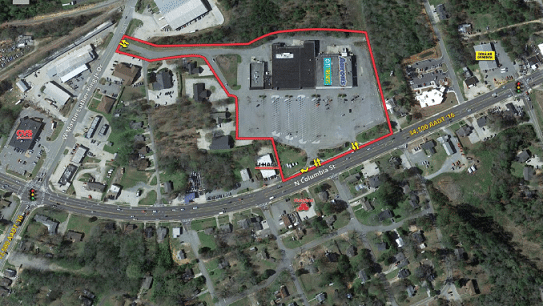

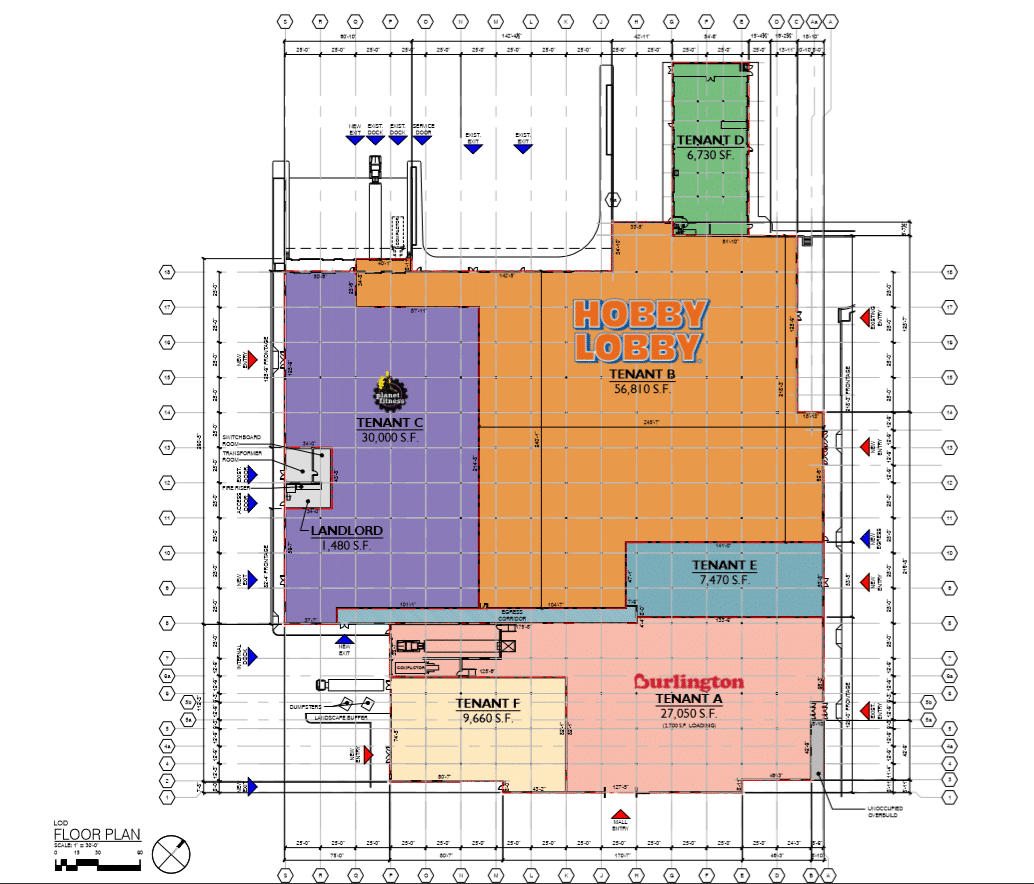

First Trust Deed collateralized by an approximately 82,000 square foot retail shopping center in Milledgeville, GA (about 95 miles southeast of Atlanta, GA and 93 miles southwest of Augusta, GA). Although the property is currently only 45% leased, the borrower is working with two tenants to occupy all the vacant space. The two new tenants are Harbor Freight (a national discount tool store) and Dunhams Sports (a reginal sporting goods store). Both new tenants are in retail sectors that have performed better in this coronavirus world than they did pre-pandemic. The existing tenants would include Aaron’s Rents, China Buffet, Citi Trends, and Baldwin Dialysis. Additionally, the borrower will work with the local municipality to get a pad site approved for a drive thru building. Loan Amount: $2,700,000 Yield: 10.5% (Principal Balance ≥ $100,000); 10.0% (Principal Balance < $100,000) Interest is paid monthly in arrears with payments due on the 1st of each month with a 10- day grace period. Term: Nine months with two optional nine-month extension periods at maturity