Elation Homes, Inc. #4977 | NEVADA – FUNDED

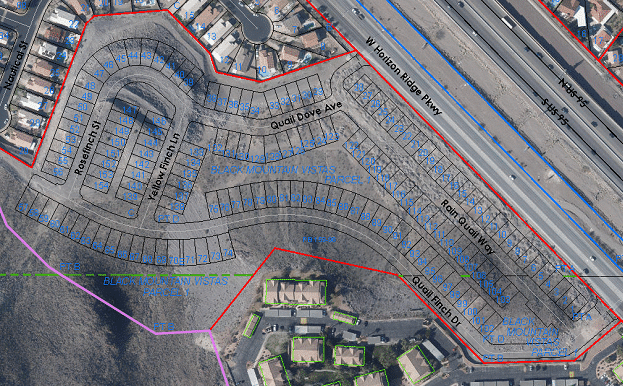

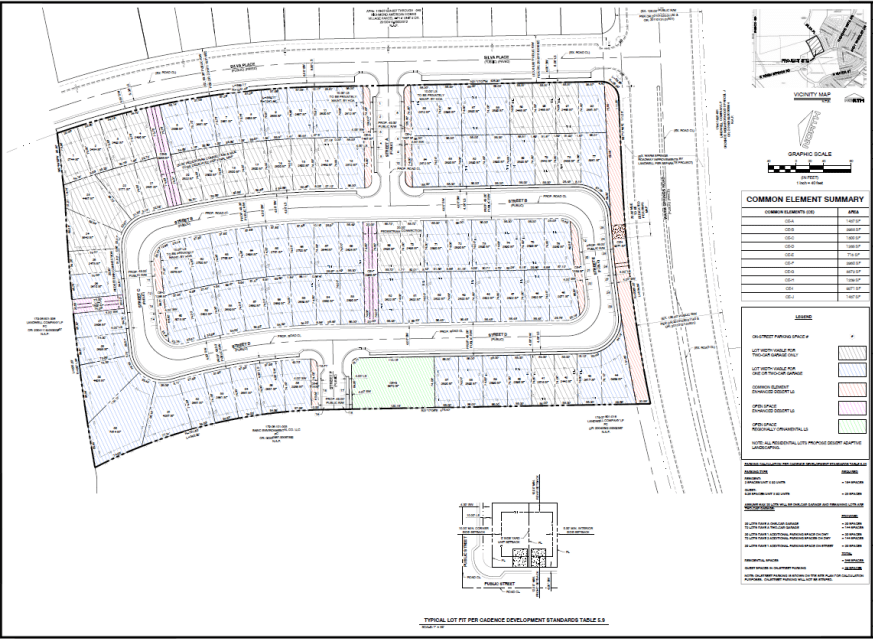

First Trust Deed collateralized by 14 approximately half acre, fully developed residential lots located in the Valley Heights community in Moapa Valley, Nevada (approximately 58 miles northeast of Las Vegas, NV and 73 miles southwest of St. George, UT). The subdivision includes over 70 homes that are either finished or under contract to be built in the next 30 days. The borrower sold 43 lots within this same community to DR Horton in May of 2019 for $35,000 per lot and this loan is for under $20,000 per lot. Two of the lots will have homes built on them. These two homes will be about 1,600 square feet each and be the same product type this borrower has previously built in this community. Loan Amount: $750,000 Yield: 10.50% Interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. Term: Nine months with one optional nine-month extension period at maturity.