Rhino Holdings Village, LLC #5221 | WASHINGTON – FUNDED

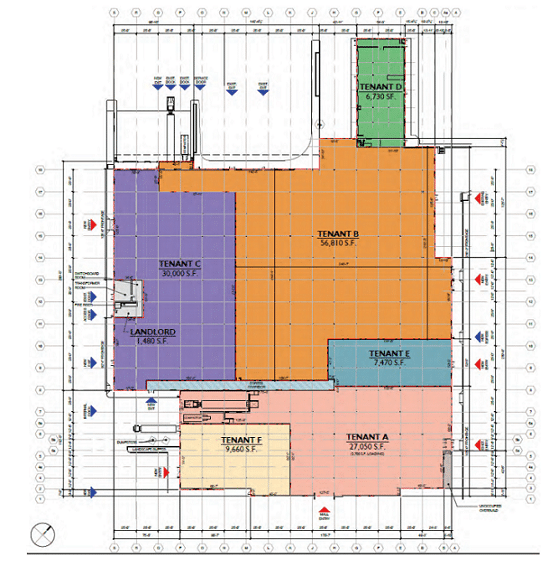

The collateral for this loan is an approximately 5.78-acre site that is currently divided into five separate parcels with nearly 80,000 square feet of rentable space. These five separate parcels were built in 1963-1965 and consists of one large inline retail shopping center, three retail pads, and two apartment buildings. Although the project is nearly 80% leased, the lack of capital improvements to the site in many years has made it very hard to rent much of the remaining space. Our borrower plans to demolish the two apartment buildings and two retail pads to make way for two new drive through retail pads. With the two new drive throughs and the deferred maintenance resolved, the unleased space should quickly be absorbed with national tenants. Current tenants include Grocery Outlet, Kitsap Credit Union, New American Funding along with many local tenants. Loan Amount: $14,000,000 Yield: 10% interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. *For investments equal to or greater than $100,000 investors will earn 10.5%. Term: Nine months with an optional nine month extension at maturity. Final maturity date is 3/28/23.