Sargem Management, LLC #5139-5145 | NEVADA – FUNDED

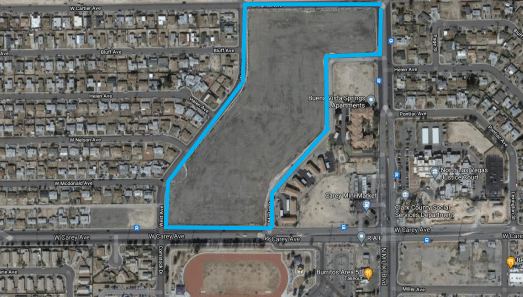

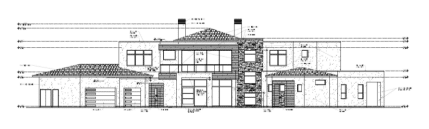

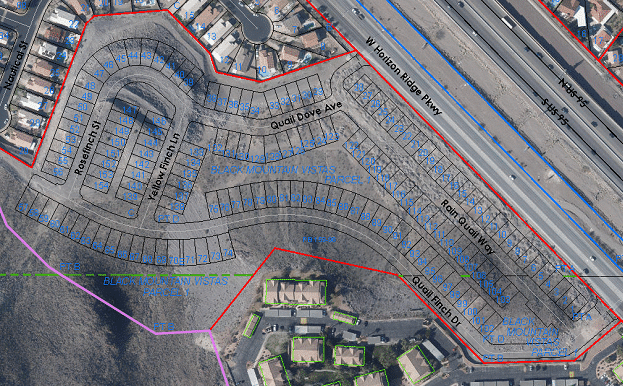

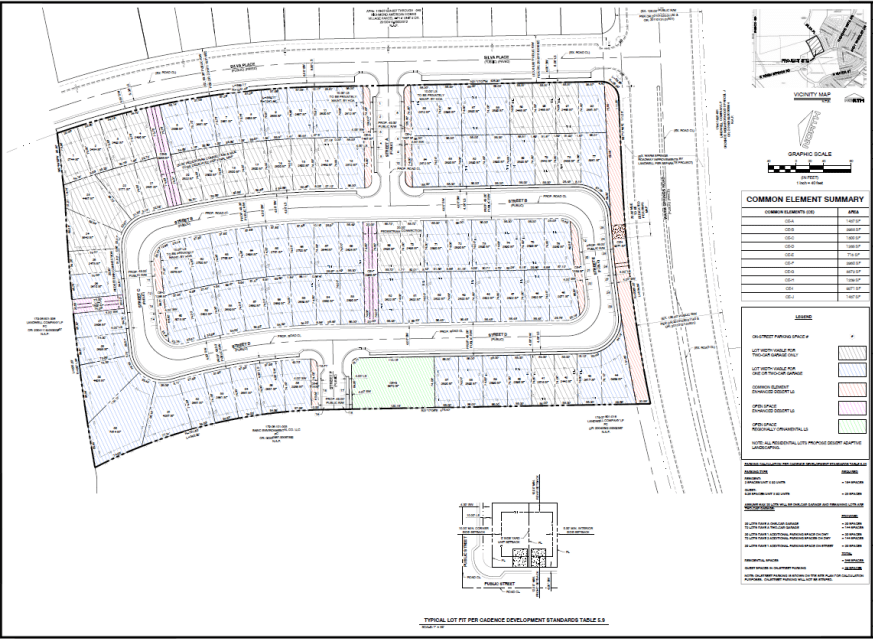

First Trust Deed collateralized by just over 18 acres of land in North Las Vegas, NV. Although the property is currently a level piece of dirt, it had a vibrant past. The property was home to apartments beginning in the early 1960’s and transitioned into low-income housing in the 80’s. As time went on, the property became very rundown, and riddled with crime. After the Department of Housing and Urban Development foreclosed on the previous owner during the financial crisis of 2008, the borrower began working with HUD and the city of North Las Vegas to plan what will eventually become a key piece to the city. The borrower formally acquired the property in October of last year for over $3,000,000 and will formally obtain city approval for an eightbuilding medical complex on 7/21/21. The borrower will then construct and sell each of the buildings once completed which is anticipated to begin in about a year Loan Type: This Master Loan will be sold in tranches, giving investors the opportunity to invest in one or more lots in the complex. Master Loan Amount: $2,600,00 Tranche Loan Amount: Ranging between $121,000 and $604,000 Yield: 10.00% Interest is paid monthly in arrears