Rhino Holdings Front, LLC #5058 | OHIO – FUNDED

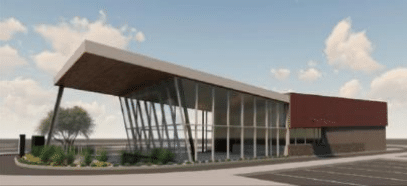

First Trust Deed collateralized by an approximately 20,000 square foot former indoor skating rink in New Philadelphia, OH (about 85 miles south of Cleveland, OH). Although the property is currently vacant, the borrower has a lease ready to be signed with national tenant to occupy the entire property. Once this new tenant is signed up (shortly after acquiring the property), the borrower will begin the renovation work on the property the tenant has requested. The new tenant will then begin their tenant specific work to the building with the anticipation of opening to the public in November. Single tenant assets have seen a hot commodity in today’s real estate marketplace. With this in mind, the borrower has teamed up with this national brand as their preferred developer whereby the tenant tells the borrower what building they want to get into, and the borrower will go out and make it happen. This is one of those transactions Loan Amount: $1,300,000 Yield: 10.5% (Principal Balance ≥ $100,000); 10.0% (Principal Balance < $100,000) Interest is paid monthly in arrears with payments due on the 1st of each month with a 10- day grace period. Term: Nine months with two optional nine-month extension periods