Green Level West I Apartments, LLC #5564 | NORTH CAROLINA – FUNDED

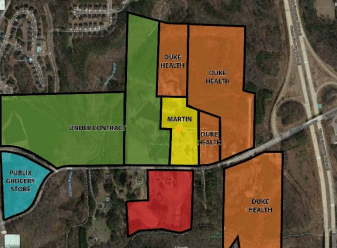

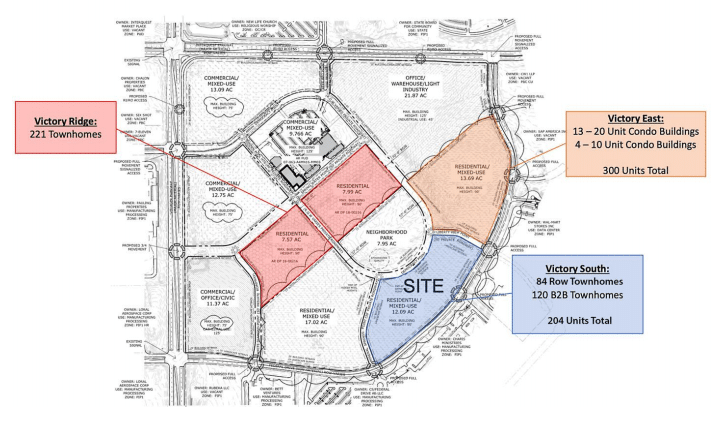

The collateral for this loan is an approximately 25-acre site that will be entitled to allow for the construction of a 300+ unit apartment building. This site sits contiguous to another property the borrower already owns which totals roughly 35 acres. Since acquiring this site and the property next door, about a year ago, the borrower has worked with the city to modify the zoning to allow for apartments. They are continuing to work with the city to obtain approval on their building plans. This has been a bit slower process than originally anticipated because they “teamed up” with the property owner next door. On the other side of the property construction has begun on over 1 million square feet of medical space that is owned by Duke Health. The city has already expressed a desire on their master plan to make this corridor the new “heart” of the city which bodes well for the long-term viability of the project and the short term needs to get the property entitled. The borrower for this loan is working alongside Duke Health to get the two projects combined into one master plan which will increase the property’s value given the economies of