Ten15 Craig Tenaya, LLC #5075 | NEVADA – FUNDED

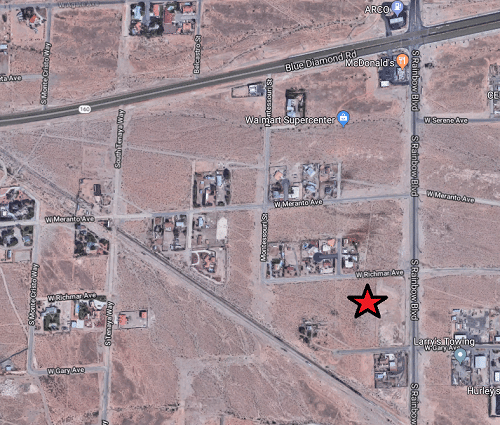

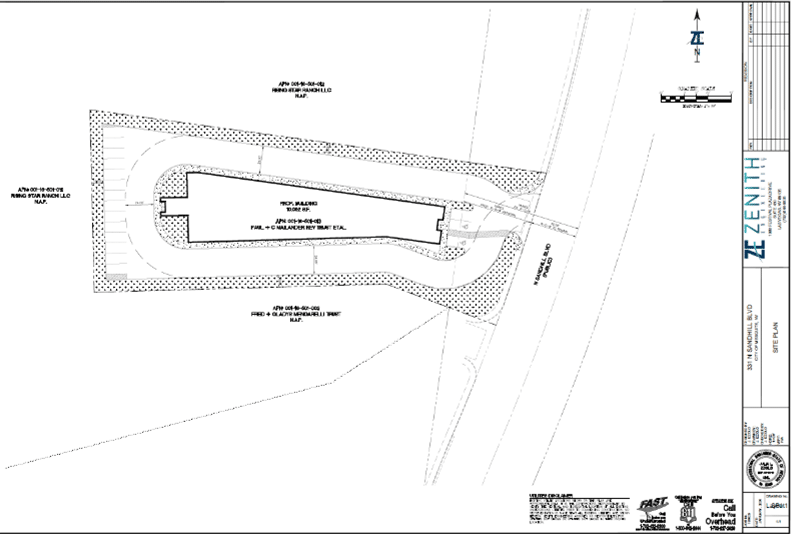

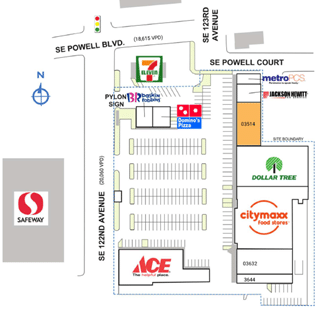

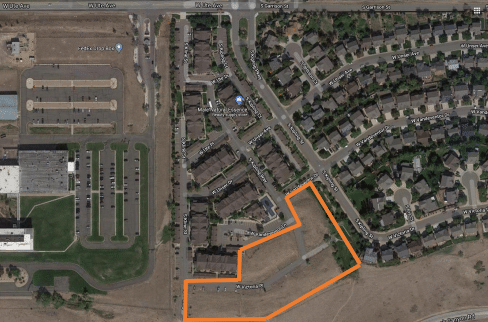

The collateral for this loan is 0.95 acres of land located near the corner of Craig Road and US-95 which is about 9 miles northwest of downtown Las Vegas, NV. Since acquiring the property in March of 2016, the borrower has worked with the city to allow for the construction of a 4,039 square foot drive thru outparcel. Additionally, work began on the vertical construction back in February of this year and they are currently 50% complete. The picture above was taken of the site in late April as work continues to progress. The property is 100% preleased to Bonanno’s New York Pizzeria and Plant Power Fast Food. This will be Bonanno’s fifth location in Las Vegas and Plant Power’s eighth location but the first in Las Vegas. Construction will continue on the project and is expected to be completed in August of this year. Loan Amount: $2,650,000 Yield: 10.5% (Principal Balance ≥ $100,000); 10.0% (Principal Balance < $100,000) Interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. Term: Nine months with two optional nine-month extensions at maturity.