Dixie Highway Storage, LLC #5151 | FLORIDA – FUNDED

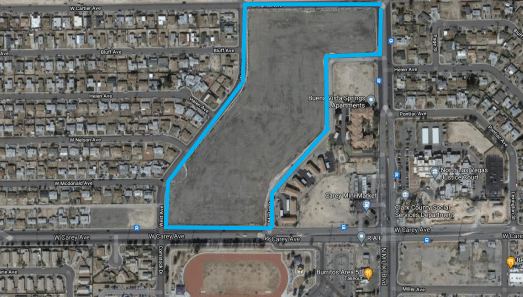

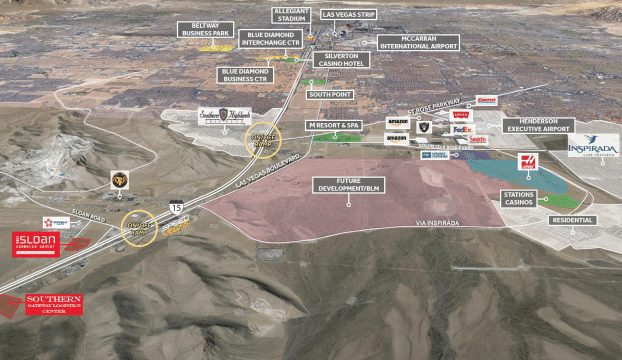

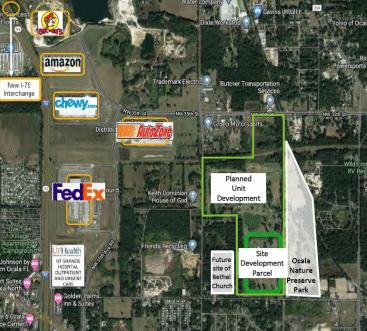

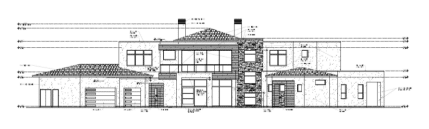

First Trust Deed collateralized by a 1.37-acre parcel of land in North Miami Beach Florida which is a suburb of Miami and approximately 17 miles north of downtown Miami, FL. The property is fully entitled with zoning and site plans in place for a 7- story, 163,660 SF Self-Storage Facility with 1,081 climate-controlled storage units. The site is in an Opportunity Zone in a densely populated area surrounded by several major new developments (see page two for a proximity map). Due to the fact the property is located within an opportunity zone, there are some tremendous tax advantages available to the borrower if they hold the property for at least 10 years which they plan to do. This is one of four properties the borrower is currently in escrow to purchase in Florida. Given the influx of residence and the state’s pro-business mindset, the borrower believes it is an area primed for long term growth. Loan Amount: $4,500,000 Yield: 10.5% (Principal Balance ≥ $100,000); 10.0% (Principal Balance < $100,000) Interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. Term: 9 months with an optional nine-month extension period at maturity.