Aurora Ocala, LLC #5077 | FLORIDA – FUNDED

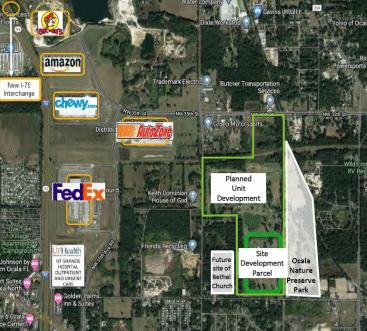

The collateral for this loan is an approximately 22-acre site that will be entitled to allow for the construction of a 272-unit apartment building. This parcel of land is located within a larger planned unit development consisting of over 200 acres that will be developed into over 1,000 single family homes and nearly 300 multi-family units. This loan is collateralized by all the multi-family land associated with this development which will consist of 11, three story garden style walk-up buildings directly across from the new $6.5mm Nature Preserve Park. Each unit will average nearly 1,000 square feet in size and rent for over $1,400 each. Loan Amount: $2,600,000 Yield: 11% (Principal Balance ≥ $100,000); 10.5% (Principal Balance < $100,000) Interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. Term: Nine months with an optional nine-month extension at maturity.