Midway Heritage Development, LLC #4796 | UTAH – FUNDED

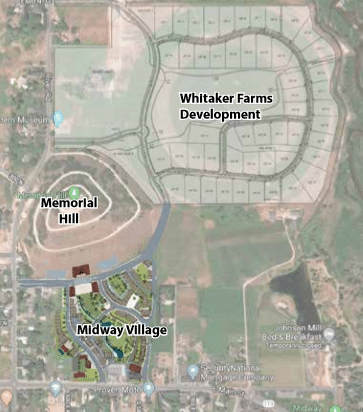

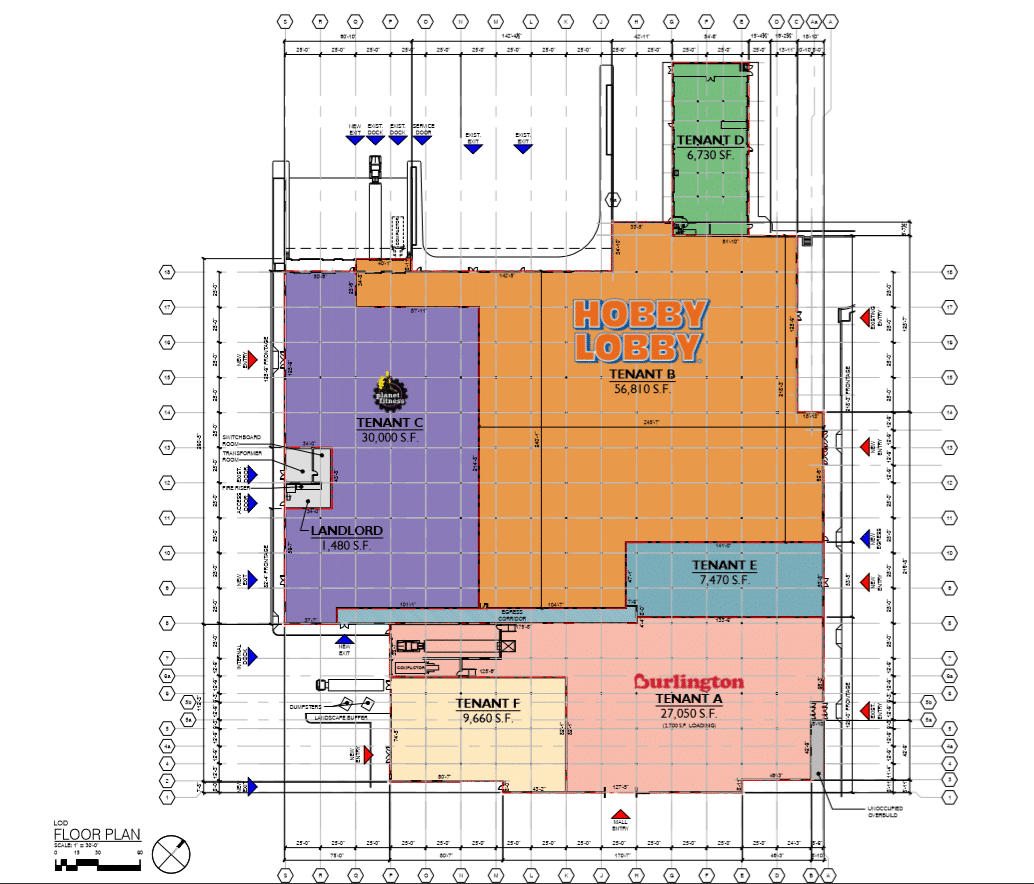

First Trust Deed collateralized by roughly 24.9 acres of farmland which will eventually be developed into at least 160 townhome and cottage sized lots as well as a few commercial pads. This is the next phase of the successful Whitaker Farms project the borrower recently completed. Although the tentative map has not been approved, part of the site is already zoned to allow higher density townhomes. Over the next year, the borrower will work with the city to get a masterplan approved for the entire site that will eventually turn into a phased development. As of today, it is not anticipated for the development work to begin until June of 2021. Additionally, the borrower already has over 20 reservations for the townhomes and two of the commercial pads even though homes won’t be finished for at least 18 months. Loan Amount: $11,900,000 Yield: 10.50% (Principal Balance ≥ $100,000); 10.00% (Principal Balance < $100,000) Interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. Term: 9 months with one optional 9-month extension period at maturity. Looking for an updated? Take a look at this video taken in January 2023: https://vimeo.com/786705835