Harmony Homes Nevada, LLC #6128-#6142 | NEVADA – FUNDED

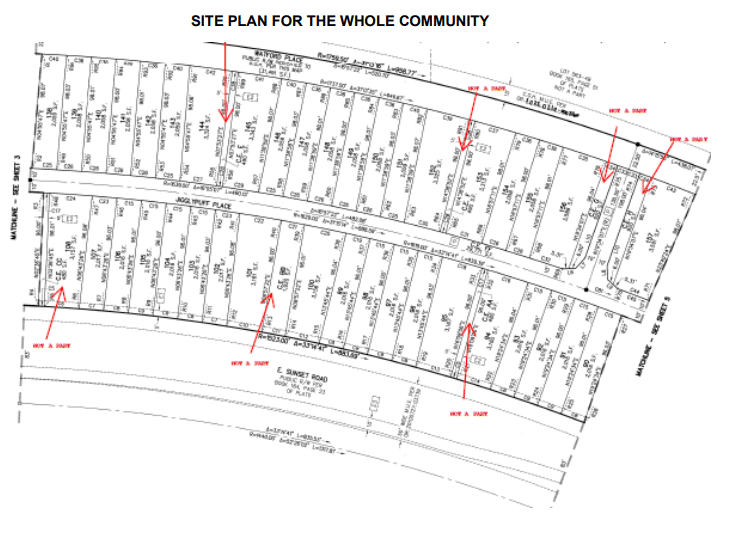

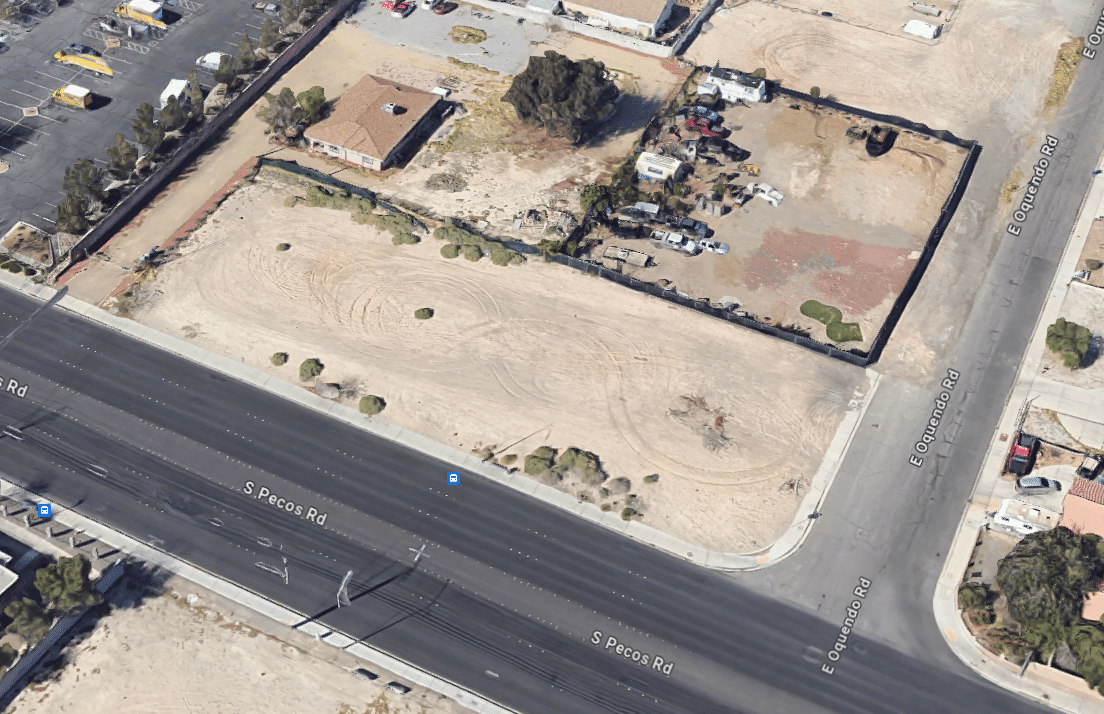

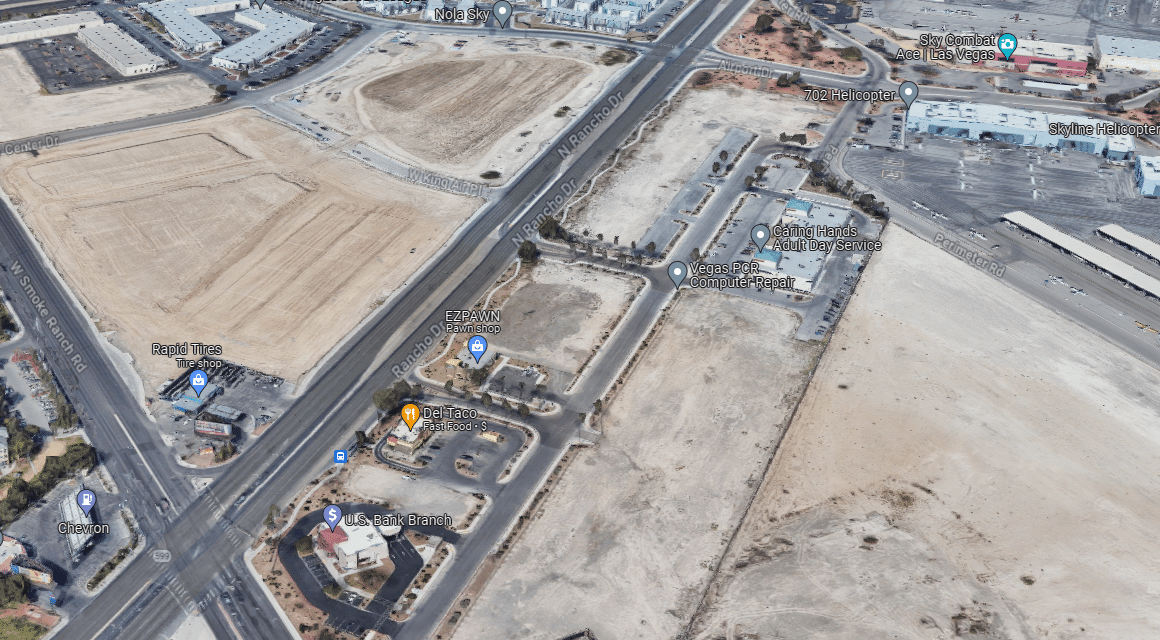

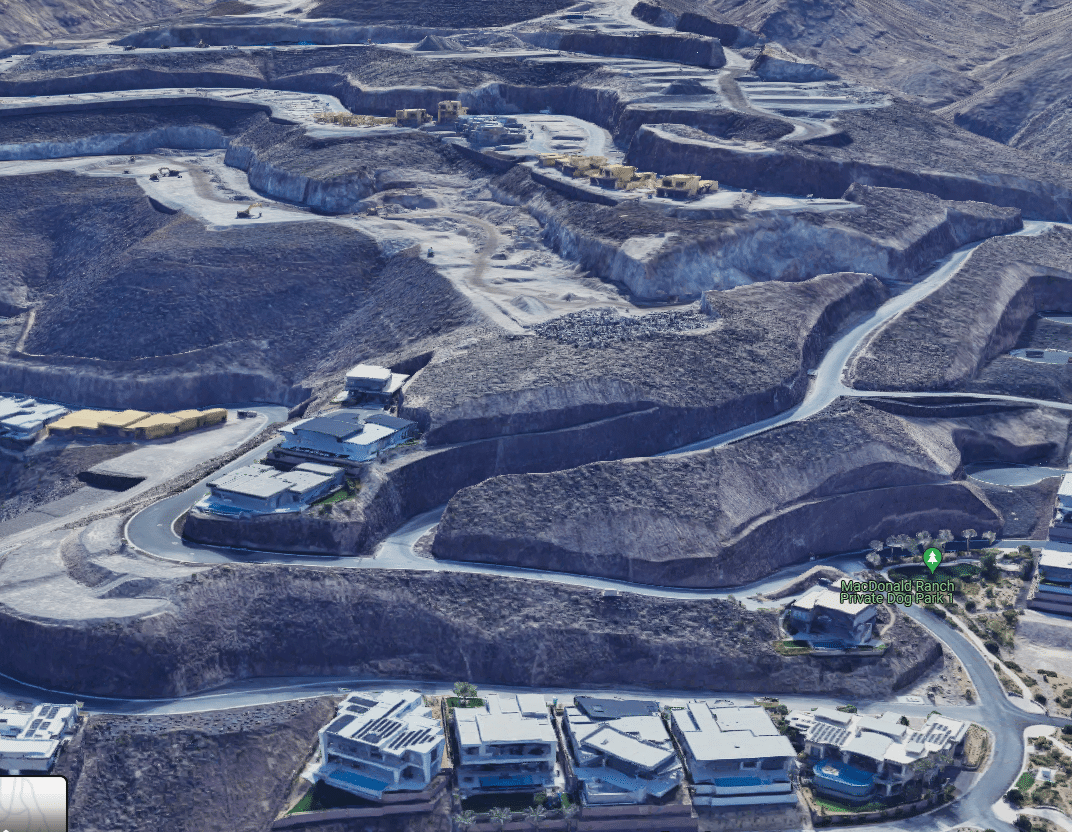

First Trust Deed collateralized by 98 finished residential lots in the Cadence Master Planned Community near the corner of Grand Cadence Drive and Sunset Road in Henderson, NV (roughly 15 miles southeast of downtown Las Vegas). This is the second phase of the larger 150 lot community that the borrower is actively selling in. This is the third community in this area the borrower has done with the exact same floor plans. With plans ranging from 1121 -1711 square feet and price points of under $350,000, these townhomes will help fill the demand for the entry level buyer. The first phase of the community continues to sell homes even in this post COVID era where home sales have slowed. Master Loan Amount: $4,018,000 Yield: 10% interest is paid monthly in arrears with payments due on the 1st of each month with a 10- day grace period. *For investments equal to or greater than $100,000 investors will earn 10.5% Term: Nine months with an optional nine-month extension at maturity. Final maturity date is 7/23/25.