Gold Rose Group, LLC #5377-5380 | NEVADA – FUNDED

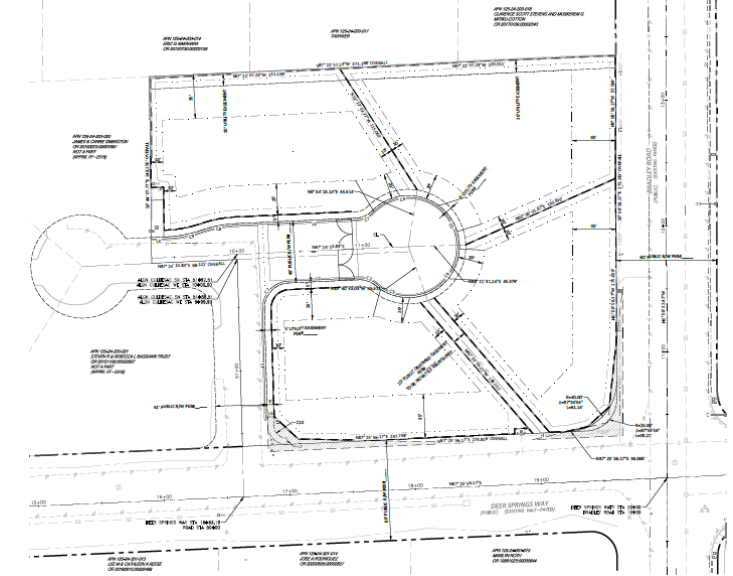

First Trust Deed collateralized by 2.01 acres of residentially zoned land in the Northwest part of Las Vegas, NV. The currently undeveloped land is surrounded by properties zoned as rural estates as well as some parcels of slightly higher density. It is the intent of the borrower to get a tentative map (shown on the following page) approved with the city and begin developing the land into four half acre lots. Once the land development is completed, the borrower intends to build single family homes on the lots which should average 5,000 square feet each and start at a selling price of $2,100,000. The tentative map is anticipated to become a final map in three months since this is what is considered a conforming zone change. Master Loan Amount: $1,520,000 Yield: 10% interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. Term: Nine months with an optional nine-month extension at maturity. Final maturity date is 10/16/23.