Future Legends, LLC #5524 | COLORADO – FUNDED

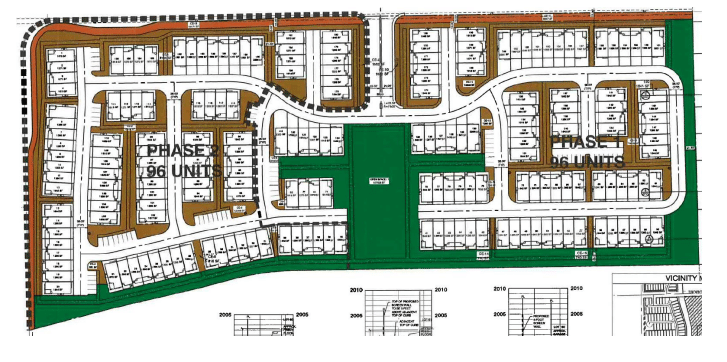

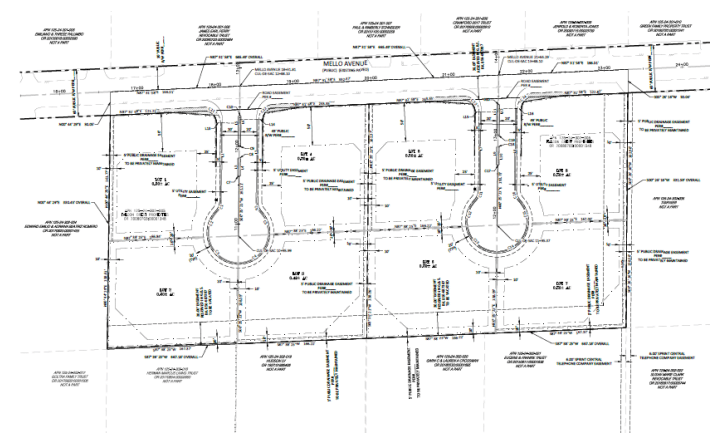

Second Trust Deed collateralized by roughly 100 acres of land which will eventually be developed into a youth sports facility, surrounding a professional baseball stadium. This property is located about two miles east of downtown Windsor, CO (60 miles north of Denver, CO). After purchasing the Orem Owlz’ minor league baseball team in 2004, the borrower envisioned developing a youth sports complex integrated into a minor league baseball facility. His vision is being manifested through the Future Legends Complex which will consist of 12 soccer fields, 10 baseball diamonds, 1 64-team dorm, with retail shops and hotels surrounding the complex. This loan will encumber everything owned by the borrower in the area excluding the stadium and retail area which already has bank financing in place or in process. The 100 collateralized acres will continue to be developed by the borrower using the financing from this loan and additional money from the borrower. Loan Amount: $3,600,000 Yield: 13% interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. Term: Nine months with an optional nine-month extension at maturity. Final maturity date is 12/24/23