Our Pledge to our Investors

Ignite Funding believes strongly in transparency to our Investors, which is why every year we release our Loan Portfolio Performance Record with supporting data. The information contained within the Performance Record includes the following statistics; number of Borrowers, aggregate number of loans and amount funded, loan type by percentage, average annual interest rate paid to Investors, aggregate loan-to-value ratio, average duration of loan terms.

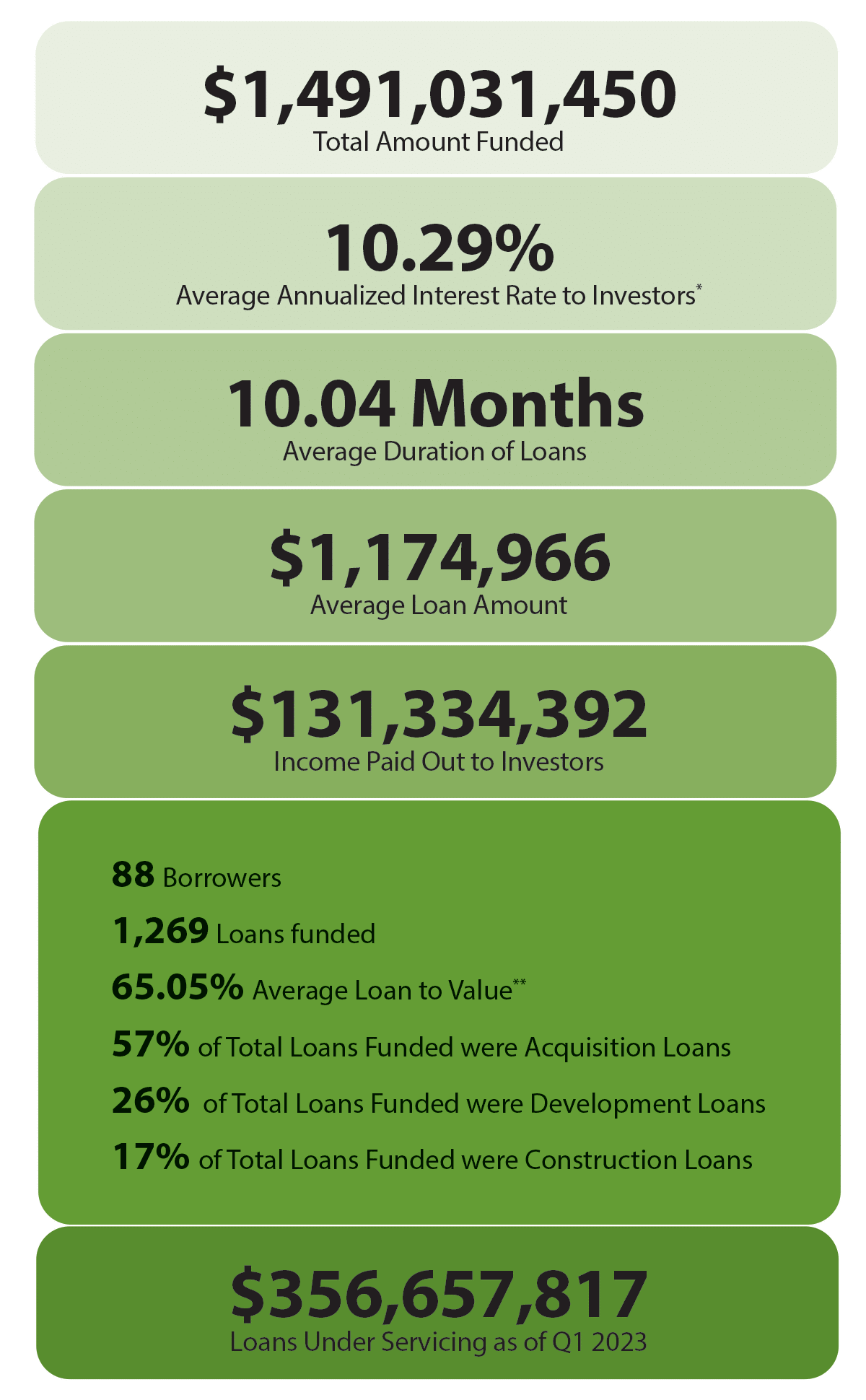

2011 – End of Q1 2023 loan Portfolio Performance Record

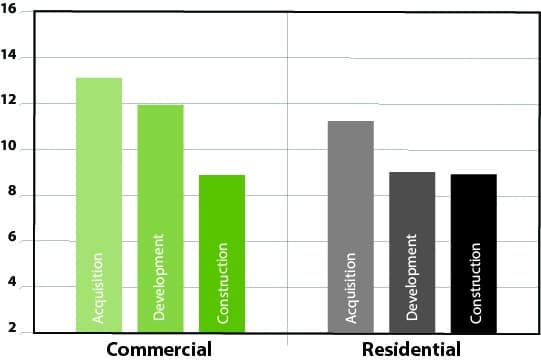

Acquisition Loans***

57% Residential

43% Commercial

75 Borrowers****

$8,53,292,300 Total amount funded

609 Loans funded

10.43% Average annualized interest rate to investors*

61.06% Avg Loan to Value**

11.49 Avg duration of loan term (months)

$78,532,660 Income Paid to Investors

Development Loans

80% Residential

20% Commercial

23 Borrowers****

$383,070,750 Total amount funded

212 Loans funded

10.21% Average annualized interest rate to investors*

67.84% Avg Loan to Value**

9.08 Avg duration of loan term (months)

$30,726,190 Income Paid to Investors

Construction Loans

68% Residential

32% Commercial

27 Borrowers****

$254,668,400 Total amount funded

448 Loans funded

10.14% Average annualized interest rate to investors*

69.43% Avg Loan to Value**

8.95 Avg duration of loan term (months)

$22,075,541 Income Paid to Investors

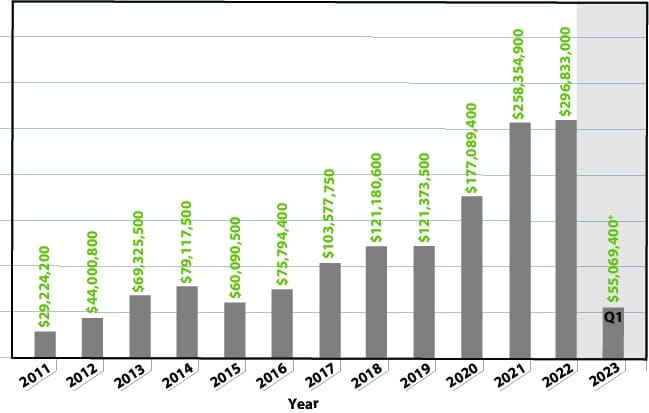

Total Loans Funded By Year

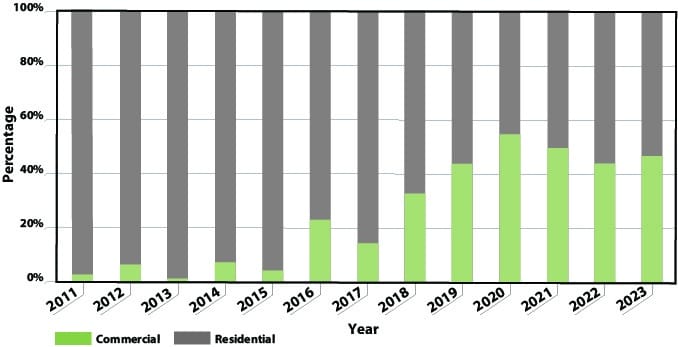

Commercial vs. Residential Fundings By Year

Average Duration of Loans By Loan Type

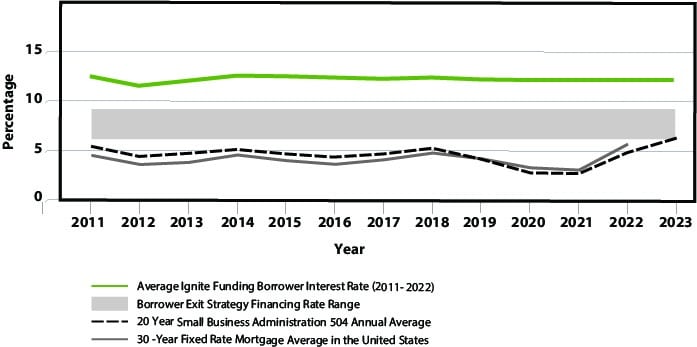

Residential and Commercial Borrowing Rates

Information reflected above is for loans funded in 2011 through Q1 of 2023. *Average annualized interest rate to investors is based upon the annualized interest rate received by investor(s) is dependent upon the payoff before maturity or extension of the loan term. Some loans may payoff before the loan terms which would decrease the duration of the loan, and others may have extension available that could increase the duration of the loan. **loan to Value is determined by an appraisal, Broker Price Opinion (BPO), or the valuation provided by the County Assessor’s Office. loans with an appraisal wavier are not included. *** An acquisition loan includes raw land and/or an existing structure. ****Number of borrowers calculated unique by point of contact per segment.