Why invest in real estate deeds of trust?

Ignite Funding is an alternative investment option that matches quality real estate Borrowers with Investors seeking capital preservation in collateralized turn-key real estate offering:

- Returns – Earn a 10% to 12% annualized return

- Ease – Trust Deeds are a turn-key real estate investment, the hardest thing you’ll do is complete some simple paperwork

- Diversification – Diversification is essential to any investment strategy. Trust Deeds allow you to go beyond stocks and bonds and invest in Real Estate

- Acceleration – Ignite Funding’s loans are short term, typically ranging from 6 to 24 months in length

- Control – Ignite Funding does not choose where to invest your money, or how much you earn in interest on your money, you do! You can even choose to invest with your self-directed IRA

- Transparency – Ignite Funding believes strongly in transparency for our Investors, which is why every year we release our Loan Portfolio Performance Record with supporting data

Ultimately, it is our goal to provide an investment vehicle for you to build upon your financial future.

Why Ignite Funding?

When banks are not lending, Ignite Funding is.

We fill a void in the financial market for short-term funding for commercial homebuilders. Borrowers seek funding typically between $1 million – $10 million to purchase land, start development and get their residential communities ready for market. This size of the loan is too large for a community bank and too small for a large institutional bank, the 9-18 month timeframes do not appeal to banks either, making our investment opportunities just right for Investors.

There are an abundance of borrowers seeking capital to build new communities throughout the Southwest U.S. As an investor the borrowers pay you an interest rate to use your funds earning you 10%-12% annualized return – at Ignite you are the bank! Integrating alternative investments into your financial portfolio diversifies you into real collateralized trust deed assets.

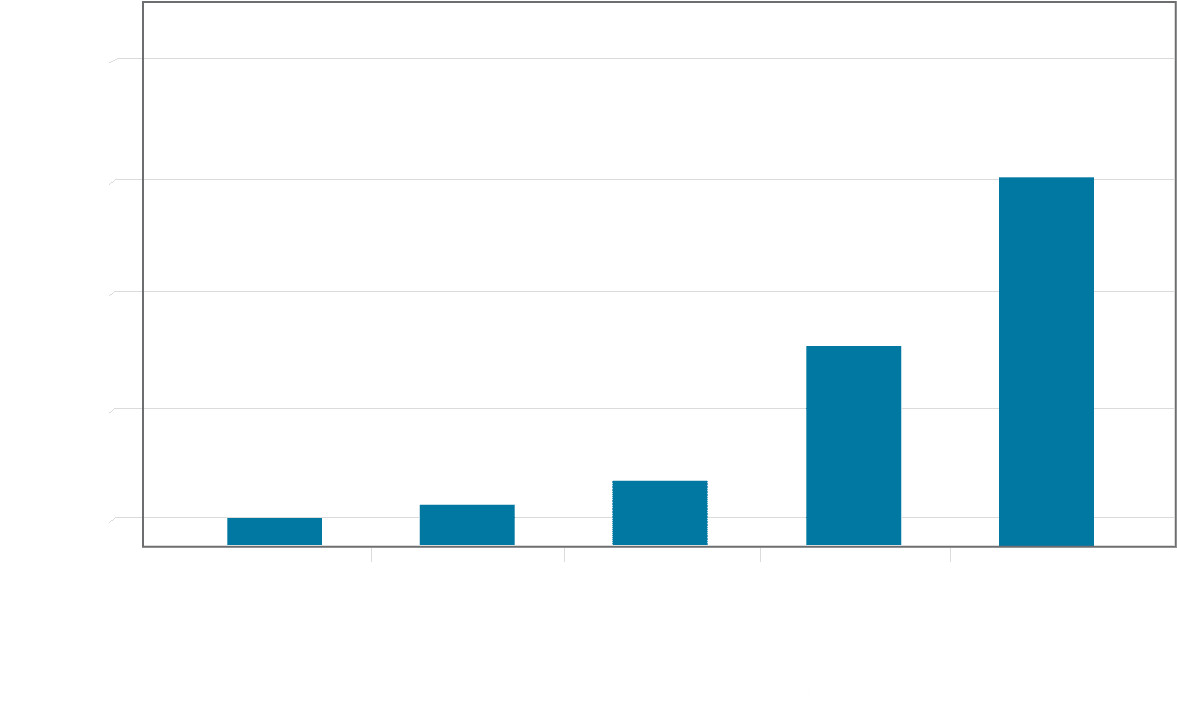

Portfolio Allocation

Depending on your investing time horizon and risk tolerance, where you invest your money can make a big difference in your financial future. Diversification is essential to any investment strategy.

Example – By investing $100,000 over 5 years with annual compounding in each of the below investment vehicles, your returns vary significantly based on the potential performance:

How do I Invest?

Prior to investing with Ignite Funding or mortgage loans in general, Nevada Statutes state you must meet the suitability standards (NRS 645B). Before an investor may invest in any mortgage loan, the investor must verify that he meets one or more of the following financial requirements:

- The investor’s household net worth is more than $250,000.00, excluding any equity in any real property used as the investor’s primary residence at the time of the investment; or

- The investor’s household net income was more than $70,000.00 for each of the previous 2 tax years and there is a reasonable expectation of attaining or exceeding the same income for the current year.

- The investor must also verify that his total investments in mortgage loans transacted by a mortgage broker or mortgage agent are not valued at more than 50% of the investor’s net worth or net annual income.

Our minimum investment is $10,000.

Ignite Funding actively provides investment advisors with an avenue for offering our investments to their investors. Either you or your advisor can contact us to learn how to integrate real estate into your financial portfolio.