Why Borrowers Choose Ignite Funding

Banks are notoriously slow; and if time is money, then Ignite Funding is a borrower’s best option. Ignite Funding can raise capital for a project in a matter of weeks.

Example: In cases where a borrower wins a bid to purchase a property at auction (having already notified Ignite Funding of their intent to purchase), the borrower needs to be able to provide the capital quickly or else they will lose their deposit which can be a significant amount of money.

Many lenders in our industry advertise low interest rates. However, what the lender foregoes in interest they make up for by charging additional fees which can increase the overall cost of the loan.

Example: A borrower will always choose a loan with 1% origination and 11% interest over one with 2% origination and 10% interest.

Most people are familiar with a mortgage, where you pay the principal on top of the monthly interest payments. Interest only allows for lower monthly payments than you would originally have.

Interest only loans are intended for short-term bridge financing to obtain the project quickly. The goals is to move the project forward and then get long-term financing in place.

For the amount of time it takes most banks to put a loan under contract, they depend on long-term payments to recoup the underwriting costs. Hence the implementation of prepayment penalties. For many real estate projects, the borrower is typically adding value to the property and looking to sell or refinance in a shorter amount of time than is needed with a longer-term bank loan. Ignite Funding removed this penalty element to allow borrowers to be more versatile. This can translate into greater returns for the borrower on projects and their overall success in the long run.

At the end of the day, lending is a relationship driven business. Ignite Funding prides itself on nurturing longstanding relationships with its borrowers, built on trust and a familiarity with our underwriting and servicing process. This goes a long way for borrowers when they are deciding who to utilize for financing future projects.

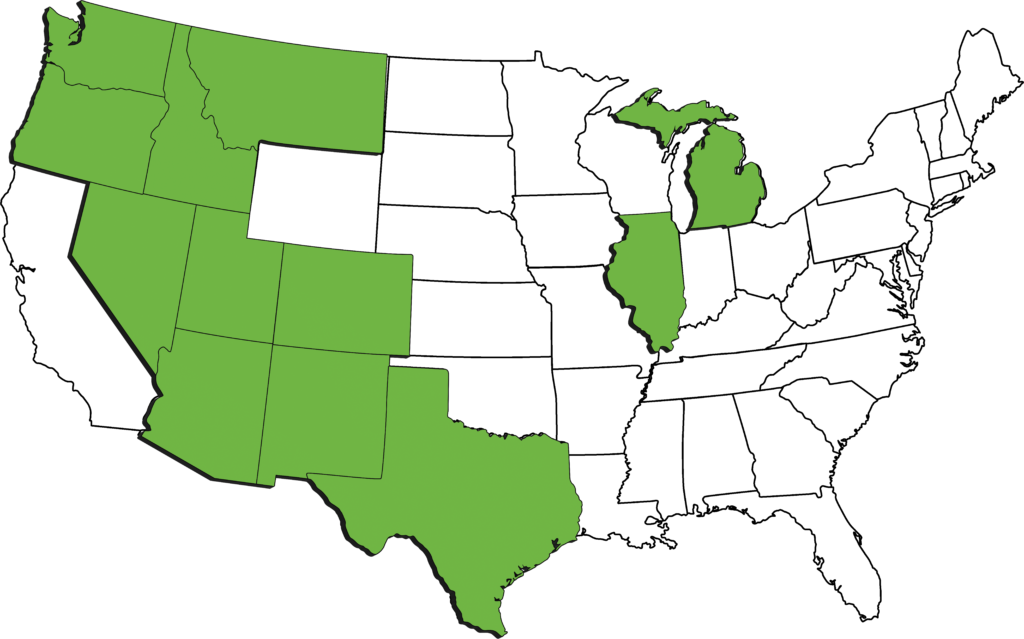

FUNDING LOANS IN 12 STATES AND COUNTING!

Ignite Funding loans spanned across the following states: Arizona, Colorado, Idaho, Illinois, Michigan, Montana, Nevada, New Mexico, Oregon, Texas, Utah, and Washington. This geographic diversity showcases Ignite Funding's broad lending reach across significant regions of the United States, reflecting its ability to support borrowers in a wide range of markets.

CRITERIA

The following criteria should be considered by borrowers before sending a funding request.

TYPES OF LOANS

At Ignite Funding, we offer the following loan types:

- Financing or refinancing of non-primary residential or income-producing commercial structures

- Acquisition or refinancing of undeveloped land

- Development and construction of residential or commercial projects

- Acquisition of distressed assets from regional banks, the FDIC, and other lenders

FUNDING LIMITATIONS

The per loan funding limits are typically $1M to $10M. Note, these are general limits and loans may exceed $10M depending on the type of loan among other variables.

TERMS

Loan terms are generally between 9 to 18 months. Extensions may be offered subject to additional fees. Longer term loans are considered on the overall project viability and strength of the borrowing entity.

LOAN-TO-VALUE

At Ignite Funding, we carefully consider various factors such as property type, location, and other relevant aspects to determine the most suitable loan-to-value ratio ranges for our lending. Our goal is to provide tailored and competitive financing solutions that align with the unique needs and circumstances of each property.

Land Acquisition | Up to 65% of the acquisition value of the land

Development | Up to 70%

Construction | Up to 75%

Learn how To earn Double Digit Returns!

Learn how To earn Double Digit Returns!

Ignite Funding, LLC | 6700 Via Austi Parkway, Suite 300, Las Vegas, NV 89119 | P 702.739.9053 | M 702.919.4281 | F 702.922.6700 | NVMBL #311 | AZ CMB-0932150 | Money invested through a mortgage broker is not guaranteed to earn any interest and is not insured. Prior to investing, investors must be provided applicable disclosure documents.

© 2025 Ignite Funding. All rights reserved

Ignite Funding, LLC | 6700 Via Austi Parkway, Suite 300, Las Vegas, NV 89119 | P 702.739.9053 | M 702.919.4281 | F 702.922.6700 | NVMBL #311 | AZ CMB-0932150 | Money invested through a mortgage broker is not guaranteed to earn any interest and is not insured. Prior to investing, investors must be provided applicable disclosure documents.

© 2025 Ignite Funding. All rights reserved