WHY PEOPLE INVEST WITH IGNITE FUNDING

Our Company

When banks are not lending, Ignite Funding is! We fill a void in the financial market for short-term financing for commercial developers and builders. We offer an alternative investment for investors seeking capital preservation in collateralized turn-key real estate investments that offer:

Ultimately, it is our goal to provide an investment vehicle for you to build upon your financial future.

Not ready to jump right in? That's fine.

Sign up for text messages so that you can see our deal flow and the type of investments that are available. But, don't wait too long when you see something you like, our investments go pretty quickly.

Text "Website" to

(702) 919-4281

to see our available investments.

Want to learn more about Trust Deeds? Enter your Name and Email below to Schedule Your Consultation.

WHY PEOPLE INVEST WITH IGNITE FUNDING

Our Company

When banks are not lending, Ignite Funding is! We fill a void in the financial market for short-term financing for commercial developers and builders. We offer an alternative investment for investors seeking capital preservation in collateralized turn-key real estate investments that offer:

Ultimately, it is our goal to provide an investment vehicle for you to build upon your financial future.

Not ready to jump right in? That's fine.

Sign up for text messages so that you can see our deal flow and the type of investments that are available. But, don't wait too long when you see something you like, our investments go pretty quickly.

Text "Website" to

(702) 919-4281

to see our available investments.

Want to learn more about Trust Deeds? Enter your Name and Email below to Schedule Your Consultation.

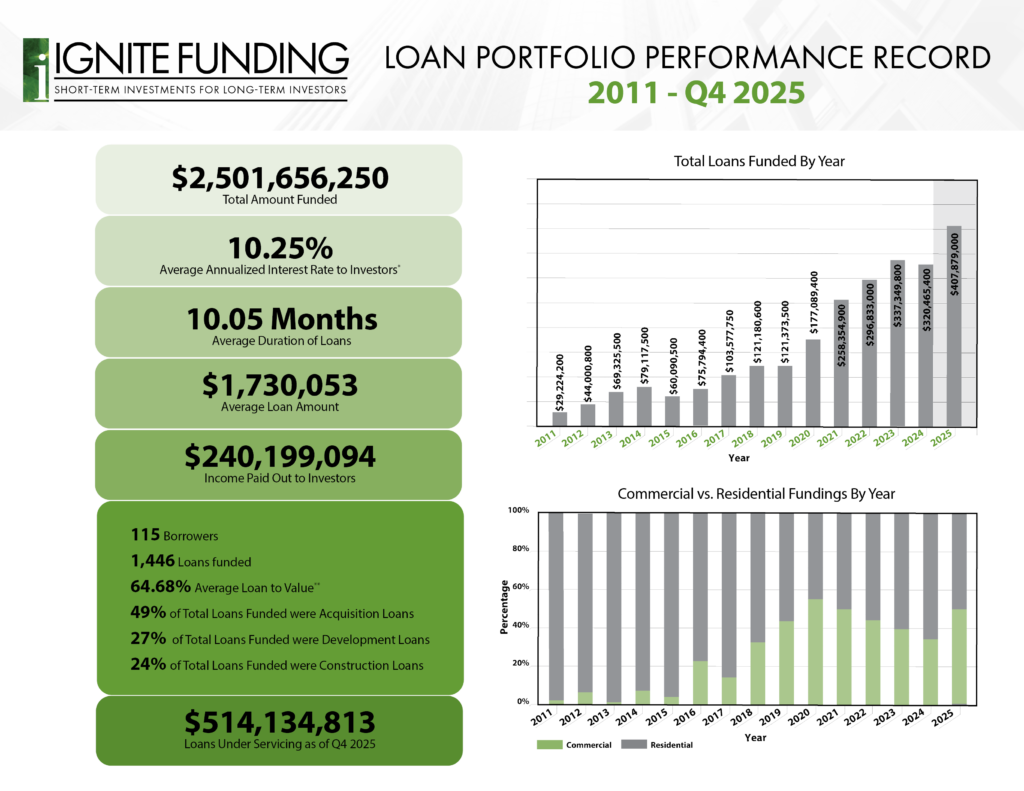

PERFORMANCE RECORD

We Believe in Transparency For Our Investors

Ignite Funding strongly believes in transparency for our investors, which is why every quarter we release our Loan Portfolio Performance Record with supporting data.

*Average annualized interest rate to investors is based upon the annualized interest rate received by investor(s) is dependent upon the payoff before maturity or extension of the loan term. Some loans may payoff before the loan terms which would decrease the duration of the loan, and others may have extensions available that could increase the duration of the loan.

PERFORMANCE RECORD

We Believe in Transparency For Our Investors

Ignite Funding strongly believes in transparency for our investors, which is why every quarter we release our Loan Portfolio Performance Record with supporting data.

*Average annualized interest rate to investors is based upon the annualized interest rate received by investor(s) is dependent upon the payoff before maturity or extension of the loan term. Some loans may payoff before the loan terms which would decrease the duration of the loan, and others may have extensions available that could increase the duration of the loan.

Transparency Pledge to Our Investors

Ignite Funding facilitates the role of Default Coordinator when a borrower defaults on a loan, and the property needs to be taken back through foreclosure or a Deed in Lieu of Foreclosure. Upon completion of a foreclosure or execution of a Deed in Lieu of Foreclosure, the investors transition from a Lender, to an Owner of a Real Estate Owned (REO) asset. Likewise, Ignite Funding coordinates ownership responsibilities on behalf of the investors and markets the asset for sale. Our top priority is protecting our investors' principal investment. We take great pride in the assets we underwrite and offer as investments. We encourage our Investors to review the materials below to have a clear understanding about the default/foreclosure process, should a Borrower default on a loan.

** 2011-2026 Asset Management Performance Record **

Default Guidebook

The Process

When banks aren't lending or have exhausted their lending capacity, residential and commercial developers come to Ignite Funding to bridge the gap. This allows Ignite Funding the opportunity to work with quality borrowers and present turn-key real estate

STEP

1

Borrower Seeks Financing

The Borrower applies for financing at Ignite Funding through one of our Application Forms.

STEP

2

Ignite Evaluates and Underwrites

We evaluate and conduct an underwriting interview with the Borrower. Upon approval we originate the loan to be offered to Investors.

STEP

3

Investor Chooses Available Loans

An Investor chooses from loans that are available at Ignite Funding.

STEP

4

Investor Lends Funds

The Investor lends the funds, representing a percentage of the total loan on the property.

STEP

5

Deed of Trust is Recorded

A Deed of Trust is recorded and lists the Investor(s) and their percentage of ownership in the property.

STEP

6

Investor Receives Monthly Interest

Investor receives monthly interest payments throughout the duration of the loan per specific loan terms.

STEP

7

Investor Receives Principal Payoff

Upon repayment of the loan by the borrower, Investor receives principal payoff in full.

STEP

8

Borrower is Granted Title

The Borrower or subsequent purchaser is granted title to the property when the loan is repaid.

The Process

When banks aren't lending or have exhausted their lending capacity, residential and commercial developers come to Ignite Funding to bridge the gap. This allows Ignite Funding the opportunity to work with quality borrowers and present turn-key real estate

STEP

1

Borrower Seeks Financing

The Borrower applies for financing at Ignite Funding through one of our Application Forms.

STEP

2

Ignite Evaluates and Underwrites

We evaluate and conduct an underwriting interview with the Borrower. Upon approval we originate the loan to be offered to Investors.

STEP

3

Investor Chooses Available Loans

An Investor chooses from loans that are available at Ignite Funding.

STEP

4

Investor Lends Funds

The Investor lends the funds, representing a percentage of the total loan on the property.

STEP

5

Deed of Trust is Recorded

A Deed of Trust is recorded and lists the Investor(s) and their percentage of ownership in the property.

STEP

6

Investor Receives Monthly Interest

Investor receives monthly interest payments throughout the duration of the loan per specific loan terms.

STEP

7

Investor Receives Principal Payoff

Upon repayment of the loan by the borrower, Investor receives principal payoff in full.

STEP

8

Borrower is Granted Title

The Borrower or subsequent purchaser is granted title to the property when the loan is repaid.

Transparency Pledge to Our Investors

Ignite Funding facilitates the role of Default Coordinator when a borrower defaults on a loan, and the property needs to be taken back through foreclosure or a Deed in Lieu of Foreclosure. Upon completion of a foreclosure or execution of a Deed in Lieu of Foreclosure, the investors transition from a Lender, to an Owner of a Real Estate Owned (REO) asset. Likewise, Ignite Funding coordinates ownership responsibilities on behalf of the investors and markets the asset for sale. Our top priority is protecting our investors' principal investment. We take great pride in the assets we underwrite and offer as investments. We encourage our Investors to review the materials below to have a clear understanding about the default/foreclosure process, should a Borrower default on a loan.

** 2011-2024 Asset Management Performance Record **

Default Guidebook

The Process

When banks aren't lending or have exhausted their lending capacity, residential and commercial developers come to Ignite Funding to bridge the gap. This allows Ignite Funding the opportunity to work with quality borrowers and present turn-key real estate

STEP

1

Borrower Seeks Financing

The Borrower applies for financing at Ignite Funding through one of our Application Forms.

STEP

2

Ignite Evaluates and Underwrites

We evaluate and conduct an underwriting interview with the Borrower. Upon approval we originate the loan to be offered to Investors.

STEP

3

Investor Chooses Available Loans

An Investor chooses from loans that are available at Ignite Funding.

STEP

4

Investor Lends Funds

The Investor lends the funds, representing a percentage of the total loan on the property.

STEP

5

Deed of Trust is Recorded

A Deed of Trust is recorded and lists the Investor(s) and their percentage of ownership in the property.

STEP

6

Investor Receives Monthly Interest

Investor receives monthly interest payments throughout the duration of the loan per specific loan terms.

STEP

7

Investor Receives Principal Payoff

Upon repayment of the loan by the borrower, Investor receives principal payoff in full.

STEP

8

Borrower is Granted Title

The Borrower or subsequent purchaser is granted title to the property when the loan is repaid.

MEET OUR TEAM

Patrick Vassar

Director of Underwriting

NMLS #391332

MLD #48510

E: pvassar@ignitefunding.com

P: 702.736.5475

Misty Bethany

Chief Compliance Officer

NMLS #1403840

MLD #54336

E: mbethany@ignitefunding.com

P: 702.921.5148

Andrew Ervin

Controller

E: aervin@i-managementgroup.com

P: 702.998.5883

Tammy Torrens

HR Specialist/Executive Assistant

E: ttorrens@i-managementgroup.com

P: 702.675.7949

Ronald Arceo

Director of Marketing

rarceo@i-managementgroup.com

702.941.7909

"I built my first website in 1999 (on geocities or something lol). I have been in the digital and video marketing industry since 2005 helping CEOs and Founders create digital marketing strategies to help them scale. From website design, to video production, to copywriting; I wore all those hats for over 20 years.

Here at Ignite Funding, as the Director of Marketing, I look forward each day to help our staff, clients, and the business we help, succeed through creative and impactful content production and curation.

My ultimate mission here is to help others (including myself) make wiser and smarter financial decisions that create generational wealth."

Ronald is Google certified in Display & Video 360, Google Search, Google Ads, and Google Analytics. He holds multiple Digital Marketing certifications from DigitalMarketer.

Ronald holds a Bachelor of Science Degree in Digital Cinematography from Full Sail University. He also is the author of the book, The Magician's Code.

Anthony Williams

Client Services Representative

MLD #391471

E: clientservices@ignitefunding.com

P: 702.941.7917

Cresta Paradice

Client Services Representative

NMLS #1285002

E: clientservices@ignitefunding.com

P: 702.941.7917

Ryan Fitzgerald

Client Services Representative

MLD #80611

E: clientservices@ignitefunding.com

P: 702.941.7917

Alex Beltran

CSR-Documentation

NMLS #2655453

MLD #124277

E: loanprocessing@ignitefunding.com

P: 702.941.7907

Brandy Warren

CSR-Documentation

E: loanprocessing@ignitefunding.com

P: 702.941.7907

Barbra Yoon

Content Engagement Coordinator

E: barbra.yoon@i-managementgroup.com

P: 702.942.8344

CreativYder

E: jostle-managementgroup.com

P: 702.921.5128

Joseph Arceo

Media Manager

E: jarceo@i-managementgroup.com

P: 702.941.7906

Nadar Hassan

Analyst Specialist

nhassan@i-managementgroup.com

702.570.9407

Noah Lopez

Production Assistant

nlopez@i-managementgroup.com

702.570.9407

Ryan Miyaki

Lead Generation Manager

E: rmiyaki@i-managementgroup.com

P: 702.570.9817

Brock Norred

Business Development Executive

NMLS #2552069

MLD #102993

bnorred@ignitefunding.com

702.941.7908

Kate Butta

Business Development Executive

MLD #71237

E: kbutta@ignitefunding.com

P: 702.921.5168

Angela Cook

Underwriting Coordinator

E: acook@ignitefunding.com

P: 702.921.5146

Tjaden Durham

Junior Underwriter

NMLS #2602515

E: tdurham@ignitefunding.com

P: 702.570.8691

MEET OUR TEAM

Carrie Cook

President

MLD #48217

E: ccook@ignitefunding.com

P: 702.921.5172

Patrick Vassar

Director of Underwriting

NMLS #391332

MLD #48510

E: pvassar@ignitefunding.com

P: 702.736.5475

Misty Bethany

Chief Compliance Officer

NMLS #1403840

MLD #54336

E: mbethany@ignitefunding.com

P: 702.921.5148

Andrew Ervin

Controller

E: aervin@i-managementgroup.com

P: 702.998.5883

Tammy Torrens

HR Specialist/Executive Assistant

E: ttorrens@i-managementgroup.com

P: 702.675.7949

Anthony Williams

Client Services Representative

MLD #391471

E: clientservices@ignitefunding.com

P: 702.941.7917

Cresta Paradice

Client Services Representative

NMLS #1285002

E: clientservices@ignitefunding.com

P: 702.941.7917

Ryan Fitzgerald

Client Services Representative

MLD #80611

E: clientservices@ignitefunding.com

P: 702.941.7917

Alex Beltran

CSR-Documentation

E: loanprocessing@ignitefunding.com

P: 702.941.7907

Brandy Warren

CSR-Documentation

E: loanprocessing@ignitefunding.com

P: 702.941.7907

Barbra Ongwico

Content Engagement Coordinator

E: bongwico@i-managementgroup.com

P: 702.942.8344

Jenifer Ostler

Creative Ringleader

E: jostler@i-managementgroup.com

P: 702.921.5128

Jordan Tyner

Growth Architect

E: jtyner@i-managementgroup.com

P: 702.852.1653

Nadar Hassan

Analyst Specialist

nhassan@i-managementgroup.com

702.570.9407

Noah Lopez

Production Assistant

nlopez@i-managementgroup.com

7002.570.9407

Ron Arceo

Head of Content

rarceo@i-managementgroup.com

702.941.7909

Ryan Miyaki

Lead Generation Manager

E: rmiyaki@i-managementgroup.com

P: 702.570.9817

Brock Norred

Business Development Executive

NMLS #2552069

MLD #102993

bnorred@ignitefunding.com

702.739.9053 ext. 7908

Christian Pennisi

Business Development Executive

NMLS #2605689

MLD #81731

E: cpennisi@ignitefunding.com

P: 702.570.3414

Kate Butta

Business Development Executive

MLD #71237

E: kbutta@ignitefunding.com

P: 702.921.5168

Angela Cook

Underwriting Coordinator

E: acook@ignitefunding.com

P: 702.921.5146

Tjaden Durham

Junior Underwriter

NMLS #2602515

E: tdurham@ignitefunding.com

P: 702.570.8691

JOIN OUR TEAM

It is the goal of Ignite Funding to provide an investment vehicle for investors to build upon their financial future. Similarly, it is our goal to provide our employees with a vehicle to build a promising and rewarding career.

We are a small group that band together as a team to help our investors and the company succeed. At Ignite, we have a “Work Hard, Play Hard” mentality. We understand that work can be fun and still be effective. We work hard to accomplish our goals and celebrate when we reach them.

We are always looking for hard-working, savvy people to become part of our team.

Got A-Player skills and want to join the team? Check out the openings below!

HOW TO APPLY

Think you’re the kind of person who would work well with our team and fit in with our core value? Apply today. We encourage interested, highly qualified candidates to contact us even if no posted position appears to match your background.

Complete the Ignite Funding application and submit it and your resume to ttorrens@i-managementgroup.com

Use the subject line: Becoming Part of the Ignite Team

OPENINGS

SALES TEAM & SERVICING TEAM

As a company representative for Ignite Funding, the Sales Team is a crucial part of our team. The Business Development Executive sets up new investor accounts. Investment Agents are responsible for actively managing Ignite Funding’s servicing portfolio.

Openings available

accounting & operations

This division is responsible for managing the daily operation of Ignite Funding, as well as the fiscal functions of the Company, in accordance with the techniques and practices appropriate within the mortgage lending/investment industry.

Openings available

marketing & communications

Manages the daily operation of Marketing for Ignite Funding, including market research and analysis, and the coordination of communication and promotional activities.

Openings available

BENEFITS

We believe that employees do their best in an environment where they are healthy and happy.

Compensation

Competitive Salary

Bonuses

Flexible Time-Off

401k

Healthcare

Paid Medical Coverage

Paid Dental Coverage

Paid Vision Coverage

Life Insurance

perks

Training Opportunities

Team Events

Rewards for Accomplishments

JOIN OUR TEAM

It is the goal of Ignite Funding to provide an investment vehicle for investors to build upon their financial future. Similarly, it is our goal to provide our employees with a vehicle to build a promising and rewarding career.

We are a small group that band together as a team to help our investors and the company succeed. At Ignite, we have a “Work Hard, Play Hard” mentality. We understand that work can be fun and still be effective. We work hard to accomplish our goals and celebrate when we reach them.

We are always looking for hard-working, savvy people to become part of our team.

Got A-Player skills and want to join the team? Check out the openings below!

HOW TO APPLY

Think you’re the kind of person who would work well with our team and fit in with our core value? Apply today. We encourage interested, highly qualified candidates to contact us even if no posted position appears to match your background.

Complete the Ignite Funding application and submit it and your resume to ttorrens@i-managementgroup.com

Use the subject line: Becoming Part of the Ignite Team

OPENINGS

SALES TEAM & SERVICING TEAM

As a company representative for Ignite Funding, the Sales Team is a crucial part of our team. The Business Development Executive sets up new investor accounts. Investment Agents are responsible for actively managing Ignite Funding’s servicing portfolio.

Openings available

accounting & operations

This division is responsible for managing the daily operation of Ignite Funding, as well as the fiscal functions of the Company, in accordance with the techniques and practices appropriate within the mortgage lending/investment industry.

Openings available

marketing & communications

Manages the daily operation of Marketing for Ignite Funding, including market research and analysis, and the coordination of communication and promotional activities.

Openings available

BENEFITS

We believe that employees do their best in an environment where they are healthy and happy.

Compensation

Competitive Salary

Bonuses

Flexible Time-Off

401k

Healthcare

Paid Medical Coverage

Paid Dental Coverage

Paid Vision Coverage

Life Insurance

perks

Training Opportunities

Team Events

Rewards for Accomplishments

Learn how To earn Double Digit Returns!

Learn how To earn Double Digit Returns!

Ignite Funding, LLC | 6700 Via Austi Parkway, Suite 300, Las Vegas, NV 89119 | P 702.739.9053 | M 702.919.4281 | F 702.922.6700 | NVMBL #311 | AZ CMB-0932150 | Money invested through a mortgage broker is not guaranteed to earn any interest and is not insured. Prior to investing, investors must be provided applicable disclosure documents.

© 2025 Ignite Funding. All rights reserved