Village at St Rose, LLC #4800 | NEVADA – FUNDED

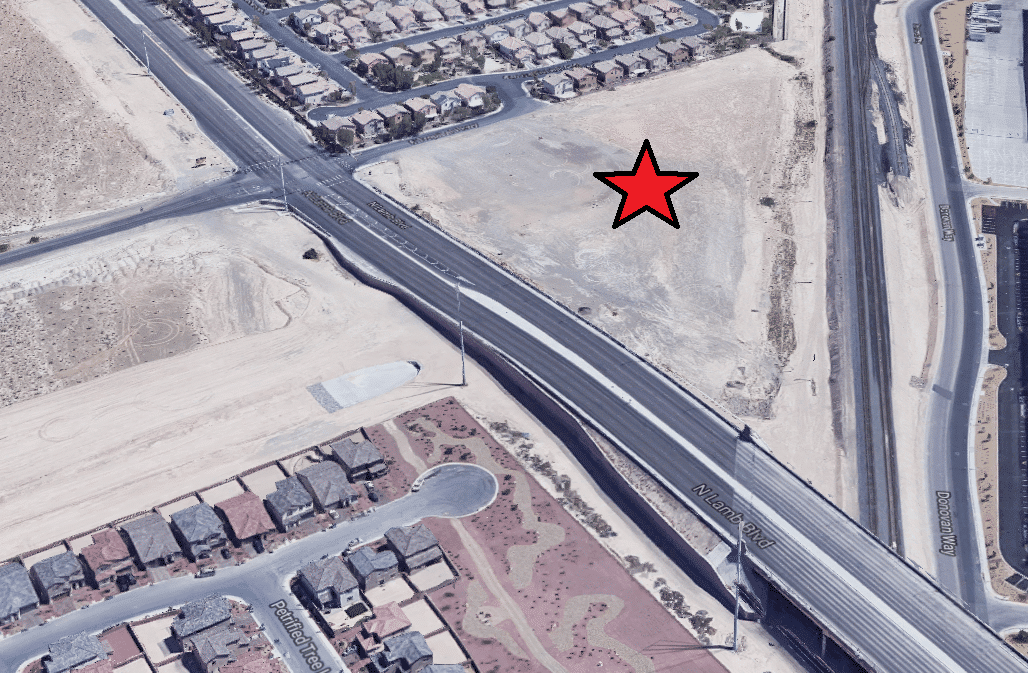

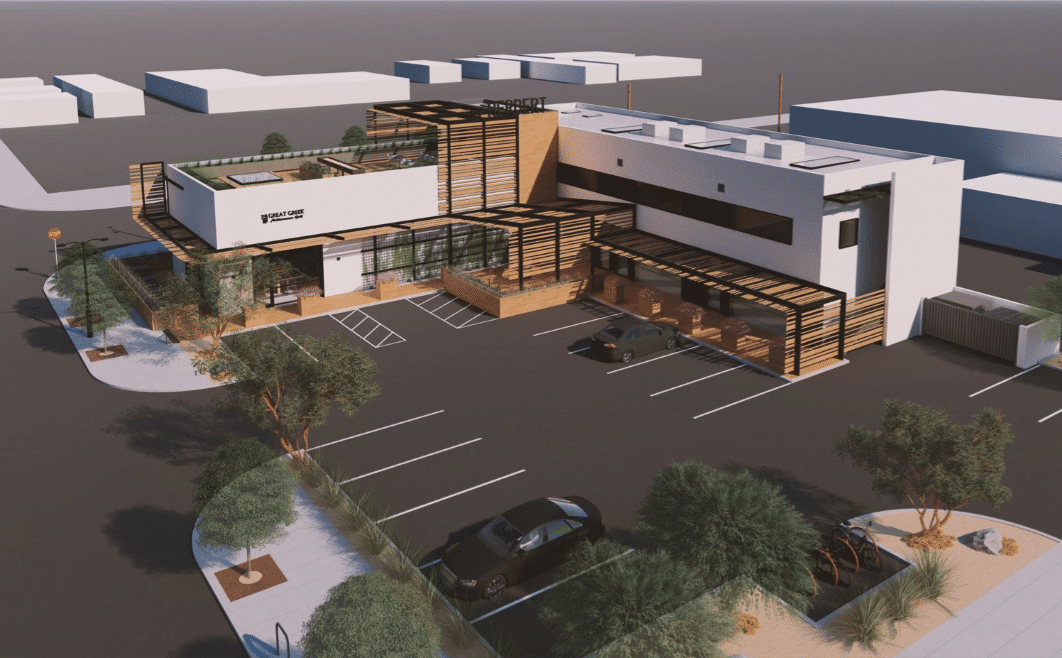

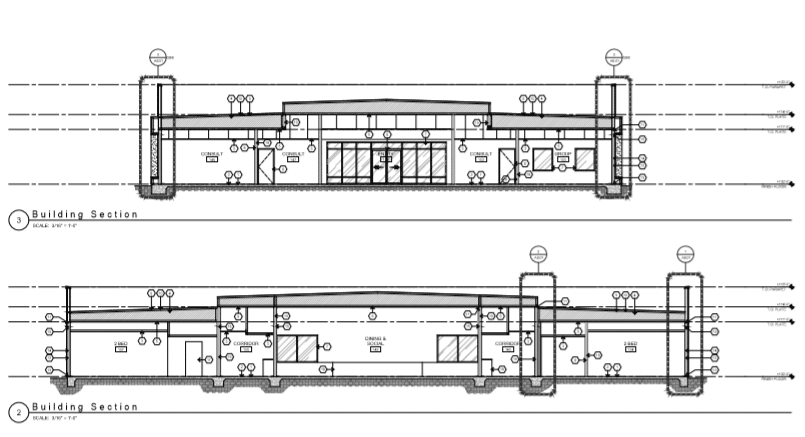

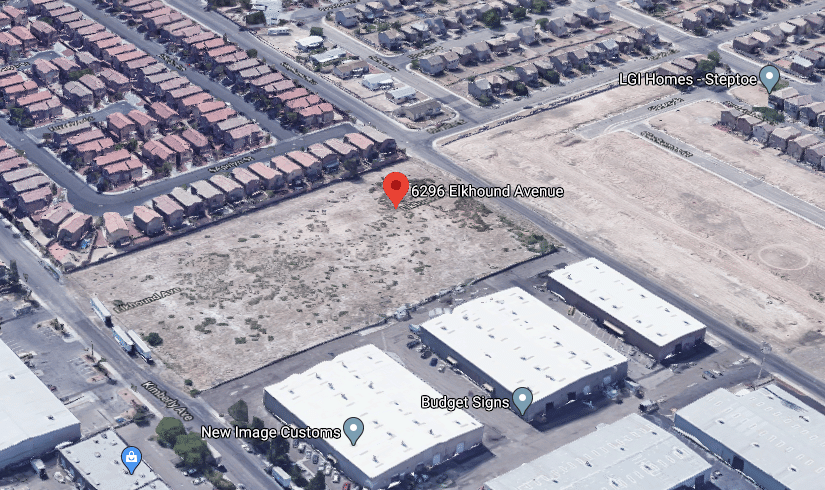

First Trust Deed collateralized by a 12.5-acre parcel of land approximately 13 miles south of downtown Las Vegas, NV. Since acquiring the property in late 2018, the borrower has continued to work with local city and county officials to get the property zoned for its intended use. Now that the property zoning of “mixed use” is in place, they have continued to work with officials to get the tentative map approved for a 300,000 square-foot development that will feature a mix of retail, office and medical space. Although leasing is ongoing, the borrower is in advanced negotiations with the anchor tenant, a major, national health care provider, which intends to occupy over 50% of the space. In addition to refinancing the existing acquisition loan, money will be used for the continued development of the project in preparation for the construction of the mixed-use building. Loan Amount: $12,500,000 Yield: 10.5% (Principal Balance ≥ $100,000); 10.0% (Principal Balance < $100,000) Interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. Term: 9 months with an optional nine-month extension period at maturity