Harmony Horizon Ridge, LLC #4650 | NEVADA – FUNDED

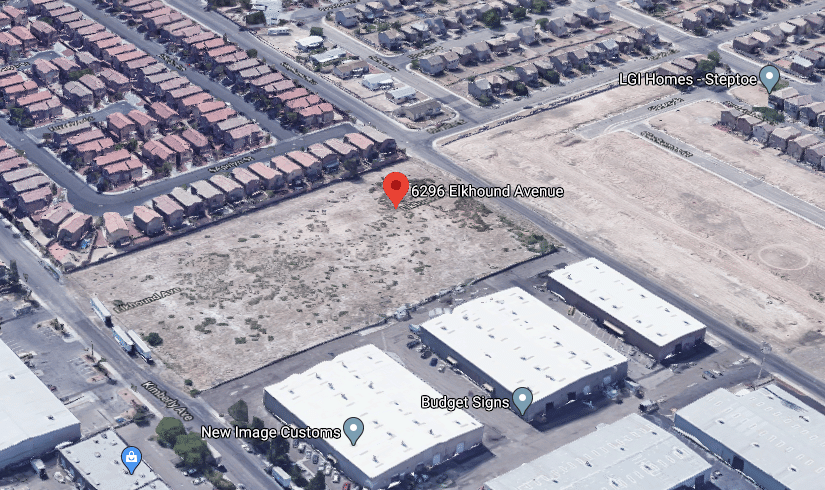

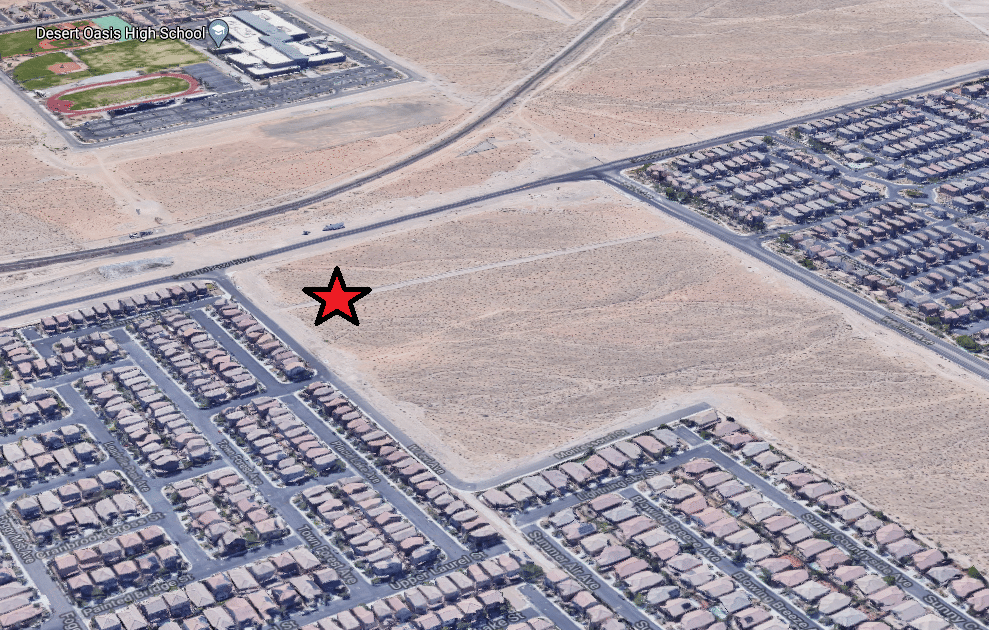

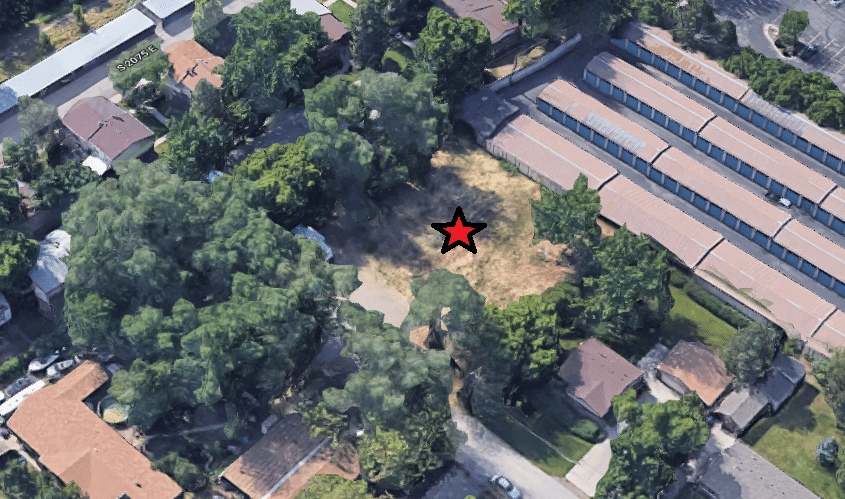

First Trust Deed collateralized by 76 partially finished residential lots near the corner of Horizon Ridge Pkwy and Horizon Dr in Henderson, NV (approximately 17 miles southeast of downtown Las Vegas). Since acquiring the property in November of 2018, the borrower has successfully obtained approval for the development of a 154-lot subdivision and subsequently completed most of the development work on the first phase of the project (the lots this loan will be encumbering). The lots are roughly 0.05 acres in size which was done to ultimately build townhomes on. Townhomes in the community will range between 1,121-1,711 square feet with three to five bedrooms and up to three baths with an average sales price of $290,000. Loan Amount: $4,600,000 Yield: 10.5% (Principal Balance ≥ $100,000); 10.0% (Principal Balance < $100,000) Interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. Term: 6 months with one optional 6-month extension period at maturity.