KB Ash Fork, LLC #6325 | ARIZONA – SOLD OUT

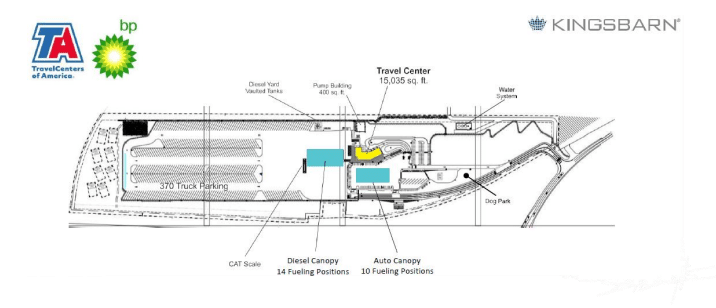

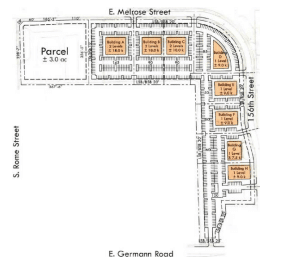

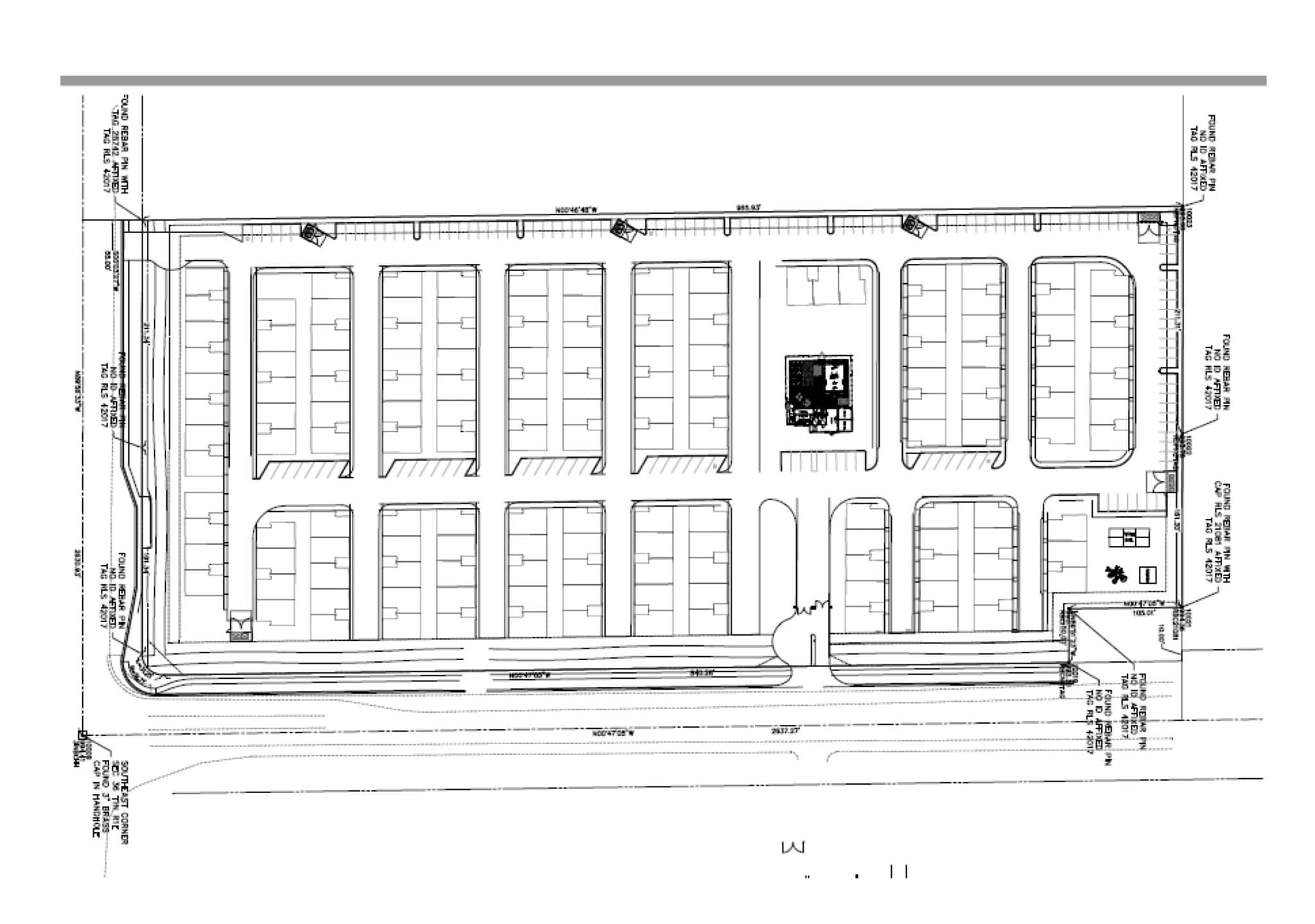

First Trust Deed collateralized by a 2,341,786 sq/ft (54 acres) parcel of land in Ash Fork, Arizona. Arizona has the 6th fastest growing economy in the US and Ash Fork is located just outside Flagstaff in central Arizona. Ash Fork offers a small-town atmosphere with the primary economic drivers consisting of wholesale trade and manufacturing. Ash Fork and the greater Flagstaff area continue to see favorable unemployment rates as well, with current rates around 2.4%. Which is well below the national average of 4.1% as of July 2024. This property is located on Highway 66 (I-40), which offers direct access for all vehicles passing through. The borrower intends to build a fully functional travel center occupied by Travel Centers of America via LV Petroleum. This travel center plans to have three QSRs within the location including KFC, Del Taco, and Sbarro Pizza. LV Petroleum has already signed a lease with Kingsbarn to occupy the entire building upon completion. Construction is currently in progress and is expected to be completed in the first quarter of 2025. The franchisee for this Travel Centers of America location has done numerous build-to-suit locations with this developer before, which has allowed for a prelease agreement