Three Palms, LLC #6164 | NEVADA – FUNDED

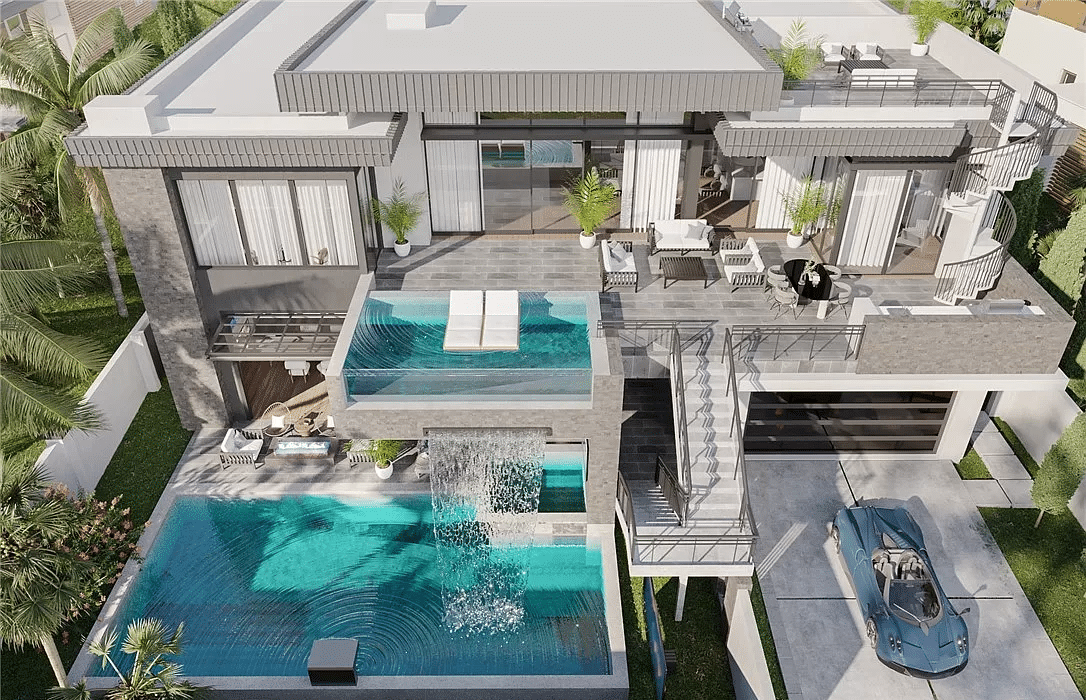

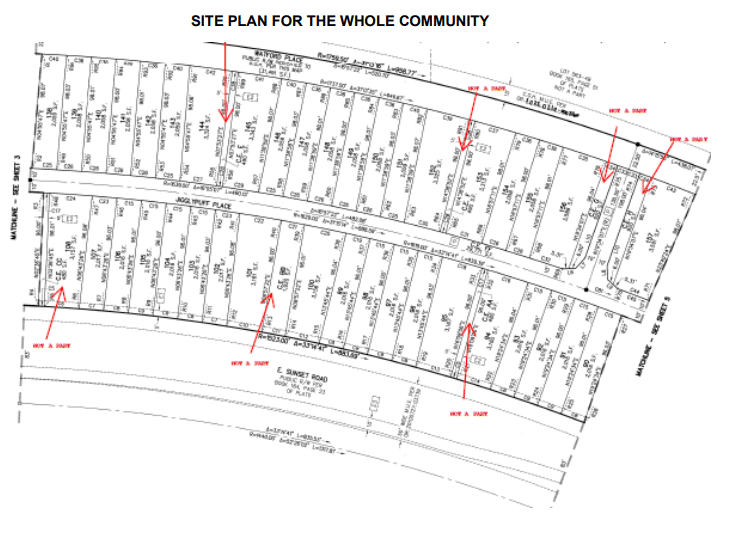

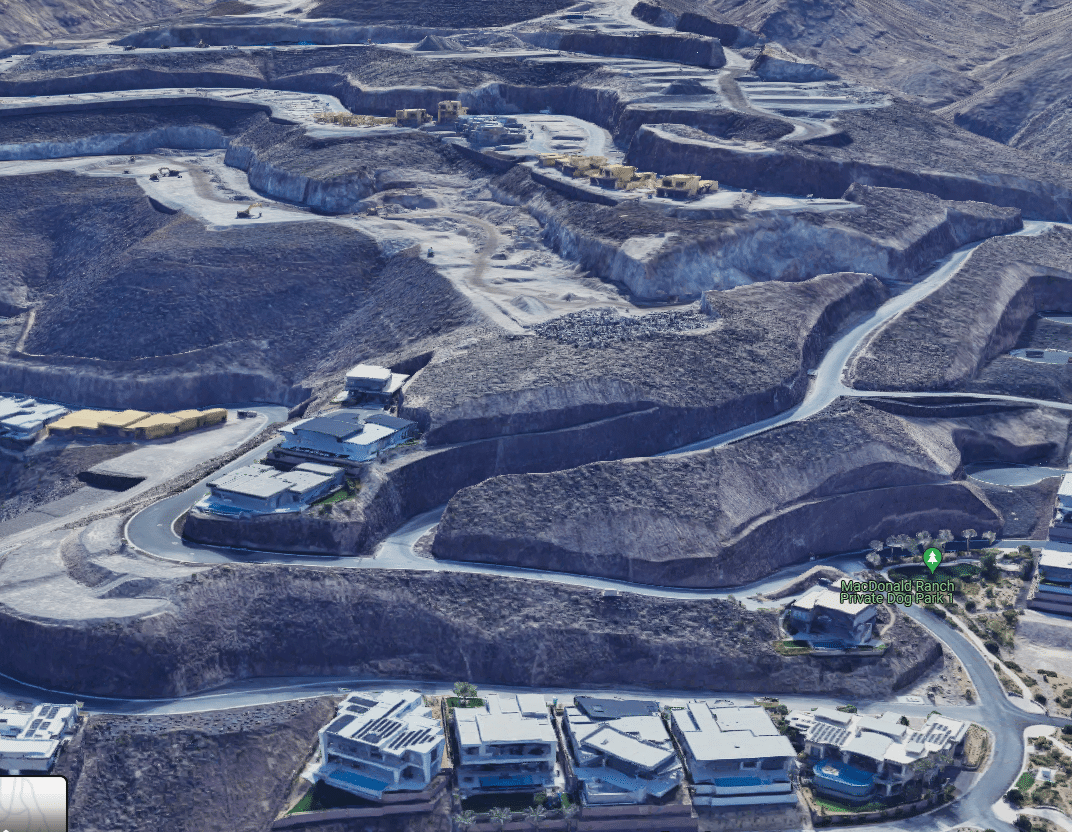

The collateral for this loan is a 0.28 acre finished residential lot in McDonald Ranch which is a luxury, guard gated community in Henderson, NV (a suburb of Las Vegas). The lot was purchased in the middle of 2023 for $1,100,000 and since that time the borrower has been approved to build a custom home working with the city and HOA to get it done. The home will be about 7,168 square feet with an asking sales price north of $8,000,000. This would be the fifth such home the borrower has built in the same community over the past few years. Loan Amount: $3,100,000 Yield: 10% interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. *For investments equal to or greater than $100,000 investors will earn 10.5%. Term: Nine months with an optional nine-month extension at maturity. Final maturity date is 7/31/25.