SR Decatur Apts, LLC #5595 | NEVADA – FUNDED

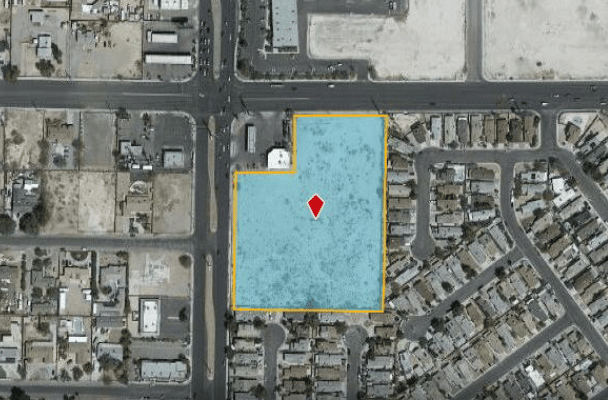

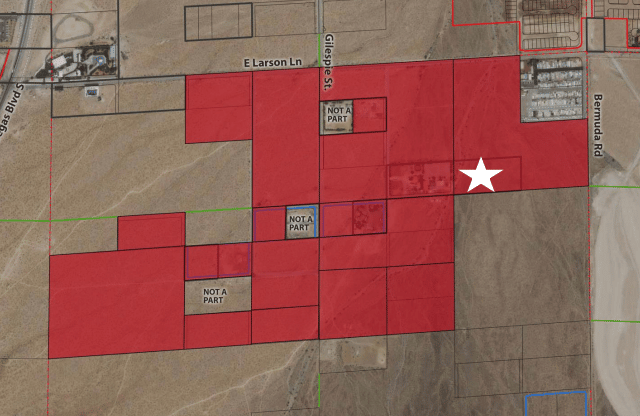

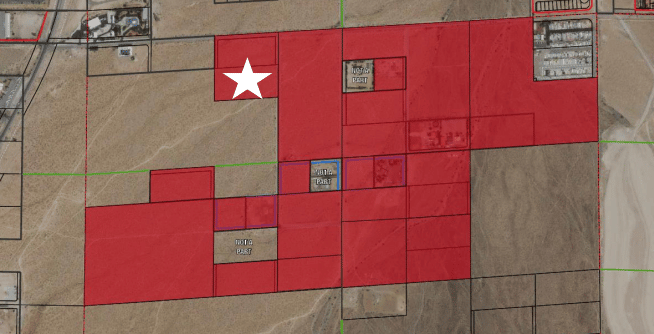

The collateral for this loan is a 5.33 gross acre parcel of land that has been approved for multi-family use of up to 191 total units. Located on North Decatur, the property is about five miles Northwest of downtown Las Vegas, NV. Since acquiring the site in 2019, the borrower worked with the appropriate government officials to get the zoning changed to C-1, Limited Commercial District which will allow apartments. Given the good visibility to the North and West of the property, apartments should have an easy time leasing. Loan Amount: $2,300,000 Yield: 10% interest Schedule: Interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. *For investments equal to or greater than $100,000 investors will earn 10.5%. Term: Nine months with an optional nine-month extension at maturity. Final maturity date is 5/1/24.