Rue Grimaldi, LLC #5984 | NEVADA – FUNDED

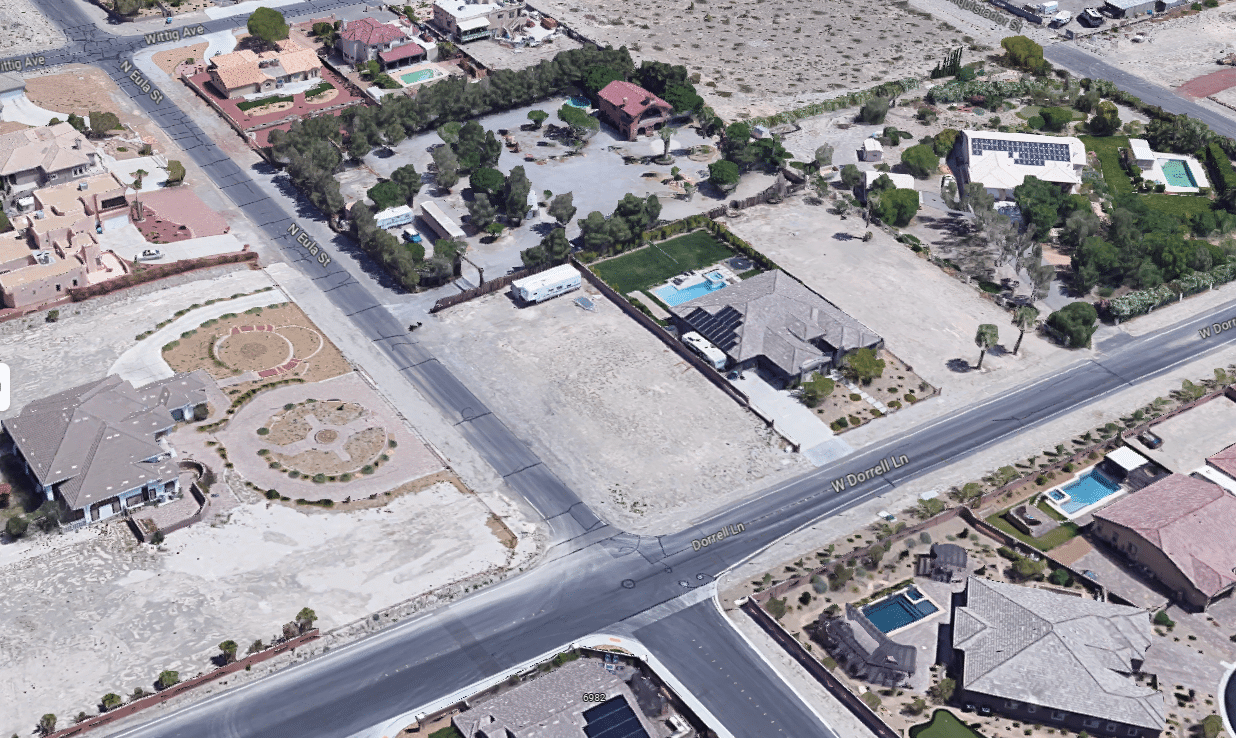

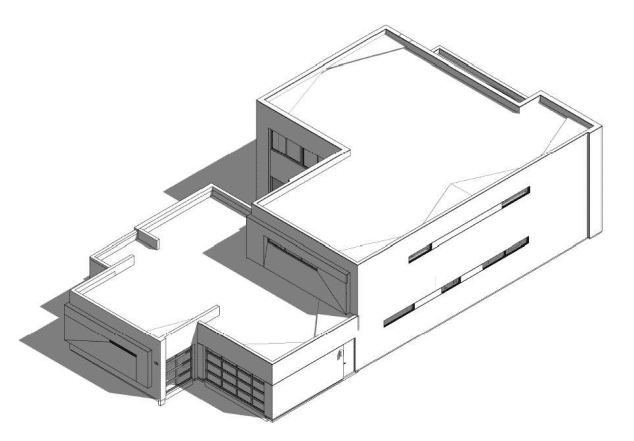

The collateral for this loan is a 0.32 acre finished lot in Henderson, NV which is about 20 miles southeast of downtown Las Vegas, NV in the Lake Las Vegas master planned community. Since acquiring the lot for $310,000 in September of 2022, the borrower successfully worked with the city and HOA to get approval for a 3,254 square foot home. This modernly designed home will feature four bedrooms and three bathrooms with a three-car attached garage. Included in the budgets is an extensive pool and landscaping package to give the buyer what should be a “turnkey” type of purchase. This one-story home will have an attached casita with a minimum of 10-foot ceilings throughout. Upgraded Thermador appliances in the gourmet kitchen, built in security and speakers, and a free-standing tub in the master to name a few of the many upgrades. It is anticipated the home will be sold prior to the home being completed. Loan Amount: $750,000 Yield: 10% interest Schedule: Interest is paid monthly in arrears with payments due on the 1st of each month with a 10-day grace period. *For investments equal to or greater than $100,000 investors will earn 10.5%. Term: Nine months with two