Blue Heron Oasi, LLC #5683-#5702 | NEVADA – FUNDED

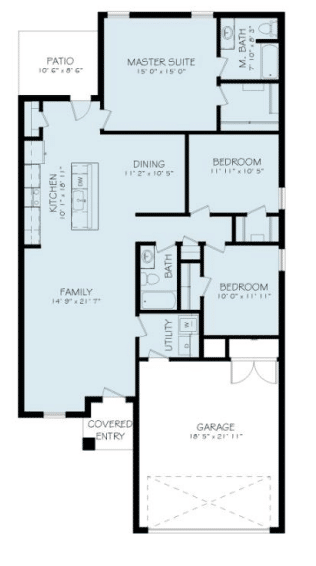

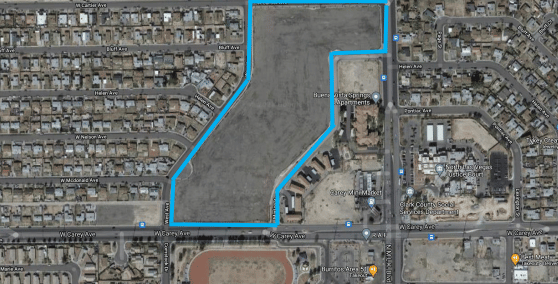

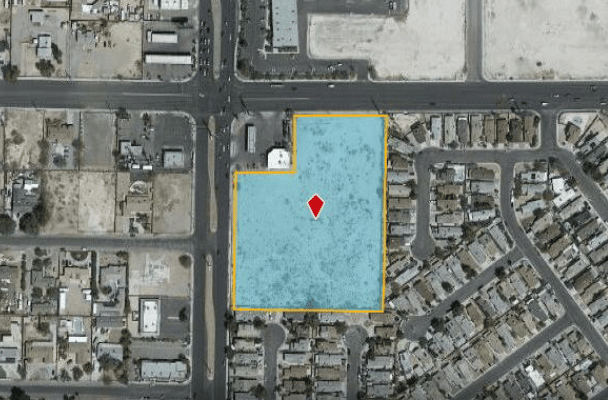

First Trust Deed collateralized by 20 of the 24 total lots within the Blue Heron developed community know as Oasi. Since acquiring the 13 acres in August of 2021, the borrower has nearly completed all of the horizontal development of the 24-lot community. Additionally, they have three model homes being built and have sold one lot to a buyer who will be contracting with Blue Heron to build a home. Homes in the community will average nearly 6,000 square feet and could sell for nearly $5,000,000. The Blue Heron business model is a bit unique in the home building industry where they will actually sell the finished lot to the home buyer and then contract back with Blue Heron to build a home on the lot. Most homebuilders don’t transfer ownership of the property until after the home is constructed. This structure allows Blue Heron to pay off the land loan (this loan) much sooner in the process and passes on much of the financing costs to the home buyer which increases the builder’s margin. Once the community gate is installed and the model homes are completed, Blue Heron expects to sell about one lot per month Master Loan Amount: