Rhino Holdings Brynwood, LLC #5670 | ILLINOIS – FUNDED

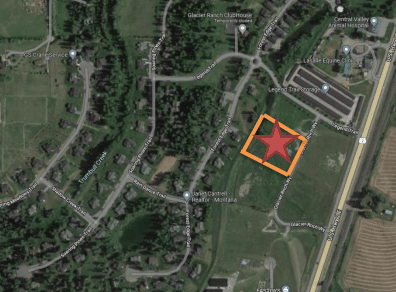

The collateral for this loan is a 121,800 square foot shopping center in Rockford, IL. The ten-acre site is mostly vacant after the anchor grocery store tenant vacated the property in late 2021. The borrower purchased the property at auction in December of 2022 with the property only 11% leased. With a finished replacement cost north of $11,000,000 they knew they were buying a project undervalued with the anticipation of quickly filling the vacant space. Over the past few months since acquiring the site, they have two tenants that will lease 82,000 square feet bringing the vacancy down to 21%. Although no tenants are lined up for the remaining vacant space, a local leasing agent has begun work to find renters. The only national tenant currently occupying the property is Baskin Robbins along with 6 local tenants. Loan Amount: $6,500,000 Yield: 10.5% interest is paid monthly in arrears with payments due on the 1st of each month with a 10- day grace period. *For investments equal to or greater than $100,000 investors will earn 11%. Term: Nine months with an optional nine-month extension at maturity. Final maturity date is 7/23/24.