Midway Heritage Land Holding, LLC #6543 | UTAH – ($18M AVAILABLE)

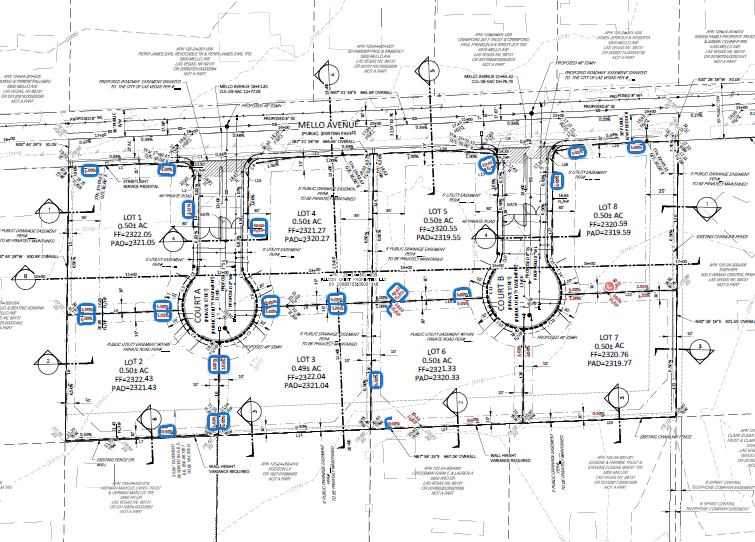

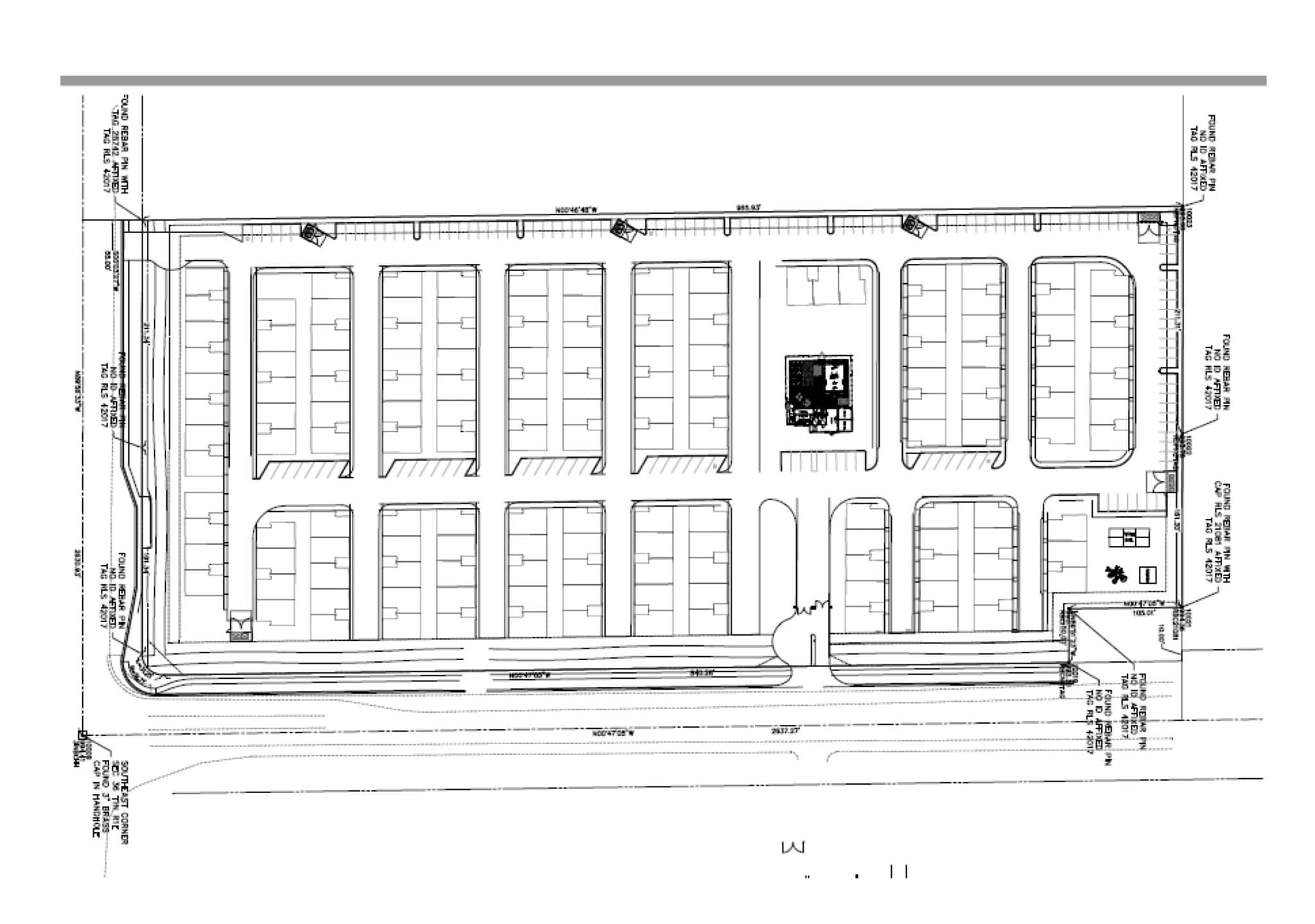

First Trust Deed collateralized by roughly 25 acres of land in the scenic town of Midway, Utah. This land is currently being developed into 141 townhomes as well as 10 commercial pads, one of which will be a 30,000 sf Athletic Club available to both residents and the greater community. Since acquiring the property in September of 2020, the borrower has received master plan approval for the entire project and began work on the site. Since work began, significant interest has been generated surrounding the project which has led to 33 units being closed with another 11 set to close within the next two months at values 75% higher than originally projected. This interest is due to many factors, one of which is the proximity of the development to a new $3.2 Billion 6,800 acre Luxury Ski Resort, called Deer Valley East Village, which will be just a 10-minute shuttle ride away. Additionally, there is limited space for new luxury developments in Park City which has led residents seeking luxury homes to the next up-and-coming area which this project is proving to be. This loan will refinance the existing loan while providing additional funds for the remaining horizontal development work